Building a $10 billion business: How sneaker resale app GOAT went from a tiny tech startup to a multi-billion dollar company

Happy Friday! Who would have thought anyone could build a multibillion-dollar business reselling sneakers? GOAT (“Greatest of All Time”) is a sneaker resale marketplace launched six years ago to let people easily buy and sell authentic, highly coveted, and general-release sneakers. Today, Goat is worth billions of dollars. GOAT has also become one of the top online marketplaces for sneaker evangelists, otherwise known as sneakerheads.

In 2016, Vox wrote a piece titled, “GOAT is a sneaker app that should be dead — but is making millions instead.” So, what’s the secret sauce behind this 6-year-old startup and why is GOAT successful where others have failed?

The story of GOAT started back in 2010 In 2010, Eddy Lu and co-founder Daishin Sugano launched GrubWithUs, a foodtech startup aimed at organizing meals between strangers. The duo went on to raise more than $7 million for their idea and later expanded to new cities at a rapid pace because, like every startup founder, they want to scale quickly. In the end, it failed.

However, Lu and Sugano did not give up despite the setback. Instead, the two pivoted into new projects and new business models. After a few unsuccessful pivots later, “Lu and Sugano were left with around $1.5 million and one last shot at a new idea with their investors’ backing,” according to Vox. In an interview with Vox, Lu added, “Most companies don’t come back to life after a couple of pivots. We’re very fortunate to do so.”

The duo decided to go into a business they are passionate about–selling sneakers. GOAT told Vox that their decision to get into the sneaker business was because Sugano was a self-proclaimed sneakerhead. According to a report from research firm Statista, in 2020, the total global sneakers market revenue was valued at approximately 70 billion U.S. dollars and was forecast to reach a value of 102 billion U.S. dollars by 2025.

Fast forward 5 years later, GOAT is a success. Harvard University even wrote about the GOAT success story. Today, GOAT has over 20 million users and is available in 164 countries. Yesterday, GOAT Group, the parent company of GOAT, announced it has raised $195 million in funding that values the business at $3.7 billion — up from $1.75 billion last September. The round was led by Park West Asset Management, T Rowe Price Associates, Franklin Templeton, Adage Capital Management, and Ulysses Management.

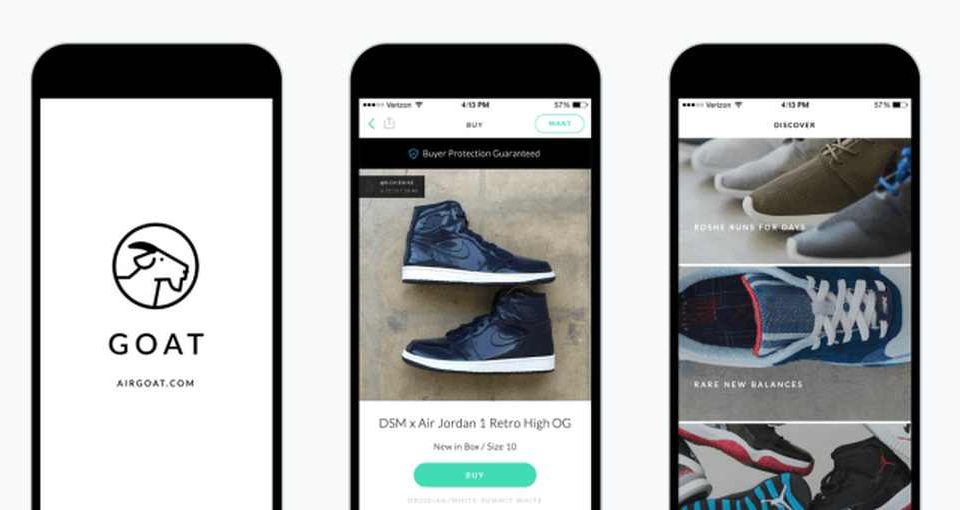

Here’s how GOAT works: Sneaker sellers post their items on the GOAT platform — these items range from $25 to more than $500,000 — GOAT then facilitates the transaction between the buyers and the sellers (just eBay does). GOAT then verifies the authenticity of sneakers through its proprietary AI technology before the items are sold to buyers. Unlike eBay that charges about 13.5% commission for items sold on its platform, GOAT only charges its customers a 9.5% commission on each sale in exchange for a safe, frictionless transaction.

So, why did GOAT succeed where others have failed? Value! Goat offers its customers unparallel value. The mark of any successful startup is in creating values for its customers. As Harvard’s article shows, GOAT creates value by selling authentic products to its customers. GOAT also “provides a “one-stop-shop” for buyers and sellers by creating a global cluster.” Finally, GOAT also reduces marketplace friction. You can read the rest below.

“Creating Value:

- Authentication of resold sneakers: the way GOAT creates the greatest value is in its authentication process. Sneakers aren’t listed on the app for sale until they have been verified by photographs (and later on, verified again by GOAT employees in distribution centers) to ensure their authenticity. GOAT also protects its buyers by offering full refunds and insuring any purchase over $300[4]. Trust and protection are valued assets when purchases in the sneaker resale market can go up to $20,000 USD or more.

- Access: The ability to have a “one-stop-shop” for buyers and sellers by creating a global network cluster. Sneakers are shipped to distribution centers (multiple in US, and now opening more internationally in Europe and Asia), where these can be deployed and shipped out to customers – in effect, centralizing its network and creating a global marketplace.

- Pricing transparency: sellers can list their sneakers at whatever price they wish, and buyers are able to see all listed sneakers. Buyers are also able to bid on kicks, similar to an eBay model but with more safety and insurance.

- Cleaning and refurbishing services: sellers can choose to have their used sneakers cleaned and refurbished by GOAT (for a fee) to help increase their value and make them feel and look like new shoes for the buyer. This is done in their centralized distribution centers.

- Large audience of buyers (~7 million), and large inventory from sellers (~400,000 SKUs)[5], which leverages strong cross-side network effects.

- Mobile app for easy shopping and selling, as well as augmented reality features to virtually try on pairs of sneakers for sale.

- Retail locations in NYC and LA with the acquisition of Flight Club (an iconic sneaker store).

- Reduces friction in marketplace between buyer and seller.”