Boku launches M1ST, the world’s largest mobile payments network that reaches 5.7 billion mobile payment accounts in 90 countries

In the past decade alone, 1.7 billion consumers have joined the world’s middle class, with over 90% of the new middle class in emerging markets (Brookings Institute, 2020). Many of the world’s new middle class in Asia, Latin America, Africa, and the Middle East are bypassing credit cards, and moving from cash to mobile payments like GoPay, Paga, PicPay, and UPI.

According to the World Bank, 45% of consumers globally use mobile wallets vs. just 18% that use credit cards for payments. However, mobile payment acceptance for global merchants is highly complex, especially due to the extreme fragmentation of mobile payment methods.

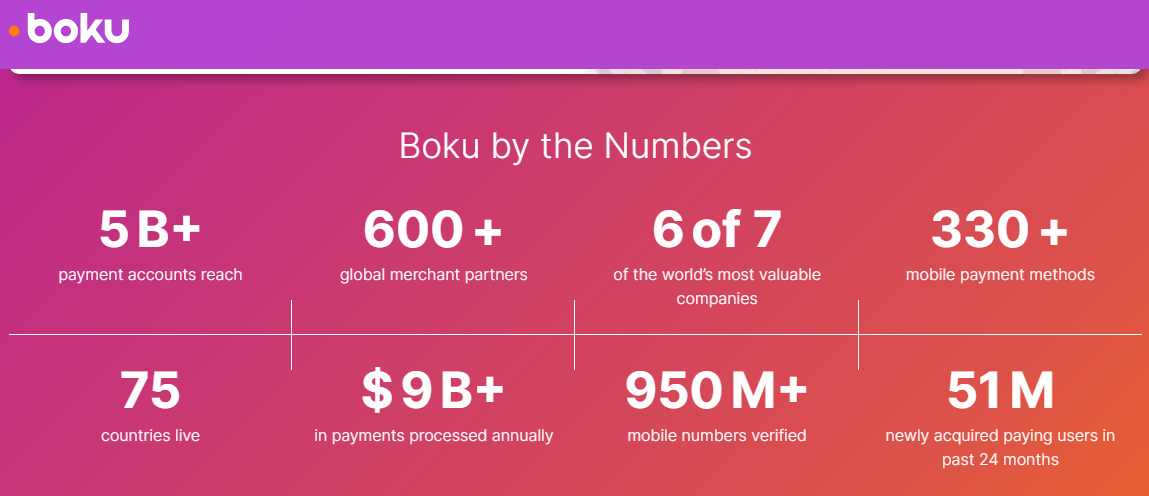

Enter Boku, a London, England-based tech giant and a global mobile payments company, and the world’s largest mobile payments network. Companies that use Boku to simplify sign-up, acquire new paying users and prevent fraud include global leaders such as Apple, DAZN, Facebook, Google, Microsoft, Netflix, PayPal, Sony, Spotify, and Tencent.

Today, Boku announced the launch of M1ST to solve a number of the above challenges so that merchants can easily accept mobile payments, globally, and at scale. M1ST (aka Mobile First) is the world’s largest mobile payments network.

M1ST is designed to eliminate the difficulty of mobile payment acceptance so that merchants can accept mobile payments more quickly, at a lower cost, and focus on building world-class user experiences that drive long-term, valuable relationships with their customers.

The M1ST Payments Network features an unrivaled 330+ mobile payment methods, including mobile wallets, direct carrier billing, and real-time payments schemes, reaching 5.7 billion mobile payment accounts in 90 countries – all through a single integration.

Founded in 2008, Boku is the fintech powering the world’s largest mobile payments network, M1ST (Mobile First). With 45% of global consumers using mobile payment methods to buy goods online, compared to 18% using credit cards, the future of commerce is mobile-first. Headquartered in London, UK, Boku also has offices in Brazil, China, Estonia, France, Germany, India, Indonesia, Japan, Singapore, Spain, Taiwan, Vietnam, and the US.

Boku’s technology platform helps the world’s most demanding merchants attract, convert, and retain customers using mobile payments. By turning payments infrastructure into a source of sustainable competitive advantage, Boku safely activates a range of new merchant business models – from bundling to subscriptions.

Boku’s platform is used in 90 countries with more than a billion verified transactions in 2020, contributing more than $8 billion to the digital economy.

“We’ve seen a fundamental shift of consumer purchasing power from west to east, from established to emerging markets, and from credit cards to mobile payments. Today, we’re launching the M1ST Network to enable global merchants to acquire, monetize, and retain mobile-first consumers,” said Jon Prideaux, CEO of Boku.

“For merchants to capitalize on the massive potential of mobile-first consumers, they need to accept the payment methods they have and prefer, which are increasingly behind glass screens, not rectangular pieces of plastic. We’ve spent the past decade delivering new customers to our merchants through mobile payments. Now that mobile payments have overtaken credit cards globally, merchant acceptance has moved from a competitive advantage to a strategic imperative,” Prideaux added.