These are the top venture capital firms of 2021

Finding investors for your startup can be hard and very challenging. One of the traditional avenues for founders to raise funding for their startups is through venture capital firms. Venture capital (VC) is a type of private equity financing that is provided by venture capital firms. These VC firms invest in promising startups, early-stage, and emerging companies with high growth potential, or companies that have already shown impressive growth.

Despite recent COVID-19 pandemic challenges, venture capital firms are still seeking out investment opportunities across the country. According to the National Venture Capital Association, the U.S has 10,400 active venture capital firms managing over 2,200 active venture funds, and more than $444 billion in venture capital (VC) assets under management (AUM) as of 2019.

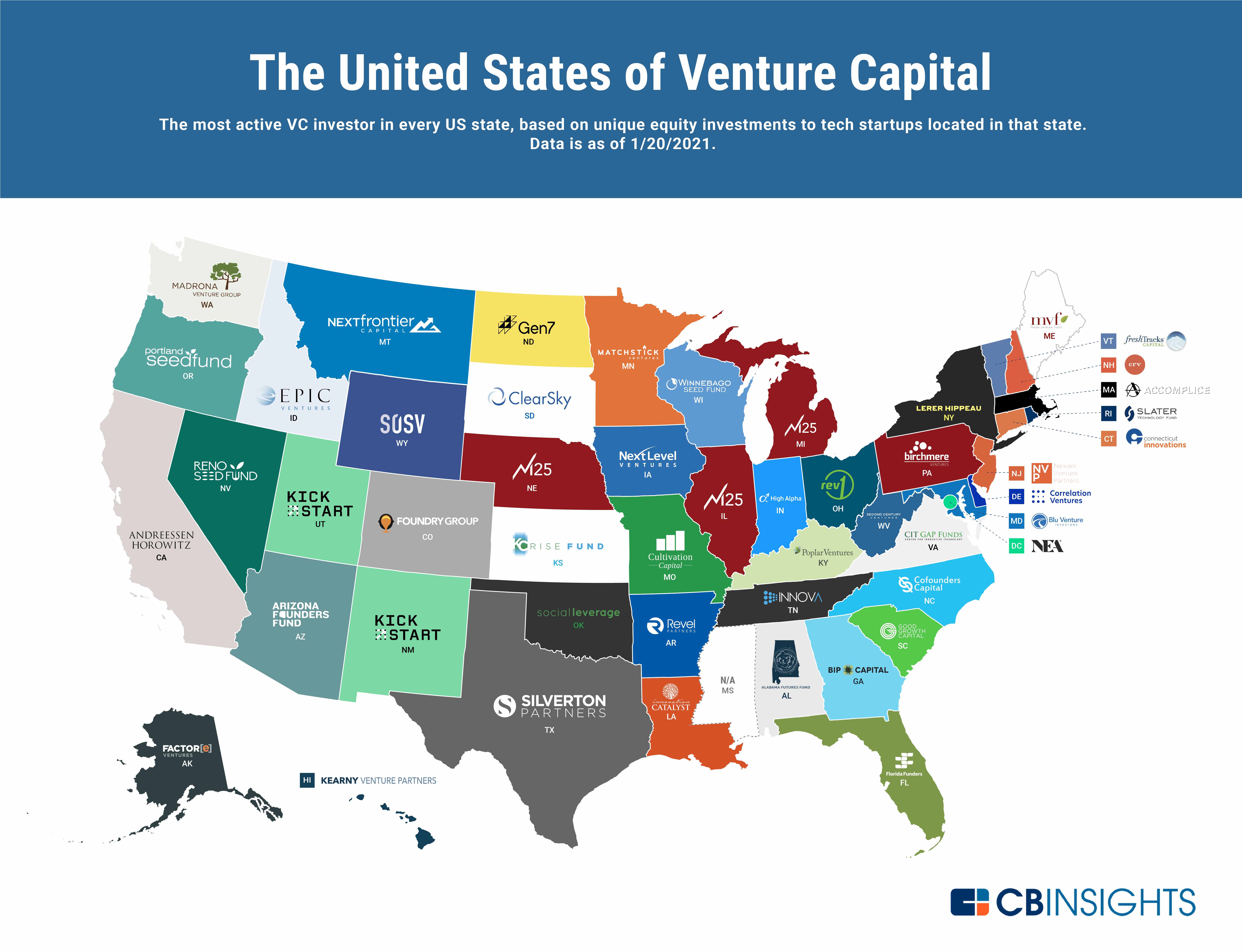

With thousands of VC firms out there, how do you find the best VC firm for your next step startup idea? In this article, we will discuss the top Venture Capital Firms of 2021 based on data from CB Insights, a research firm that predicts technology trends.

In its annual report of the “The United States Of Venture Capital,” the firm identified the most active venture capital firm across the 50 U.S. states. The report was created with data from CB Insights’ emerging technology insights platform, which offers clarity into emerging tech and new business strategies through tools like:

- Earnings Transcripts Search Engine & Analytics to get an information edge on competitors’ and incumbents’ strategies

- Patent Analytics to see where innovation is happening next

- Company Mosaic Scores to evaluate startup health, based on our National Science Foundation-backed algorithm

- Business Relationships to quickly see a company’s competitors, partners, and more

- Market Sizing Tools to visualize market growth and spot the next big opportunity

Below is a graphic of the most active VC investor in every US state for 2021.

| State | Top Investor |

|---|---|

| Alabama | Alabama Futures Fund |

| Alaska | Factor(e) Ventures |

| Arizona | Arizona Founders Fund |

| Arkansas | Revel Partners |

| California | Andreessen Horowitz |

| Colorado | Foundry Group |

| Connecticut | Connecticut Innovations |

| DC | New Enterprise Associates |

| Delaware | Correlation Ventures |

| Florida | Florida Funders |

| Georgia | BIP Capital |

| Hawaii | Kearny Venture Partners |

| Idaho | Epic Ventures |

| Illinois | M25 |

| Indiana | High Alpha |

| Iowa | Next Level Ventures |

| Kansas | KCRise |

| Kentucky | Poplar Ventures |

| Louisiana | Innovation Catalyst |

| Maine | Maine Venture Fund |

| Maryland | Blu Venture Investors |

| Massachusetts | Accomplice |

| Michigan | M25 |

| Minnesota | Matchstick Ventures |

| Missouri | Cultivation Capital |

| Montana | Next Frontier Capital |

| Nebraska | M25 |

| Nevada | Reno Seed Fund |

| New Hampshire | CRV |

| New Jersey | Newark Venture Partners |

| New Mexico | Kickstart Fund |

| New York | Lerer Hippeau Ventures |

| North Carolina | Cofounders Capital |

| North Dakota | Gen7 Investments |

| Ohio | Rev1 Ventures |

| Oklahoma | Social Leverage |

| Oregon | Portland Seed Fund |

| Pennsylvania | Birchmere Ventures |

| Rhode Island | Slater Technology Fund |

| South Carolina | Good Growth Capital |

| South Dakota | ClearSky |

| Tennessee | Innova Memphis |

| Texas | Silverton Partners |

| Utah | Kickstart Fund |

| Vermont | FreshTracks Capital |

| Virginia | CIT GAP Funds |

| Washington | Madrona Venture Group |

| West Virginia | Second Century Ventures |

| Wisconsin | Winnebago Capital Partners |

| Wyoming | SOSV |