Investors filed lawsuits against free-trading app Robinhood after it was reportedly selling people’s GameStop shares without warning

The fight between the Reddit army of over 2.8 million members gets nasty this afternoon after Robinhood users started to report that Robinhood is selling their GameStop (GME) shares without warning. Now a group of Robinhood users has filed a lawsuit against the fintech startup for not only selling their shares without their permissions but also for “removing Gamestop from its trading platform.”

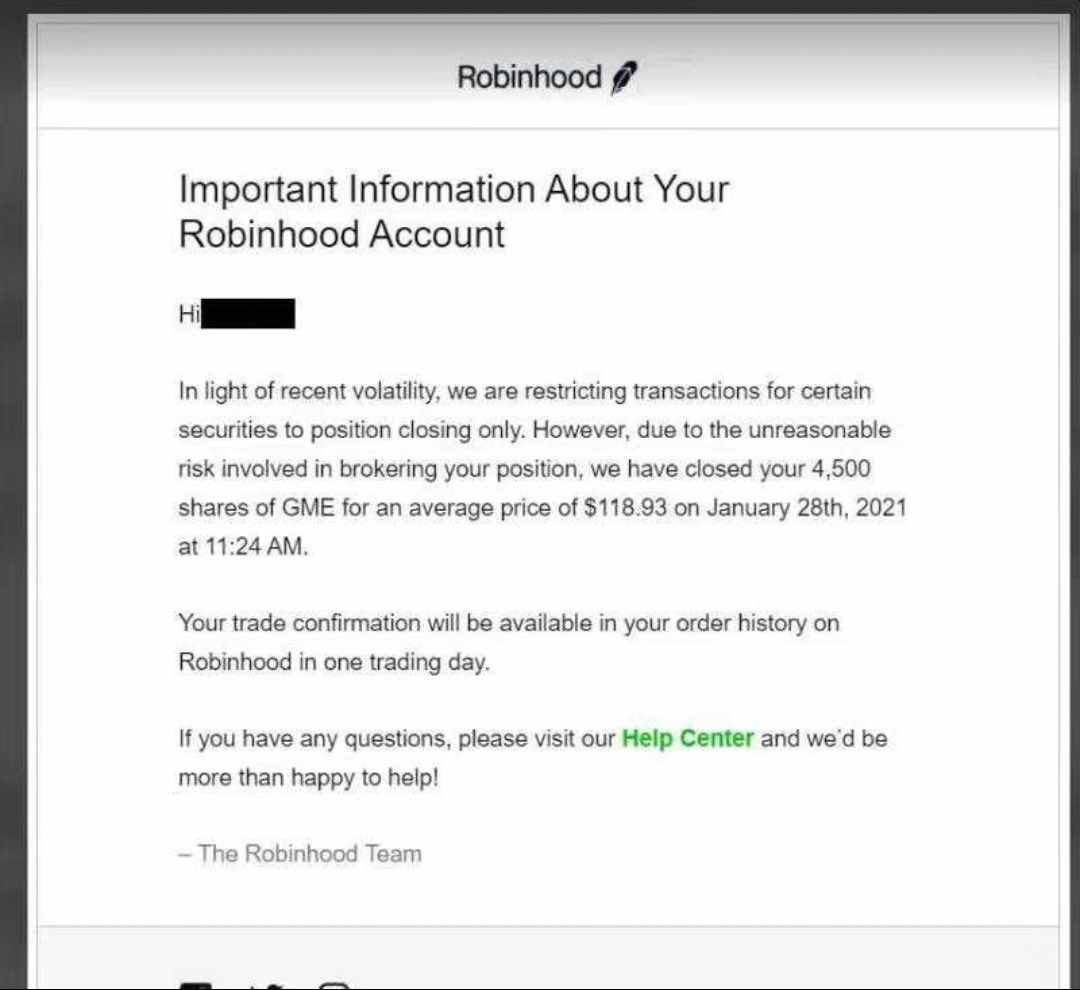

Below is one of the screenshots making rounds on social media. Meanwhile, platforms like Webull and Merrill Edge have also joined in the restrictions.

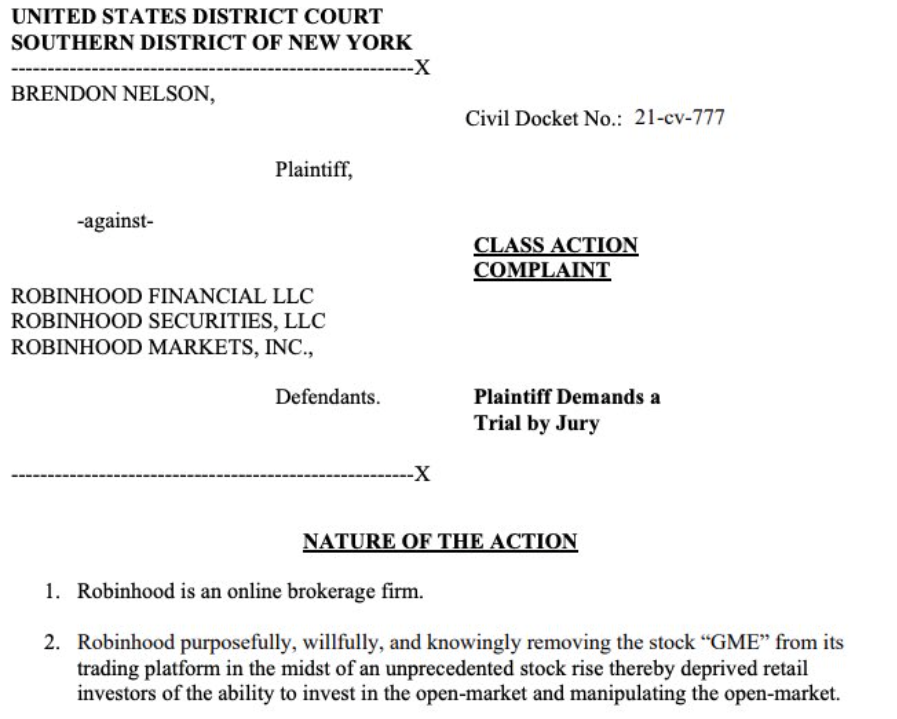

Following the outrage of stock manipulation from U.S. Congresswoman Alexandria Ocasio-Cortez (AOC), Brendon Nelson (presumably a Robinhood user), filed a lawsuit against Robinhood Financial LLC, Robinhood Securities, LLC, and Robinhood Markets, Inc. in the Southern District of New York this afternoon for “removing Gamestop from its trading platform.”

The lawsuit reads:

“Robinhood purposefully, willfully, and knowingly removing the stock “GME” from its trading platform in the midst of an unprecedented stock rise thereby deprived retail investors of the ability to invest in the open-market and manipulating the open-market.”

It all started after several hedge funds and Wall Street elites lost billions as a result of their GameStop play. Then this morning, Robinhood announced that millions of its customers will no longer be able to buy Gamestop stock on the free-trading app, thereby blocking 2.8 million members of the WallStreetBets forum on Reddit. Robinhood also said it aims to do the same for AMC, Nokia, BlackBerry, Naked Brands, and a few other stocks.