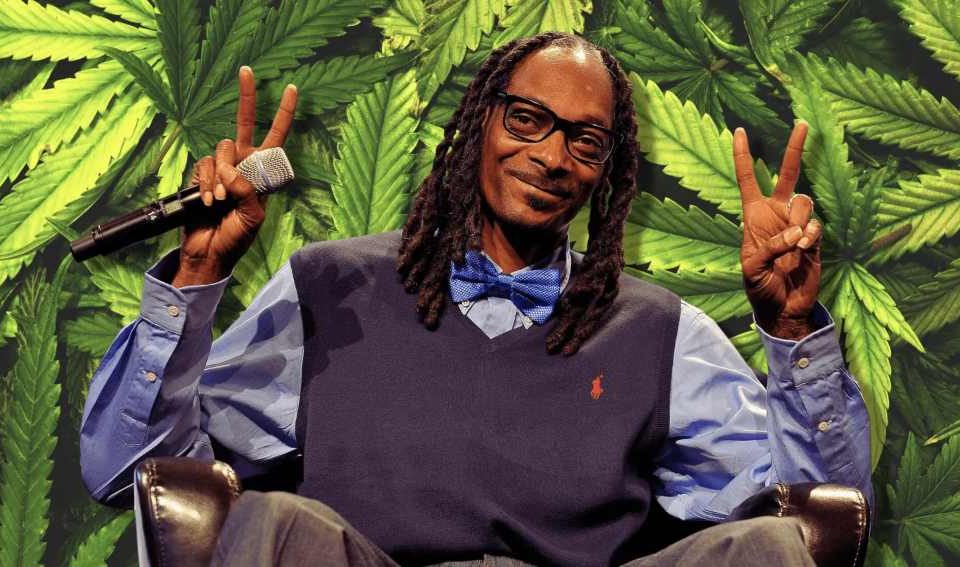

Snoop Dogg-backed fintech startup Bespoke Financial raises $125M to fund the growth of the cannabis industry

In 2020, the global cannabis market was valued at $22.10 billion. As millions stayed at a home during the pandemic, an increasing number of people turned to cannabis to relax and alleviate their anxieties. This, in addition to more states legalizing marijuana use, has led to the booming cannabis industry which has also caused cannabis businesses to seek additional funding to meet the rising demands. That’s where fintech startup Bespoke Financial comes in.

Bespoke Financial is the nation’s first licensed fintech lender focused on the cannabis industry and is focused on bridging the divide between institutional investors and cannabis. Bespoke wants to level the playing field by providing cannabis businesses with the same kind of financial services that other businesses get, but dispensaries and growers can’t yet get access today.

Today, the Snoop Dogg-backed Bespoke Financial announced it has closed a $125 million credit facility to expand its lending capacity and fund the growth of the cannabis industry. The latest capital infusion is a strong show of investors’ confidence in Bespoke Financial and cannabis debt financing. Since its inception three years ago, Bespoke has seen rapid growth in recent years as demand for debt financing accelerates.

Founded in 2018 by CEO George Mancheril, Ben Dusastre, Jeffrey Ghitman, and Pablo Schwarzbeck, the Los Angeles-based Bespoke is a licensed lender supporting cannabis companies. Bespoke Financial provides clients access to working capital by offering short-term lending options to fuel business growth in the legal cannabis industry, reducing cash flow cycles, and providing cannabis companies greater financial flexibility. Bespoke also alleviates working capital constraints across the entire cannabis supply chain.

In a statement, Bespoke Financial CEO George Mancheril said, “This added lending capacity demonstrates that more institutional investment firms are recognizing the cannabis industry’s potential. Institutional investors are chasing high yields and seeking to minimize volatility, especially through investments that are not subject to future COVID-related market disruptions. Cannabis debt financing checks all of these boxes.” He added, “Bespoke Financial is serving as a conduit for larger pools of capital to enter the space in a structured and scalable manner ahead of federal regulatory change, if and when that comes.”

Bespoke has been at the forefront of the industry trend toward debt financing, working with both large and small companies of all license types, including brands like Jeeter, Buddies, Claybourne Co., and Friendly Farms. Since the company’s launch more than three years ago, Bespoke has provided funding for a growing number of businesses spanning the entire cannabis supply chain. The company now works across the country in 12 regulated markets from California to Maine, financing lines of credit in amounts as large as $15 million.

“The rise of debt financing is an encouraging and important moment in the history of the industry and will enable smart operators to scale and remain nimble without sacrificing growth opportunities,” Mancheril said. “Debt capital is a tool that has been a mainstay of how traditional businesses operate and is now finally widely available to cannabis businesses of all sizes. We feel this is really exciting news, not just for Bespoke and our team, but for the industry as a whole.”

Bespoke is backed by respected venture capital firms such as Sweat Equity Ventures, Greenhouse Capital Partners, Outbound Ventures, Ceres Group Holdings, and Vista Investment Group, and Casa Verde Capital — the investment firm launched by legendary cannabis aficionado, Calvin Broadus (AKA Snoop Dogg).