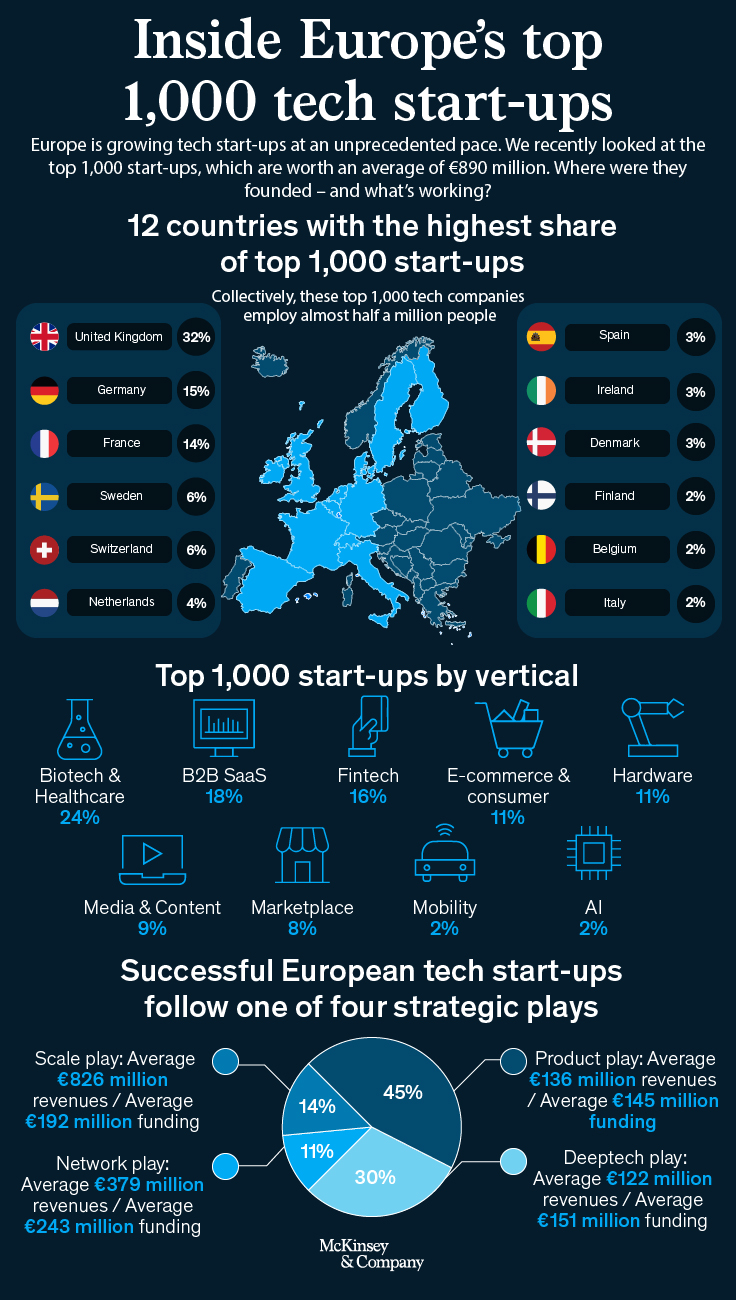

Inside Europe’s top 1,000 tech startups

Two years ago, we looked at Europe’s top-funded startups. Since our last story, thousands of European tech startups have been created, raising a collective of nearly $9 billion in disclosed equity funding as of October 8, 2019. Europe is also the home to some of the world’s unicorns including Sweden’s Klarna and Spain’s Cabify.

It is estimated that there are about 123,000 tech startups in Europe as of 2020, according to a model from Jan Hoekman, a Data Scientist working on quantifying the private market and Co-Founder and CTO at GlassDollar.

These days, European tech startups have been growing at an unprecedented pace, attracting the attention of global investors, customers, and corporate partners alike. Despite the setbacks caused by the coronavirus pandemic and a range of systemic challenges start-ups still face, including regulatory and cultural challenges, growing numbers of European tech startups continue to thrive and some cases performing their American counterparts.

Unlike the previous article where we only looked at the top-funded startups in Europe, in this piece, we want to cast a wide net and take an inside look at Europe’s top 1,000 tech startups using insights from a recently published research by McKinsey, a global management consulting firm with over 10.5 billion revenue as of 2019.

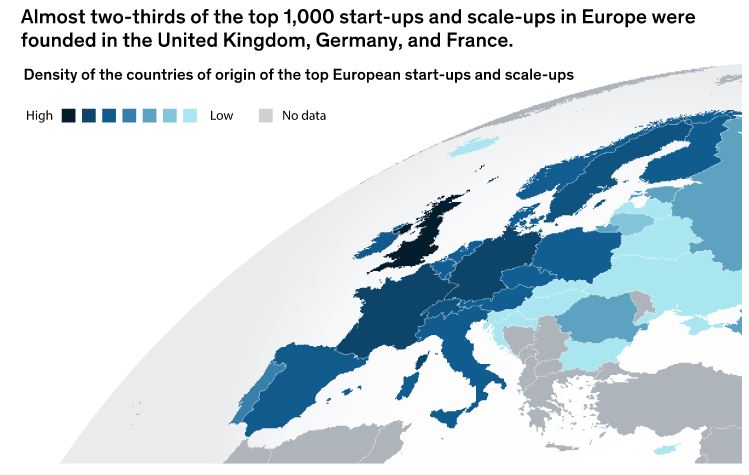

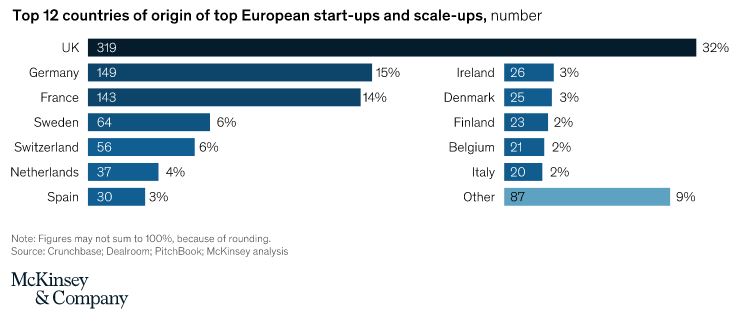

Earlier today, McKinsey reached out to us to share the results of their findings and how these tech startups have grown to 9-, 10- and 11-figure valuations despite Europe’s intrinsic challenges. To better understand how these top 1000 startups standouts from the rest, McKinsey studied the top 1,000 European tech start-ups founded after 2000 in 33 countries, which include 21st-century companies such as Spotify, Adyen, and BioNTech. The research finds that the UK is the home to Europe’s top startup with a total of 219, attracting 32 percent of Europe’s top 1,000 tech startups.

They then analyzed them along 15 critical growth dimensions and variables such as geography and vertical, as well as on the requirements for the time, funding, and revenues it takes to reach unicorn status (see Exhibits 1 and 2; also see the sidebar, “About our research”). Three key insights emerged from our analysis:

- Successful European tech start-ups follow one of four distinct roads to success: network, scale, product, or deep tech, each with its own characteristics regarding revenue growth, employees, and other similar markers.

- Different strategic plays require different success factors, such as over-indexing on commercial roles for scale players, focusing on an initial product hook for product players, or pursuing M&A activities for scale and network players.

- Reaching unicorn status requires on average €100 million to €200 million in funding, with 70 to 80 percent of the companies that make it achieving the €1 billion valuation mark within ten years of founding.

Below are some of the major highlights from the research:

Below are some of the major highlights from the research:

• Europe’s top 1,000 start-ups are worth an average of €890 million, ranging from several companies valued at €120+ million to Adyen & BioNTech, both currently valued at over €70 billion

• Collectively these top 1,000 start-ups have received over €140 billion in funding and employ almost half a million people

• Nearly a quarter of Europe’s top 1,000 start-ups are in biotech/healthcare, with another 18% in B2B SaaS and 16% in fintech

• McKinsey insights also point to four distinct strategic plays that all top 1,000 follow, and the success factors needed for those strategic plays:

- 1. Deep-Tech: 30% of the top 1,000 are deep tech plays. They have less than half the average employees (211 average) of other top start-ups, but the highest share of employees in R&D roles – and 27% come from top 1000 international universities.

- Network: 11% of the top 1,000 are network plays. On average they have the most employees (982) and funding (€243mn), and often rely heavily on M&A to internationalize and attain a sizeable market.

- Product: 45% of the top 1,000 are product plays. They are the most dominant in Europe and typically B2B SaaS or fintechs. They require the least amount of funding, focused on fast adoption of an initial well-defined product.

- Scale: 14% of the top 1,000 are scale plays. They seek rapid sales growth early so over-index on commercial roles (42% of employees vs 33% in other plays). As a result, they have the largest average revenue (€826 million vs €277 million for the top 1,000)

Kim Baroudy, senior partner at McKinsey and one of the report’s authors, said: “Europe often gets overlooked as we only produce around 15% of the world’s unicorns, but growth is accelerating at an unprecedented pace. We now have well over a thousand start-ups with valuations north of €100 million.”

He added: “In fact, Europe’s top 1,000 start-ups are worth an average of €890 million, ranging from several companies valued at €120 million to Adyen & BioNTech, both currently valued at over €70 billion. Collectively these top 1000 companies have received €140+ billion in funding and employ almost half a million people. The innovation coming out of Europe is greater than it’s ever been, and it’s not coming from just one or two super hubs – they’re spread across the entire region. It’s exciting to see Europe build, grow and keep more homegrown tech champions.”

Below is the infographic.