MicroStrategy bought another 1,434 bitcoins for ~$82.4 million in cash at an average price of $57,477 per bitcoin; now holds a total of 121,044 bitcoins for ~$3.66 billion

Late last month, MicroStrategy announced it bought 7,002 bitcoins for $414 million at an average price of about $59,187 per bitcoin. Now, the Virginia-based company has doubled down on its cryptocurrency investments by increasing its bitcoin reserve.

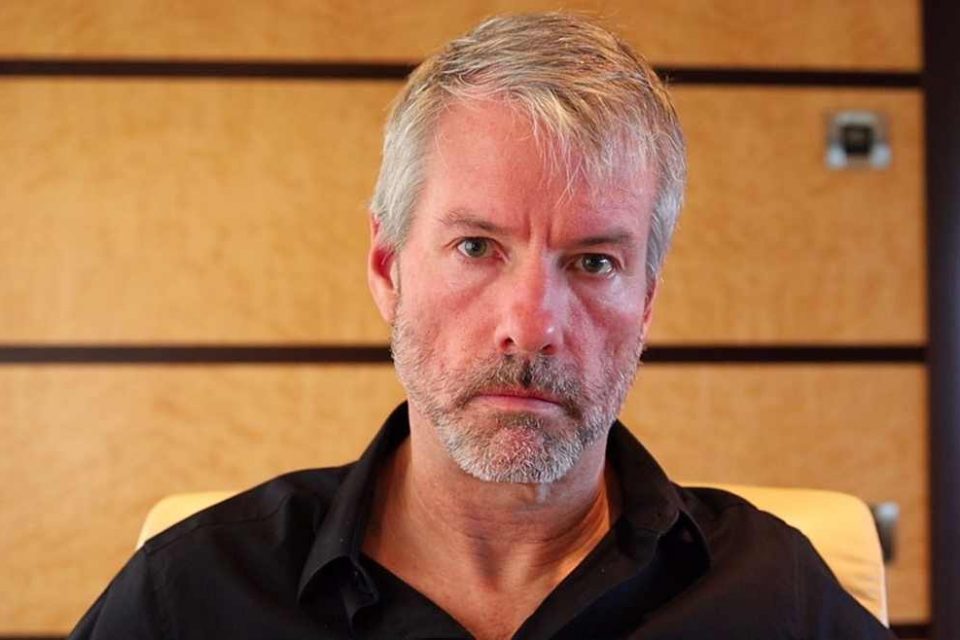

In a Twitter post, Microstrategy founder and CEO announced the company has purchased an additional 1,434 bitcoins for ~$82.4 million in cash at an average price of about $57,477 per bitcoin. As of yesterday, December 9, 2021, Microstrategy now owns approximately 122,478 bitcoins acquired for around $3.66 billion at an average price of ~$29,861 per bitcoin.

MicroStrategy has purchased an additional 1,434 bitcoins for ~$82.4 million in cash at an average price of ~$57,477 per #bitcoin. As of 12/9/21 we #hodl ~122,478 bitcoins acquired for ~$3.66 billion at an average price of ~$29,861 per bitcoin. $MSTRhttps://t.co/Xke8QhoYpy

— Michael Saylor⚡️ (@saylor) December 9, 2021

Microstrategy also revealed in SEC Form 8K filing that it purchased about 1,434 bitcoins for approximately $82.4 million in cash during the fourth quarter of the Company’s fiscal year to date.

“On December 9, 2021, MicroStrategy Incorporated (the “Company”) announced that, during the period between November 29, 2021 and December 8, 2021, the Company purchased approximately 1,434 bitcoins for approximately $82.4 million in cash, at an average price of approximately $57,477 per

bitcoin, inclusive of fees and expenses. As of December 8, 2021, the Company held approximately 122,478 bitcoins that were acquired at an aggregate purchase price of $3.66 billion and an average purchase price of approximately $29,861 per bitcoin, inclusive of fees and expenses..”

At this point, Microstrategy is all-in on Bitcoin with probably no exit strategy if the bitcoin price were to go to zero. Saylor is a vocal supporter of Bitcoin. MicroStrategy was founded in 1989 by Michael Saylor and Sanju Bansal as a software company with a focus on analytics software. The company was at one time famous for its business intelligence software before it later becomes a bitcoin investment company.

In June, MicroStrategy announced it’s borrowing $400 million to buy more Bitcoin It’s the first-ever junk bond sale used for financing purchases of the volatile cryptocurrency, according to a report from Bloomberg. The announcement came at a time when the company stocks plunged from an all-time high of $1292 to $472.

Meanwhile, below is a video of how Twitter users responded to Microstrategy’s latest bitcoin purchase. Enjoy!

https://twitter.com/Crypto_guy_01/status/1467148300423888902

form-8-k_12-09-2021