Israeli founded digital ad platform startup Outbrain makes its public debut at over $1 billion valuation

Outbrain’s highly-anticipated public offering is finally here. The New York-based digital ad platform tech startup makes its Wall Street debut today opening at its initial public offering (IPO) price of $20 per share.

At the close of the market yesterday, Outbrain sold 8 million shares in the IPO to raise about $160 million, valuing the company at nearly $1.1 billion. Outbrain is a rival to Taboola, another digital ad platform that announced its plans back in January to go public via a SPAC merger with ION Acquisition Corp.

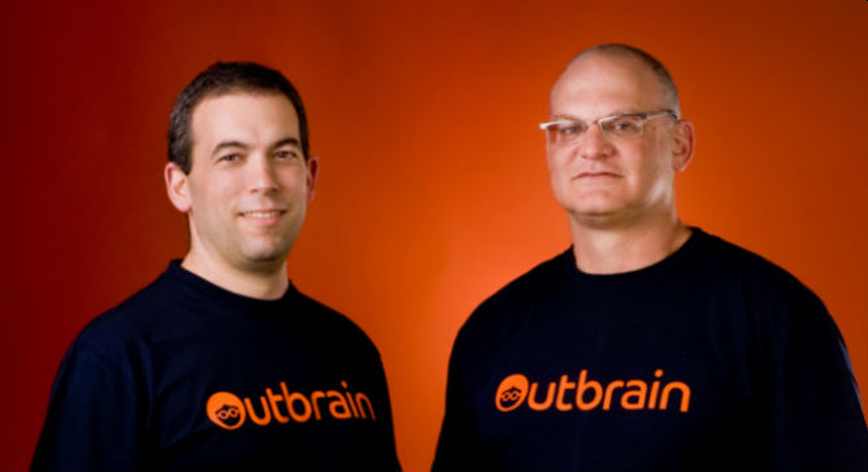

Founded in 2006 by two Israeli friends Ori Lahav and Yaron Galai, Outbrain provides a recommendation platform to connect advertisers to open web consumers. Its technology connects advertisers to audiences to grow their business through recommendation feeds on websites. Outbrain also partners with publishers and marketers in more than 55 countries.

In 2109, there was a planned merger between Taboola and rival Outbrain in hopes of becoming a bigger competitor to digital advertising giants such as Google and Facebook. However, the deal fell through and the merger talks ended after the companies failed to agree on revised deal terms.

Before going public, Outbrain has raised a total of $394 million in funding over 10 rounds. Its latest funding was raised early this month from a Private Equity round when the company raised $200 million from Boston-based investment manager Baupost Group.

Outbrain describes itself as a “mobile-first” company and got more than 66% of its revenue last year from mobile platforms, according to a regulatory filing.