GameStop stock hits $385 as Reddit army crushes Wall Street hedge funds; short sellers Melvin and Citron lost more than $5 billion

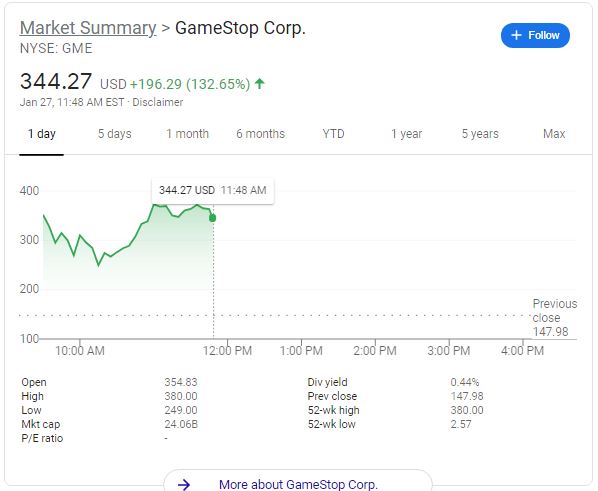

It’s a battle of David versus Goliath as WallStreetBets, a Reddit army of more than two million users, crushed Wall Street hedge funds and other investment bigwigs. Following the group’s success in driving up the stock price of GameStop to more than 500% this year, the stock price of GameStop hits $385, even after short-sellers Melvin and Citron capitulate.

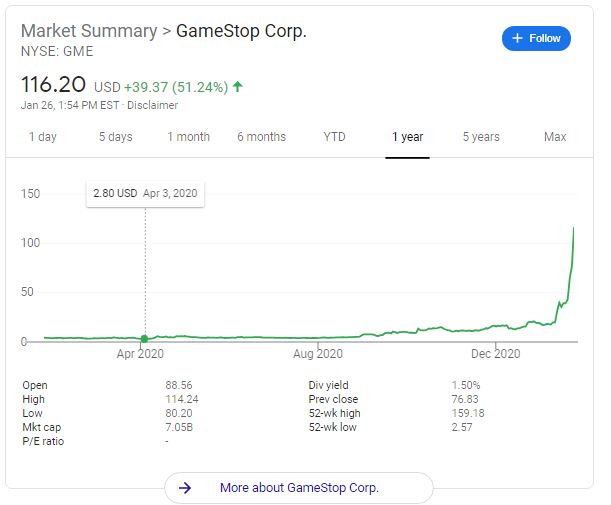

The stock price of the flailing video game chain has gone from $2.80 on April 3 to $344.27 as of the time of writing. According to data from the financial-analytics firm S3 Partners, GameStop short-sellers have lost more than $5 billion in the year to date.

CNBC also reported this morning that Melvin Capital closed out its short position in GameStop on Tuesday afternoon after taking a huge loss. CNBC could not confirm the amount of losses the firm took on the short position. Citadel and Point72 have infused close to $3 billion into Melvin Capital to shore up its finances.

The infamous r/wallstreetbets, also known as WallStreetBets or WSB, is a subreddit where an online group of traders on Reddit with more than two million users discuss stock and options trading. In recent weeks, the group was able to outsmart a bunch of hedge funds and massively drive up the stock of flailing video game chain GameStop to more than $240 (in after-hour trading).

The subreddit, describing itself through the tagline “Like 4chan found a Bloomberg terminal”, is known for its aggressive trading strategies, which primarily revolve around highly speculative, leveraged options trading.

Yesterday, we wrote about how a flailing video game chain GameStop went from losing $470 million a year ago to becoming a $7.05 billion company by market cap. In April 2019, the company posted $470 million in losses. Coronavirus pandemic was the last nail in the coffin as consumer trends shift online. Immediately after the pandemic hit, GameStop announced it would permanently close 300 of its store locations permanently. Its stock price on April 3 was $2.80.