Top 3 Lease Accounting Software for Enterprise

If you don’t automate your critical lease accounting workflows and tasks, you run the risk of racking huge admin costs. You’ll also get stuck in inefficient workflows and complicate your Generally Accepted Accounting Principles (GAAP) accounting standards compliance processes.

The good news is, there is a solution in lease accounting software.

However, not all lease accounting software is made equal. You’ll need to find the best-fitting platform for your business based on your needs and in terms of cost, features, and tools (among others).

In this guide, we’ll look into the three leading lease accounting software for enterprises.

Lease accounting software: A brief overview

Lease accounting software is a financial application designed to automate the record-to-report processes for the new GASB 87, IFRS 16, ASC 842, and SFFAS 54 standards.

Generally, the software can take lease contract information, such as payment frequencies, rent formulas, and discount rates, and perform the required calculations automatically. This streamlines generating all the necessary journal entries for the cash flow statement, balance sheet, income statement, and quantitative disclosure reports.

Lease accounting software helps you manage and minimize the associated risks of lease portfolios while centralizing their life cycles and processes. It automates manual tasks and workflows, including tracking journal entries, individual lease audit trails, and whether a lease is financing or operating.

Most of the main lease accounting software features include:

- Auto-generating journal entries and calculate lease data accurately

- Classifying lease types

- Notification options for critical dates

- Data importing from existing spreadsheets and repositories into the software’s database

- Lease, asset, and journal entry data storing and tracking

- Automated workflows speed up compliance with new lease accounting standards

Additionally, most lease accounting software can integrate with your Enterprise Resource Planning (ERP) systems to automate general ledger journal entry creations.

These can also integrate with your existing accounting and Point of Sale (POS) systems to give you complete visibility into your entire lease portfolio.

Top 3 lease accounting software

While lease accounting apps generally provide the essential features, some offer unique tools and functionalities. Below are the three leading lease accounting software for enterprises.

1. Trullion

Trullion is an Artificial Intelligence (AI) based software that automates accounting, including lease accounting workflows.

The Software as a Service (SaaS) platform uses AI technology to read PDF and excel files and turn them into financial workflows automatically, including lease accounting and revenue recognition.

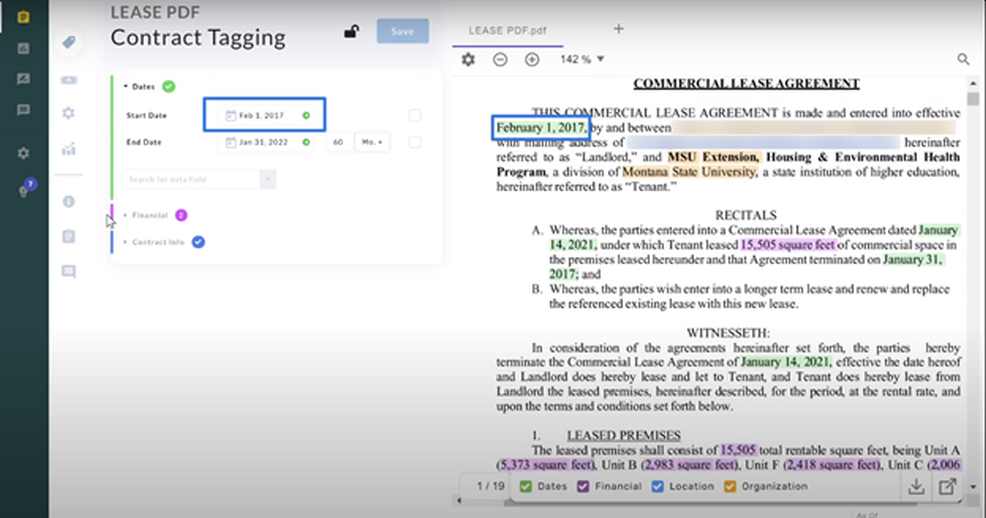

Trullion’s lease accounting 2.0 solution offers AI-powered contract extraction, allowing you to upload and import lease contracts with a few clicks.

It then uses Optical Character Recognition (OCR) and Machine Learning (ML) to analyze the contract and extract relevant information automatically.

The software highlights critical information on the lease agreement and displays the data points such as lease contract start and end dates and other essential financial and contract info.

These features automate lease contract data extraction, helping you streamline report generation. Modifying lease agreements and records is also a breeze with Trullion’s visual modification feature.

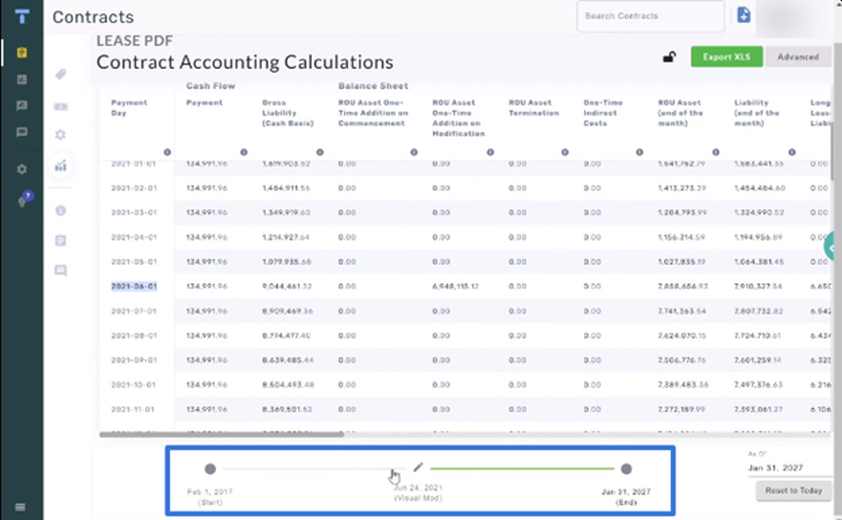

Click the data points and records you want to modify, and the software automatically creates a timeline showing the historical and current data (or the information before and after changes).

This simplifies tracking lease agreement modifications and streamlines your lease accounting workflows.

Trullion’s other features include bulk uploading and modifications with automation and intelligent features to help you upload and apply changes to volumes of records quickly and easily.

It also provides audit reporting features that automate essential aspects of your IFRS 16, ASC 842, and GASB 87 compliance and generate all your liability, Right-of-Use (ROU) assets, and other entries.

Trullion’s enterprise-level features give you a 360-degree view of your data in real-time. It helps you draw out data from your source documents and seamlessly link them to your audit trail and streamline your compliance processes.

2. LeaseAccelerator

LeaseAccelerator is a lease management SaaS solution that automates corporate lease management and accounting across the entire lease life cycle.

The software streamlines the most time-consuming tasks of the record-to-report process, such as classifying operating and finance leases and calculating modifications and reassessments.

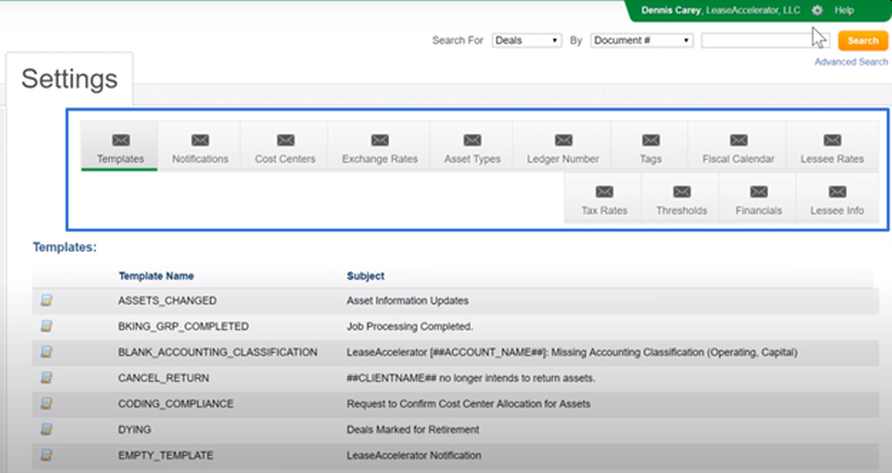

LeaseAccelerator provides an integrated system to help you minimize audit risks by enforcing automated policies and governance and applying corporate policies. This helps ensure you are always compliant with GASB 87, IFRS 16, and ASC 842 standards.

The software’s main features include centralized policy management. You and your team can set parameters during implementation.

You can establish these entries once, and the software’s system uses them to classify leases and automatically generate accounting entries and according to the lease accounting standards.

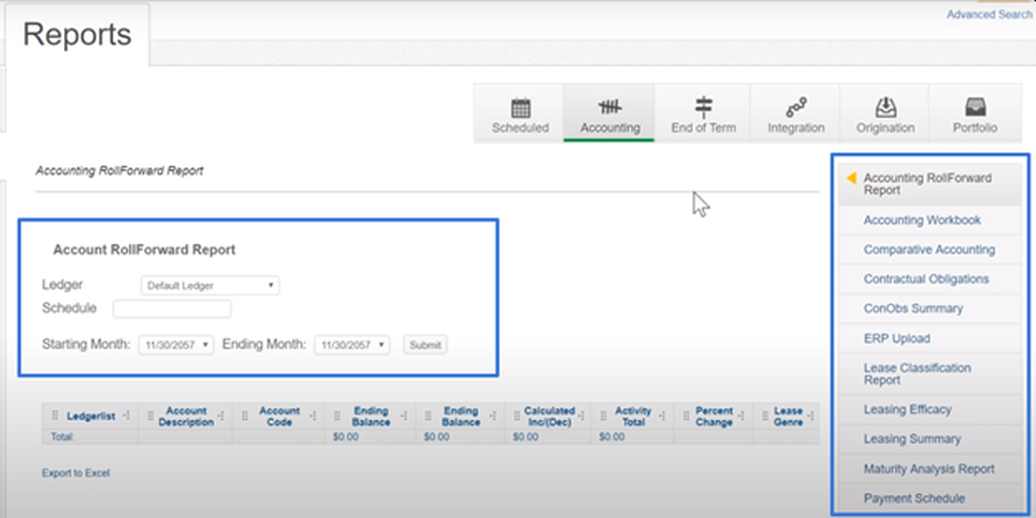

LeaseAccelerator also offers automated reporting features across the entire lifecycle, allowing you to leverage a true sub-ledger to ensure an audit-ready monthly close.

This helps you implement an efficient close process through push-button disclosures, cause of change, trial balance, and roll-forward reports.

The software’s other key lease accounting features include real estate and equipment rental lease tracking, asset-level accounting, and audit trail documentation (among others).

LeaseAccelerator allows you to establish a repeatable, accurate, and predictable global close process while seamlessly achieving lease accounting regulatory compliance.

3. LeaseQuery

LeaseQuery is a cloud-based lease management and accounting software that accounts for any kind of lease and facilitates compliance with IFRS 16, ASC 842, and GASB 87.

The solution equips you with a suite of lease accounting features, including data integrity and security, operational tools, specific disclosure reports required by regulators and operators, and accounting intelligence.

It also offers seamless integration with ERPs, allowing the automatic production of necessary journal entries for your general ledger.

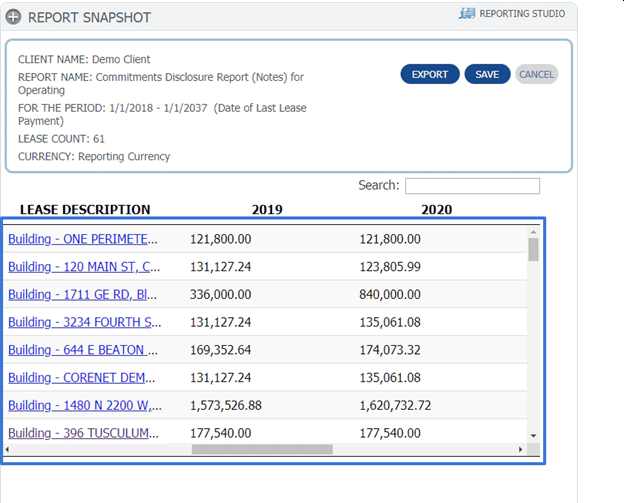

LeaseQuery offers a robust reporting suite that comes with around 100 ways to analyze your leases, including rent commitment, cost center, and geography.

Image Source: capterra.com.

The software lets you set critical date reminders and generate accurate Accounts Payable (AP) reports for invoice validation.

LeaseQuery also improves your lease accounting workflow’s efficiency through a central repository with easily accessible lease abstracts and quick document retrieval features.

You can retrieve journal entries in one click and get consolidated compliance and disclosure reports out of the box.

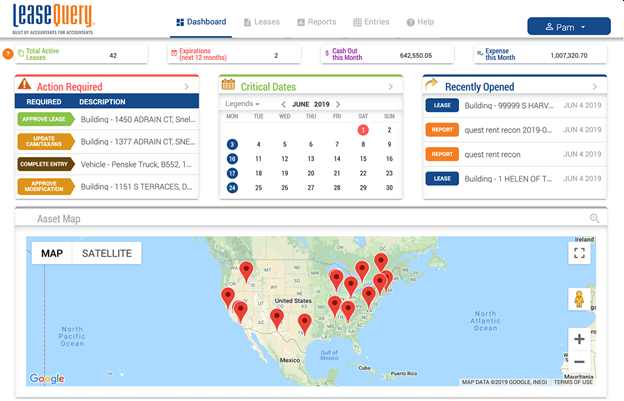

LeaseQuery even provides a dashboard to give you quick access and data insights such as your total active leases, cash out and expenses per month, expirations, critical dates, recently opened agreements, and the required actions for leases (among others).

Image Source: leasequery.com.

Additionally, LeaseQuery provides built-in controls to ensure lease accounting data integrity. This helps you catch errors and avoid material misstatements.

These controls include lease change and audit trail reporting, duplicate prevention, data entry validation, and customizable role-based access based on location or subsidiary.

LeaseQuery has the features to help you with efficient lease tracking and management, streamlining your lease accounting, and improving your compliance and other related processes.

Which lease accounting software is for your enterprise?

The right software can supercharge your lease accounting workflows and compliance. This can boost your overall efficiency, optimize your audit process, and help you make better, more strategic financial decisions.

Avoid going for a lease accounting software just because it’s cheap. Instead, focus on finding a solution with functionalities that meet your needs long-term, starting with the top three accounting software in this guide.