Can DeFi Spell the End of Centralized Finance?

Currently, Decentralized Finance, or DeFi as it is called, accounts for investments worth over $42 billion. As it grows at a breakneck speed to rival the centralized financial institutions, it begs the question, can DeFi fulfill the aspiration for blockchain and cryptocurrency to provide self-sovereign democratization of finance ultimately.

Built predominantly on the Ethereum blockchain, DeFi has grown from a cache investment opportunity to a juggernaut representing a fully-fledged financial system controlled by no single entity.

DeFi is an innovative version of banking that allows p2p, financial services to facilitate crypto trading, interest-bearing accounts, lending, and other services. The growth of DeFi will mean financial institution would:

- Have no more central control:

both decisions and funding for the project will come from the community. - Unlimited Access:

more people will have access to finance and financial services than ever before. - Interoperability:

Banks and other financial services providers will cooperate more efficiently and work with consensus rather than competition. - Transparency:

Banking and financial services will be delivered with greater transparency and equity in service delivery.

Size Matters, But

You might consider this a pipe dream with the centralized financial institutions and the global stock market worth around $90 trillion. The DeFi, Bitcoin, and the entire cryptocurrency market just hit the $2 trillion mark, of which the DeFi only represents about $75 billion. But, consider this, the stock market has been around since the 17th century, and the crypto market just over a decade.

But, what made blockchain and significantly DeFi snowball? The question may have several answers and factors that have influenced its rapid growth. But, one surefire answer that trumps all is Innovation.

Tools and Innovations

The rapid development and expansion of the decentralized finance market have resulted from a wide variety of products, tools, and investment and income opportunities spawned over the past couple of years.

The DeFi market has welcomed investment and saving products like Interest- earning accounts, loans, and short-term loans in the recent past. It has also initiated options, synthetic assets, and currency pairs.

Along with the investment products, rapid automation of both the market information gathering and trading functions gets the credit for the rapid growth of crypto and DeFi markets. A growing list of tools, from Automated Market Makers and trading platforms to analysis tools and trading bots, have super-charged a market already hot with explosive growth.

The algorithmic trading platforms and crypto trading bots mean a growing trend towards a portion of traders from other markets, specifically day traders, getting involved in the crypto space.

Mainstream Acceptance

Where the ongoing shift of institutional money rapidly moving into crypto and DeFi markets and the ever-growing rewards it has bourne for the past couple of years, there is a likelihood that a good portion of institutional investment will both filter into and remain in DeFi.

The recent developments like “Wall Street firms like Goldman Sachs, Citigroup, and BlackRock are now getting in on the action,” will have a substantial positive impact on the recognition of DeFi as a legitimate alternative to traditional financial institutions if not an outright replacement of them.

Decentralization and Its Advantages

Another aspect of several DeFi products that might impact how traditional financial service providers operate is its ability to operate on auto-pilot in a trustless environment seamlessly.

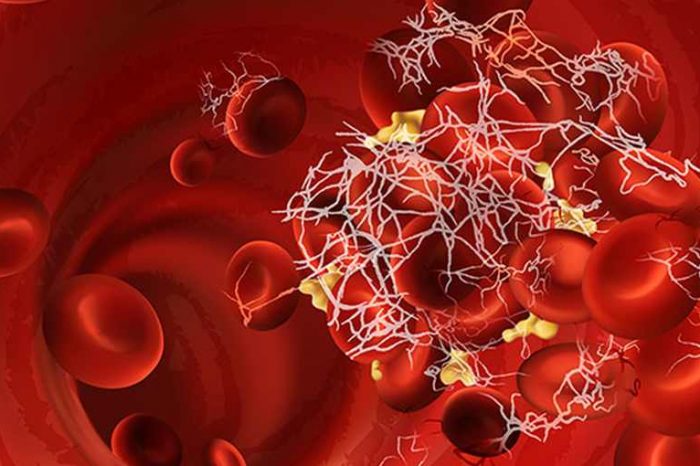

DeFi financial products, built on the Ethereum network whose functions are executed by smart contracts once specific rules are triggered. Unlike traditional financial institutions that act as a middleman organization that keeps a hold of and distributes capital while charging a fee.

DeFi works directly through peer-to-peer, which means the complete value being transferred in DeFi txs can go through as opposed to going to another entity’s, that is, institutional pockets.

In terms of handling assets and their governance, DeFi is decentralized in two ways: its governance and its custody of data, an exciting change for the established finance industry. Many DeFi lending platforms operate as non-custodial, which means that the lender’s crypto assets remain in the owner’s wallet.

Decentralization, being the central tenet of the crypto and DeFi world, Satoshi Nakamoto imagined the crypto platforms to be a proper financial system uncontrolled by a single entity.

Providing Access Without Protocol

There are over one and a half billion people who lack access to financial services across the globe because they have no official identification. DeFi lending, in stark contrast to the traditional centralized and permission structure of banking and short-term lending industries, does not require any identification to lend or borrow funds.

The decentralized protocols on DeFi platforms often do not require the official identification or the financial history of either party. Aside from the privacy benefits for the individual seeking to lend or borrow, DeFi might free a large chunk of the earth’s population from seeking financial services just because they cannot fulfill a central bank’s Know-Your-Customer (KYC) criteria.

Granted that these controls have a place in securing and identifying the source of any ill-gotten funds, but using an identification as a reason for denying someone the freedom to seek opportunities via access to financial services is too steep a price to pay.

Product Innovation

Because of how an Ethereum Blockchain operates, Aave, a DeFi lending platform on DeFi, offers short-term unsecured loans, called Flash Loans. These loans are primarily created to help users exploit arbitrage opportunities: the loan is made and retrieved in the same smart contract and during the same Ethereum transaction block where the loan originated.

In conclusion, the miraculous growth of DeFi has occurred because it genuinely provides products and services needed in the marketplace. With centralized, traditional financial institutions serving fewer people with more harsh terms and consequences of failure to abide by those terms, a decentralized system like DeFi with communal governance and a robust financial sector with unlimited access, interoperability, and transparency is sorely needed.