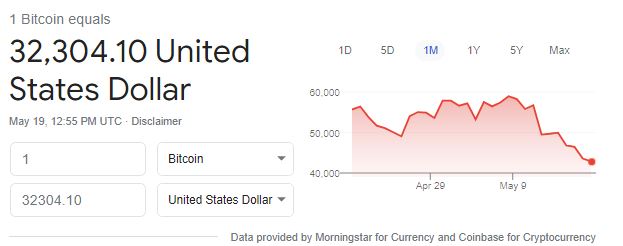

Bitcoin crash: Bitcoin down about 40% from its peak of $64,829.14 in mid-April as $300 billion wiped off crypto market

On Monday, bitcoin was trading around $43,000 to the U.S. dollar. Since then, the world’s most popular cryptocurrency has lost at least 15% of its value. At around 12:54 a.m. Eastern Time, bitcoin hit an intraday low of $38,585.86 according to CoinDesk data. That was the lowest level since Feb. 9, the last time it dropped below $40,000.

Bitcoin was down 20% in the last 24 hours, according to Coinbase data. The world’s most popular cryptocurrency hit an intraday low of around $36,189 at 7:30 a.m. Eastern Time. It was the lowest level since Feb. 3, when bitcoin hit a low of $35,393. As of 4:30 a.m. Eastern Time, bitcoin was again trading above $40,000 again. Bitcoin is now trading at $37, 746 as of the time of writing.

Update: 8:58 AM Eastern Time:

Bitcoin is now trading at $32,304.10

What is really going on?

It all started last week when Tesla announced it will no longer accept bitcoin for car purchases over concerns about the environmental impacts. The news sent shock waves to the crypto markets causing bitcoin and other cryptocurrencies to lose over 10 percent of their values in just a few days. The negative news keeps on coming. Now, the crypto market is facing another problem–China.

On Tuesday, three Chinese banking and payment industry bodies issued a statement banning financial institutions not to conduct virtual currency-related business, including trading or exchanging fiat currency for cryptocurrency.

In addition to China’s problem, many analysts are saying that cryptocurrency went up too soon and that correction is needed after one of the fastest bull runs. Some see bitcoin falling to its January price of $30,000.

According to economist Harry Dent, the correction will later lead to another bull cycle that propels bitcoin to over $100,000. Dent expects a big shakedown thinks a big crash is coming by late 2022 or early 2021. Dent also explains why he is avoiding bitcoin and gold right now.