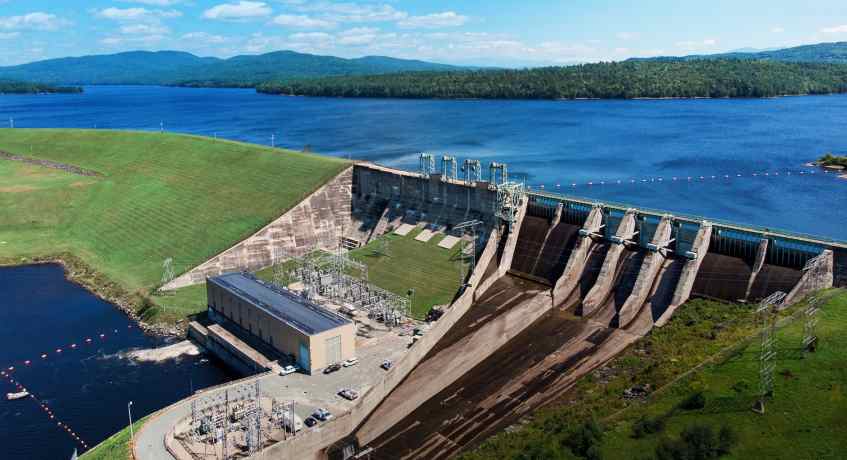

ArcLight closes its Energy Partners Fund VII with $3.4 billion to invest in tech startups in midstream and power sectors

ArcLight Capital Partners, a private equity firm focused on midstream and power infrastructure investments, announced today the final closing of its latest fund, ArcLight Energy Partners Fund VII, L.P. The fund closed with approximately $3.4 billion in commitments. ArcLight has raised over $19 billion globally since inception.

Established in 2001, the Houston, Texas-based ArcLight has invested $22 billion in over 100 investments. Headquartered in Boston, Massachusetts, the firm’s investment team brings extensive expertise, industry relationships, and specialized value creation capabilities to its portfolio. The firm also has a 1,500-person operational affiliate in Houston, Texas. The new fund will continue ArcLight’s long history of investing in infrastructure assets in the midstream and power sectors.

“Midstream and power infrastructure have never been more important as the U.S. transitions into a new energy future. Thoughtful and efficient modernization of our midstream infrastructure will be critical to supporting the U.S.’s new position as the world’s largest producer of oil and natural gas. Power infrastructure will play a similar role as we move toward a lower carbon future,” said Daniel Revers, ArcLight’s founder and managing partner.

“We believe the insights and resources that we’ve developed over the last 20 years will allow ArcLight to play a key role in these important initiatives. We greatly appreciate the support of our new and existing investors,” Mr. Revers added.