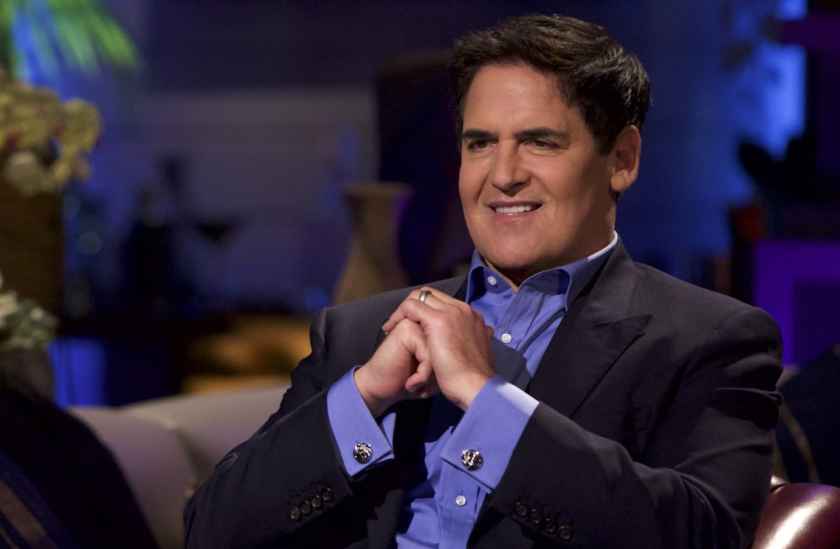

Mark Cuban calls for cryptocurrency regulation in the U.S after he lost money trading a DeFi token TITAN

Billionaire investor Mark Cuban made headlines yesterday after he reported that he lost money trading a DeFi (Decentralized Finance) token called TITAN. The token is linked to fintech startup Iron Finance, a group that runs the wider IRON Stablecoin project, which aims to avoid price volatility. The founders later abandon the project and investors after cashing out.

Cuban gets rug pulled after promoting the same token just a week before. The TITAN token crashed from $60 to zero in under 24 hours. In a Twitter post, Cuban claimed he was “hit” by a cryptocurrency token market crash on Wednesday.

After losing an undisclosed amount of money trading TITAN DeFi token, Cuban is now calling for government regulation into cryptocurrency. In an email to Bloomberg Thursday, Cuban calls for more stablecoin regulation. He also shared his experience staking liquidity for TITAN and why he didn’t do his due diligence before he was hit with the TITAN rug pull.

“The investment wasn’t so big that I felt the need to have to dot every I and cross every T. I took a flyer and lost. But if you are looking for a lesson learned, the real question is the regulatory one. There will be a lot of players trying to establish stable coins on every new l1 and L2. It can be a very lucrative fee and arb business for the winners,” Cuban wrote.

Below is Cuban’s full statement to Bloomberg about his experience with TITAN.

“I read about it. Decided to try it. Got out. Then got back in when the TVL start to rise back up As a percentage of my crypto portfolio it was small. But it was enough that I wasn’t happy about it.

But in a larger context it is no different than the risks I take [in] angel investing. In any new industry, there are risks I take on with the goal of not just trying to make money but also to learn. Even though I got rugged on this, it’s really on me for being lazy. The thing about de fi plays like this is that its all about revenue and math and I was too lazy to do the math to determine what the key metrics were.

The investment wasn’t so big that I felt the need to have to dot every I and cross every T. I took a flyer and lost. But if you are looking for a lesson learned , the real question is the regulatory one. There will be a lot of players trying to establish stable coins on every new l1 and L2. It can be a very lucrative fee and arb business for the winners.

There should be regulation to define what a stable coin is and what collateralization is acceptable. Should we require $1 in us currency for every dollar or define acceptable collateralization options, like us treasuries or?

To be able to call itself a stable coin? Where collateralization is not 1 to 1, should the math of the risks have to be clearly defined for all users and approved before release? Probably given stable coins most likely need to get to hundreds of millions or more in value in order to be useful, they should have to register.”