All eyes are on Coinbase as it sets to open on Nasdaq at about $355 per share instead of the $250 reference price

Crypto exchange startup Coinbase is unlike any market debut Wall Street has ever seen. The highly anticipated Coinbase IPO is set to hit the public market on Wednesday, a week after preliminarily reporting a ninefold increase in first-quarter revenue to an estimated $1.8 billion.

The news on the street is that Coinbase shares are now set to open at about $355 per share on the Nasdaq instead of the $250 per share reference price on Tuesday evening. Coinbase is currently the largest cryptocurrency exchange in the United States by trading volume. It’s set to go public in a direct listing that could value the cryptocurrency exchange at as much as over $100 billion.

Coinbase has been on fire lately. For the full year of 2020, Coinbase’s revenue more than doubled to $1.28 billion, and the company swung from a loss in 2019 to a profit of $322.3 million. The news of Coinbase IPO has caused the price of bitcoin to soared by as much as 5 % yesterday to $63,171. Bitcoin fell a little bit today and it’s now trading $62,771.70 at the time of writing.

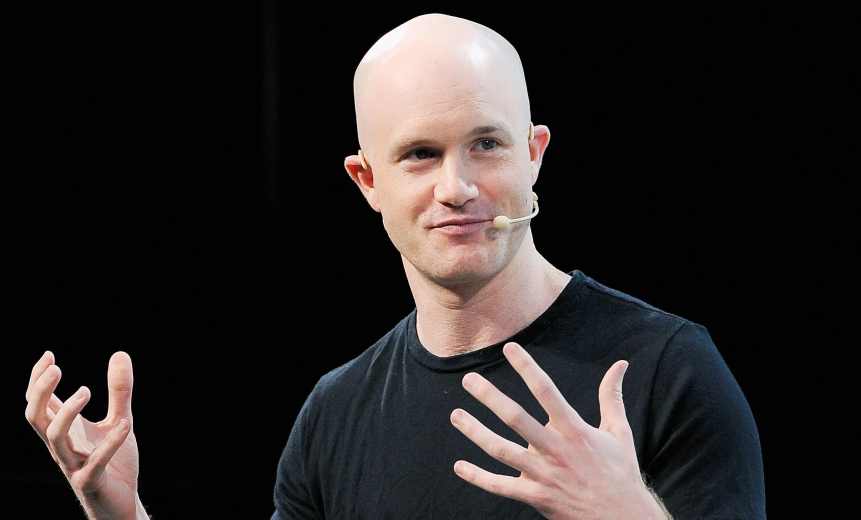

Founded in 2012 by Brian Armstrong and Fred Ehrsam, the San Francisco, California-based Coinbase is a digital currency wallet and platform where merchants and consumers can transact with new digital currencies like bitcoin, ethereum, and litecoin. Since its inception nine years ago, Coinbase has raised a total of $847.3 million in funding over 14 rounds. Its latest funding was raised on December 21, 2018, from a secondary market round.

The startup broker exchanges of Bitcoin, Bitcoin Cash, Ethereum, and Litecoin with fiat currencies in around 32 countries, and bitcoin transactions and storage in 190 countries worldwide. It was founded by Brian Armstrong and Fred Ehrsam. Coinbase launched the services to buy and sell bitcoin through bank transfers in October 2012.

In May 2013, the company raised a US$5 million Series A investment. The funding round was led by Fred Wilson from the venture capital firm Union Square Ventures. In December 2013, the company raised another US$25 million investment, from the venture capital firms Andreessen Horowitz, Union Square Ventures (USV), and Ribbit Capital.