Equipment loans in 2021: What they are and are they right for your business or startups?

Small and medium-sized businesses that require quick access to cash in less than two days can count on the growing number of financial technology (fintech) online lenders to satisfy their unique needs. Unlike traditional banks that are slow at what they do, online lenders strive for a transaction in which equipment loans are approved within 24 hours at competitive rates.

These equipment loans can be taken out as loans for photography businesses, automotive shops, or any other type of business that is in need of financial means for equipment purchase.

Banks Are Becoming Obsolete

A new reality slowly emerged in the aftermath of the 2008 financial crisis that traditional and legacy banks are becoming irrelevant. These old dinosaurs are relics of the past, highlighted by their slow speed and inability to understand or care for the urgent needs of their small business customers and consumers.

The reason why banks were able to get away with their terrible business model was that there was simply no alternative to challenge them. Fortunately, the surge in online equipment loan providers since the late 2000s and early 2010s has not only challenged the status quo but done so in a very visible way that should have banks worried.

One of the more notable signs that young, agile, and fast fintech companies represent the future of lending took place in early 2021. Billionaire tech investor Chamath Palihapitiya confirmed he is taking online fintech lender SoFi public through a special purpose acquisition company, or SPAC.

Many online lenders that offer equipment loans and other types of loans do so with little to no fees as part of a fair and transparent offering. By contrast, banks thrive off hidden and/or excessive fees along with a very restrictive lending practice.

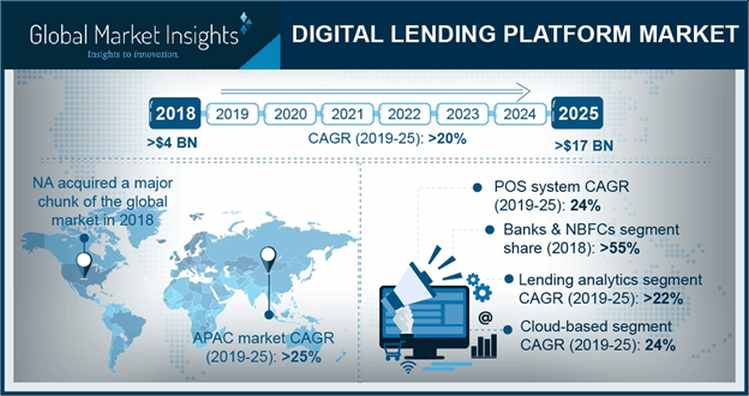

Despite a more customer-friendly approach to doing business, online lenders are years if not decades away from overtaking banks across many metrics. However, the industry can head in the right direction over the coming years by attracting the necessary attention from leading investors and winning over clients one at a time.

Source: Global Market Insights

Equipment Loans 101

Every company that sells a product or service needs some form of equipment to generate sales. Doctors at private clinics need access to edge medical equipment, kitchens need catering equipment, farmers need tractors, marketing executives need office equipment like desks and phones, and so on.

A lot of successful business owners can acquire the equipment they need through cash on hand and may even be able to make a large purchase on a corporate credit card and receive cashback points. But many hard-working entrepreneurs aren’t in the same position and don’t have immediate access to tens of thousands or hundreds of thousands of dollars of cash on hand.

There are a few reasons why business owners would need approval for an equipment loan in 2021 within 24 hours.

Perhaps an accident made a piece of equipment useless and must be replaced within five days to avoid a late penalty as part of a deal with a client. Or maybe a business owner simply wants to take advantage of a flash sale offered by an equipment supplier and the owner doesn’t want to miss out on a good deal.

Online equipment lenders are known to handle all aspects of a loan from application to funding within 24 hours. Typically, equipment loans are offered in a range of $5,000 to as much as $750,000.

Businesses that stand a high chance of approval are those that have been in operation for at least two years and can show sufficient cash flow to more than cover the payment installments. But equipment lenders in 2021 will work hard to find ways to work with all businesses.

Once the business owner fully pays off the loan, they will assume complete ownership and possession of the business asset that was acquired through equipment financing.

Equipment Lenders Want To Help

Online equipment lenders are likely more eager to lend cash versus lenders that provide standard business loans for general corporate purposes.

Tractors, forestry equipment, and vehicles are an asset and have a monetary value. From the lender’s point of view, the risk of not being able to recoup part of their loan might be low if the owner places the equipment as collateral.

In other words, if the owner’s business goes bankrupt, the online lender will assume full ownership of the equipment and can sell it. The chances of recouping 100% of the amount are quite low but it still minimizes the lender’s risk profile. As such, the equipment financing originator would be counted on to provide a much more competitive interest rate.

Online equipment lenders also want to keep their customers happy and prove to them it can act as a complete replacement to banks for their lending needs. Many equipment lenders offer other types of loans and hope to convert a satisfied one-time customer into a lifetime client that can be trusted to pay their bills on time and in full.

Equipment Financing Or Equipment Lease?

Instead of taking an equipment loan in 2021, business owners may also be able to lease the equipment directly from the manufacturer.

This is a difficult decision that comes with unique advantages and disadvantages. Some of the more notable benefits of an equipment loan are that the business has more flexibility to do as they wish with the equipment since they are paying to own it. The business can also benefit from potential tax deductions on owned equipment and it can be sold once it is no longer needed.

On the other hand, leasing might make sense if the business owner knows they will only need the equipment for a short duration. In this case, the total cost of leasing equipment for two years would be much cheaper than repaying an equipment loan over many more years.

The main drawbacks of leasing equipment mostly have to do with how it is used. Since the equipment is essentially being loaned out for a duration of time, there might be restrictions on how it is operated and this may not suit a business owner’s exact needs.

Conclusion: An Easy Transaction

Equipment loans in 2021 are a relatively straight-forward transaction that offers many benefits to the loan recipient, especially in terms of speed.

Business owners that understand the importance of accessing money very quickly will be in a unique advantage to take advantage of time-sensitive deals or solve a crisis faster than their rivals.