Mark Cuban says he lost money trading a DeFi token called TITAN that crashed from $60 to zero in under 24 hours

Billionaire investor Mark Cuban says he lost money trading a DeFi (Decentralized Finance) token called TITAN that crashed from $60 to zero in under 24 hours. In a Twitter post, Cuban claimed he was “hit” by a cryptocurrency token market crash on Wednesday.

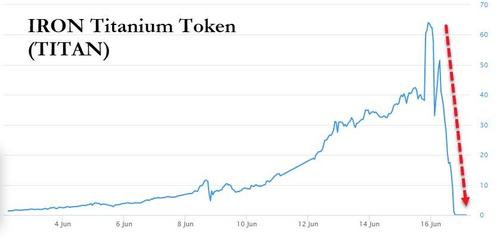

According to Decrypt, which first broke the news, Cuban invested in a token known as the IRON Titanium Token or TITAN. Instead, the opposite just happened. Just yesterday, the TITAN token was trading at over $60. As of this morning, the token has fallen to a fraction over zero, according to CoinGecko.

A couple of days ago, Mark Cuban announced his involvement in the token saying: “Crypto Businesses make more sense than you think and valuing tokens is easier and makes more sense than you think.”

Just three days later, it turned out that Cuban probably didn’t do his due diligence before investing in the bogus token. The investment makes less sense than Cuban had hoped.

The token is linked to Iron Finance, a group that runs the wider IRON Stablecoin project, which aims to avoid price volatility. The founders later abandon the project and investors after cashing out.

In his response to Twitter posts that this was a DeFi rug pull—when founders abandon a project after cashing out—Cuban said: “I got hit like everyone else. Crazy part is I got out, thought they were increasing their [total value locked] enough. Than [sic] Bam.”

https://twitter.com/mcuban/status/1405306497257586688

So why did the so-called stablecoin TITAN crash all of a sudden? According to a report from Rekt.com, “the incident started when TITAN became overpriced, perhaps due to users purchasing the token in order to farm TITAN pairs at ~50,000% APY. Some large TITAN sales were made and the price became volatile, making investors nervous, and leading them to also sell their tokens.”

Fred Schebesta, founder of the Finder.com finance site and Iron Finance investor also told CoinDesk on Thursday that the sudden crash in TITAN was caused by panic-selling by “whales,” individuals who hold large amounts of a certain token.

“TITAN’s price went to $65 and then pulled back to $60. This caused whales to start selling,” Schebesta added. In the end, the IRON stablecoin then lost its peg due to TITAN dropping so rapidly.

Cuban later told Decrypt via email: “Live and learn.” What just happened to Cuban could happen to anyone. This is one of the risks and dangers of investing in cryptocurrency.