Crypto exchange startup Coinbase to go public tomorrow at a $100 billion valuation

The crypto exchange startup Coinbase is what everyone is talking about. The startup’s highly anticipated initial public offering (IPO) is finally taking place tomorrow when Coinbase is set to go public in a direct listing that could value the cryptocurrency exchange at as much as $100 billion.

The news of Coinbase IPO has caused the price of bitcoin to climb by as much as 5% in the last 24 hours to hit $63,171, according to data from Coin Metrics. Coinbase’s Wall Street debut is also going to be the Bitcoin bull market’s first big test.

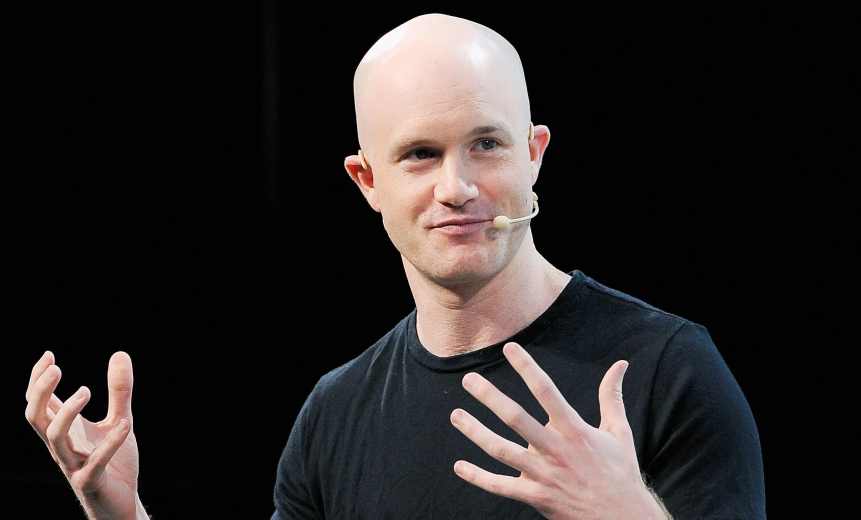

Founded in 2012 by Brian Armstrong and Fred Ehrsam, the San Francisco, California-based Coinbase is a digital currency wallet and platform where merchants and consumers can transact with new digital currencies like bitcoin, ethereum, and litecoin. Since its inception nine years ago, Coinbase has raised a total of $847.3 million in funding over 14 rounds. Its latest funding was raised on December 21, 2018, from a secondary market round.

The startup broker exchanges of Bitcoin, Bitcoin Cash, Ethereum, and Litecoin with fiat currencies in around 32 countries, and bitcoin transactions and storage in 190 countries worldwide. It was founded by Brian Armstrong and Fred Ehrsam. Coinbase launched the services to buy and sell bitcoin through bank transfers in October 2012.

In May 2013, the company raised a US$5 million Series A investment. The funding round was led by Fred Wilson from the venture capital firm Union Square Ventures. In December 2013, the company raised another US$25 million investment, from the venture capital firms Andreessen Horowitz, Union Square Ventures (USV), and Ribbit Capital.