Mark Cuban-backed digital banking tech startup Dave to go public via a $4 billion SPAC deal

The red-hot Special purpose acquisition companies (SPACs) market continues to grow with no sign of slowing down. are all the rage these days. In 2021 alone, there are 330 SPAC IPOs of the 463 IPOs, according to data from the SPAC insights website, SPACAnalytics.com.

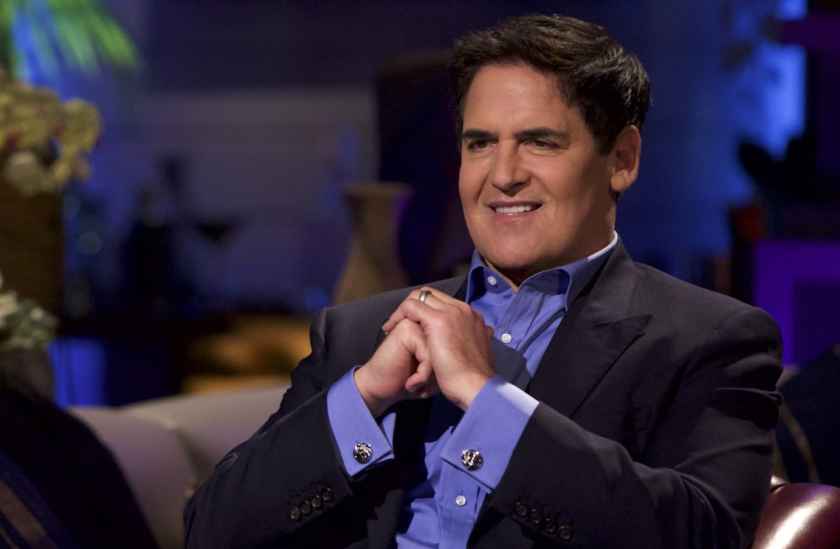

Early last month, we wrote about Better.com after the digital mortgage lending startup Better.com filed to go public via a $7.7 billion SPAC deal. Mark Cuban-backed digital banking tech startup Dave becomes the latest startup to join the SPAC frenzy.

Today, Dave announced it would go public through a merger with a blank-check firm sponsored by investment firm Victory Park Capital (VPC) Impact Acquisition Holdings III Inc, valuing the banking app at $4 billion. The deal includes a $210 million investment led by Tiger Global Management, with additional participation from Wellington Management and Corbin Capital Partners.

Founded in 2016 by Jason Wilk, John Wolanin, and Paras Chitakar, the Los Angeles, California-based Dave is a challenger bank on a mission to put everyone’s financial mind at ease with free overdraft cash, budgeting, and side gigs.

The Dave app is used to help millions of Americans avoid more than $30 billion in overdraft fees charged by traditional banks. According to its website, Dave currently has 10 million customers.

A blank-check company sometimes called a special purpose acquisition company (SPAC), is a shell company that has no operations but plans to go public with the intention of acquiring or merging with a company utilizing the proceeds of the SPAC’s initial public offering (IPO).