Audit Sight raises $2.5M to streamline the complex auditing process and make it easier for companies to share data with auditors

Financial statement audits are a necessary evil within our capital markets. They provide transparency and trust for shareholders and creditors, and the audit services industry is projected to be a $43 billion market this year in the United States alone.

Publicly traded companies must complete them every quarter, and private companies generally do them once a year. At the heart of the audit process is detailed testing of the underlying accounting transactions against source documentation. The volume of transactions and data required for audits is huge. For clerks and accountants at the company being audited, the work to compile records to share with the auditors is overwhelming. Companies often provide office space so auditors can be on-site to speed up the process, but even then it can take months to complete.

A financial audit is one of the most excruciating processes companies have to go through. In recent years, financial reporting and auditing requirements have become more complex and rigorous. It’s not unusual for auditors to move into client offices and spend weeks or months at a time. They continuously request new data and documents to verify financial statements, making life difficult for bookkeepers at the client company. It’s a painful but important process. Now, one startup is on a mission to simplify the process so companies can focus on their core business.

Enter Audit Sight, a new tech startup founded by two veteran auditors with experience building accounting software inside a Big 4 accounting firm. Audit Sight is the essential tool for auditors and lenders in the modern era. The startup uses APIs to securely access the client’s records, eliminating the tedious process of asking for them and waiting for a recordkeeper to compile and send them.

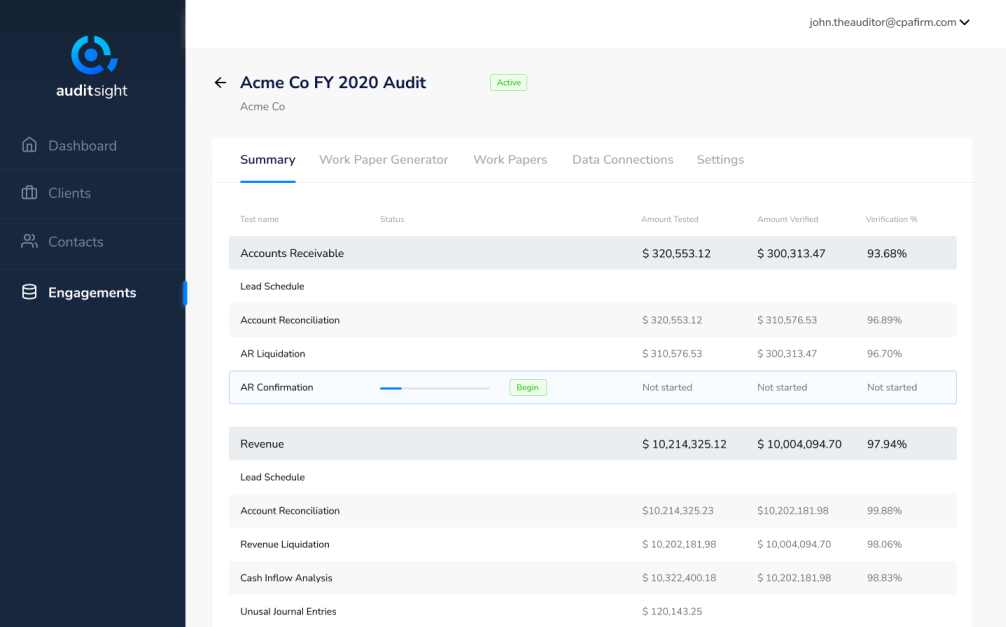

Once the client connects their accounts, Audit Sight digitally gathers the data needed for audit tests. It then uses computer-assisted auditing techniques to automate the testing of the accounting records against third-party source documentation so auditors can focus on adding value to their clients instead of keying data into spreadsheets.

Today, Audit Sight announced it has raised $2.5 million in venture funding led by Hyde Park Venture Partners, with participation from Alumni Ventures Group and individual investors, including Johnson Cook, CEO of Greenlight; Aaron Rankin, co-founder of Sprout Social; and John Seybold and Ken Branson, co-founders of Guidewire Software. In conjunction with the funding, Audit Sight also announced that Ira Weiss, partner at Hyde Park Venture Partners, has joined its board.

Founded in 2021 by CEO Thomas Whittaker and Jonathan Womack, the Atlanta, Georgia-based Audit Sight aims to fix the costly and time-consuming process of auditing financial statements. Through the use of APIs to collect company records, Audit Sight makes it easy for auditors to access the data they need when they need it with minimal impact on their clients.

“After spending my career working on financial statement audits, I have seen how complicated and cumbersome they are,” said T.C. Whittaker. “I always felt like you couldn’t design a worse customer experience than the audit even if you sat down and tried. Audit Sight takes the pain out of the process for both the auditors and their clients, but it is especially beneficial for clients who have to dedicate huge amounts of time and effort to pulling documents.”

Audit Sight also provides greater assurance to both auditors and clients. Because of the scale of most companies, auditors can’t review every record or transaction. Instead, they take samples of different parts of the business and review them. By automating the process, Audit Sight makes it possible to review larger sample sizes and, in some cases, 100% of transactions instead of a sample.

“That is a real game-changer for the industry,” said Jonathan Womack, Audit Sight co-founder and chief operating officer. “There has been no efficient way to pull and review tens of thousands of records, so auditors typically rely on sampling, but with Audit Sight, we can actually increase the size of the sample to provide even greater assurance while decreasing the burden on the client. It’s a win-win.”

Whittaker and Womack previously worked at PwC, where they became intimately familiar with the auditing process and its pain points. Whittaker also led the team at PwC that developed InsightsOfficer, automated bookkeeping, payables, and reports solution, which further prepared him to build Audit Sight.

“Jonathan and T.C. know this business really well having worked in it for so long,” Weiss said. “They exemplify the founder-market fit investors are looking for, and we’re excited to see them execute on their vision and solve this expensive, time-intensive, and challenging process for auditors and the companies that must go through it.”

Since launching the company in August, Audit Sight has added Eric Kingery as its chief technology officer and Attila Domokos as its executive vice president of engineering. The company plans to continue growing its team in the near future.