40% of US dollars in existence were printed in the last 12 months: Is America repeating the same mistake of 1921 Weimar Germany? [UPDATED]

On January 1, 2020, bitcoin was valued at $7,160, while the Dow Jones stood at 28,634 on January 3, 2020. However, the Dow Jones plummeted to 19,173 by March 20, 2020, in the wake of the coronavirus outbreak in the United States. This prompted state and federal governments to implement widespread economic shutdowns, resulting in millions losing their jobs.

In an effort to revitalize the economy, the US government distributed stimulus checks to millions of employed Americans. But where did this money originate? To fund these measures, the government resorted to borrowing by issuing US Treasury bonds and other securities. Subsequently, the Federal Reserve intervened by initiating money printing operations.

While money printing is not a new phenomenon—the Federal Reserve has been printing money to service roughly $29 trillion in US debt—the scale of recent printing is unprecedented. Remarkably, 40% of all US dollars currently in circulation were printed in the last 12 months alone.

What’s particularly striking about this statistic is its stark contrast with the Federal Reserve’s findings from just two years ago. According to an ABC News report, in 2019, the Federal Reserve revealed that 40% of Americans lacked $400 in emergency savings. Essentially, nearly 40% of American adults wouldn’t be able to cover a $400 emergency expense with available cash, savings, or a credit card charge they could swiftly pay off.

During this time, the US government has been injecting vast sums of new money into circulation. Consider this: On January 6, 2020, the US Federal Reserve held approximately $4 trillion. By January 4, 2021, this figure had surged to $6.7 trillion. Money traditionally serves as a medium of exchange to facilitate transactions of goods and services. However, with no corresponding increase in productivity—meaning goods and services—backing up the trillions of dollars currently in circulation, printing more money doesn’t necessarily enhance economic output (productivity); it simply boosts the quantity of money circulating within the economy.

So, why does this matter? Well, it leads to inflation and devaluation. When an excess of money chases the same amount of goods, inflation occurs. For instance, inflation spiked by 0.8% in April and 4.2% annually, the most significant increase since 2008, partly due to substantial hikes in food prices and other commodities. This inflationary pressure is also evident in the stock and cryptocurrency markets.

Recall the three rounds of stimulus checks distributed to millions of financially strained Americans. Instead of allocating these funds to essentials like food, savings, or debt repayment, some individuals chose to invest their stimulus checks in assets such as stocks (e.g., GameStop) and cryptocurrencies like Bitcoin, further driving up their prices.

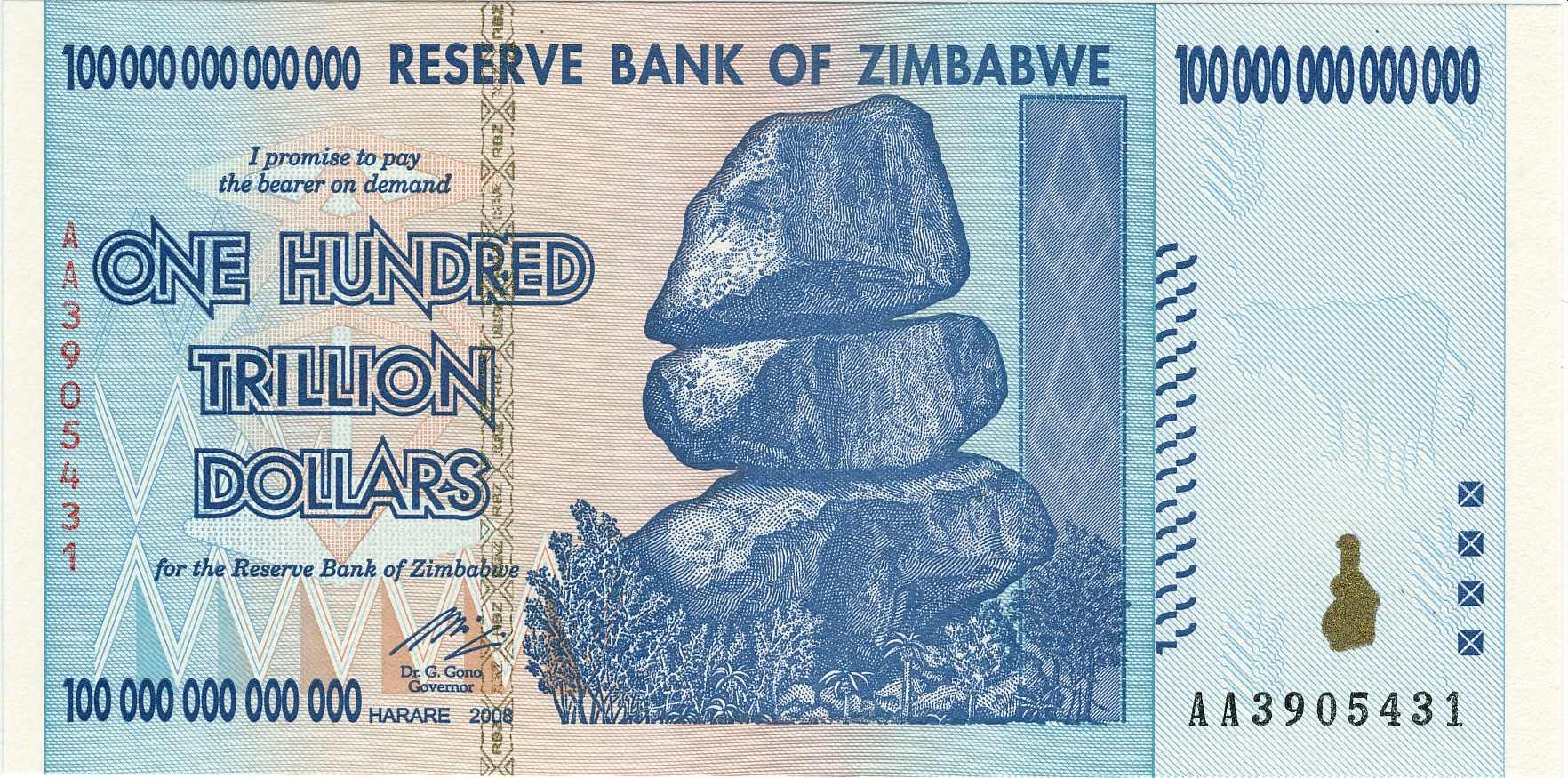

Moreover, excessive money printing by the Federal Reserve leads to the debasement and devaluation of the dollar. This practice, akin to historical examples seen in countries like Weimar Germany, and Zimbabwe, has consistently resulted in hyperinflation and economic turmoil.

In the video below, Jake Tran delves into the historical accounts of nations attempting to print their way out of economic crises, only to plunge deeper into financial woes. He also notes that while the quantity of money printed is a contributing factor to inflation, it’s just one of many elements influencing the phenomenon.

To get inflation, Jake explains, we need:

- Industrial Output: How much “stuff” an economy makes

- Employment: Too much employment leads to employers fighting over workers, which leads to higher wages, which leads to higher prices

- The Money Supply: More money when an economy is producing the same amount or less stuff equals higher prices

- Velocity of Money: If money is exchanging hands, and if so, how fast is it exchanging hands?

Hats off to Jake for the video. Enjoy!

1921 Weimar Germany

Zimbabwe