Unicorn fintech startup Revolut’s losses doubled to $278 million as risk control costs increase

In October 2019, Unicorn fintech startup Revolut reported a £32.8 million net loss on revenues of £58.2 million for 2018. The reported loss was more than double the £14.8 million loss the 6-year old British started posted a year earlier. A year later, raises $500 million at a $5.5 billion valuation, making it one of Europe’s most valuable startups along with e-commerce payments start-up Klarna.

As we all know, the startup journey can be bumpy and never a smooth-sailing road. Today, Revolut said its annual losses doubled to $278 million (£200 million pounds) due to rising administrative costs that rose from investment in risk, compliance, and controls.

According to a report from Reuters, Revolut’s administrative costs increased from £125 million in 2019 to £266 million pounds in 2020, outpacing growth in revenues as it expands into new markets.

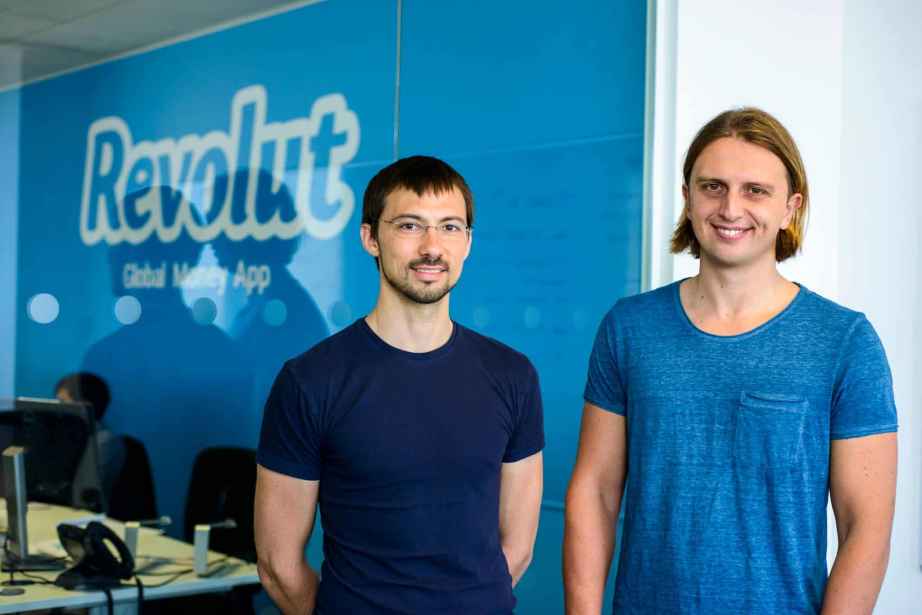

The UK-based startup was founded in 2015 by Nikolay Storonsky and Vlad Yatsenko. Revolut launched to the public in July 2015 with the aim of “building a fair and frictionless platform to use and manage money around the world” by removing hidden fees and offering interbank currency rates. Nikolay Storonsky is a former trader at Credit Suisse and Lehman Brothers. Vladyslav Yatsenko is a former Credit Suisse and Deutsche Bank developer.

The Revolut mobile app supports spending and ATM withdrawals in 120 currencies and sending in 29 currencies directly from the app. It also provides customers access to cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and XRP by exchanging to or from 25 fiat currencies.

In March 2019, an exposé of the company’s employment practices and culture was published by Wired. This found evidence of unpaid work, high staff turnover, and employees being ordered to work weekends to meet performance indicators. A more recent article suggests that the company has responded to the criticism.

Revolut became the UK’s most valuable financial technology startup in February 2020 after a funding round that more than tripled its value. This comes after the company announced it had raised $500 million from a group of investors led by the US fund Technology Crossover Ventures