Top tech startup news of the week (startup weekend roundup – May 26)

Happy Memorial Day Holiday weekend! Here is a roundup of the top startup news of the past week. Please subscribe to the TechStartups Newsletter using the form at the right corner of this page, if you want this weekly update in your inbox every week.

NorthOne Raises $2M Seed Round To Build A Mobile API-Powered Banking Platform For Small Businesses.

Mobile digital-only banking platform NorthOne has closed a $2 million seed round to build a mobile API-powered banking platform for small businesses. The latest round is led by investors Peter Graham, Tom Williams, and initial investor Ferst Capital Partners. NorthOne is building a mobile-first, API-enabled banking platform serving Canadian small business (SMBs), startups and freelancers. NorthOne’s mission is to eliminate the devastating impact that poor financial literacy and financial management has on small business failure rates and costs. NorthOne’s banking platform acts as the tech-forward finance department that SMBs could never afford. The NorthOne mobile app and API-enabled bank account connects to all the financial management tools businesses already use and gives them clarity into their financialhealth in real time while also automating the most time consuming financial management tasks.

Mobile digital-only banking platform NorthOne has closed a $2 million seed round to build a mobile API-powered banking platform for small businesses. The latest round is led by investors Peter Graham, Tom Williams, and initial investor Ferst Capital Partners. NorthOne is building a mobile-first, API-enabled banking platform serving Canadian small business (SMBs), startups and freelancers. NorthOne’s mission is to eliminate the devastating impact that poor financial literacy and financial management has on small business failure rates and costs. NorthOne’s banking platform acts as the tech-forward finance department that SMBs could never afford. The NorthOne mobile app and API-enabled bank account connects to all the financial management tools businesses already use and gives them clarity into their financialhealth in real time while also automating the most time consuming financial management tasks.

Fintech startup Covesting joins the Enterprise Ethereum Alliance

Covesting announced that it has joined the Enterprise Ethereum Alliance (EEA), the world’s largest open source blockchain initiative. As a member of the EEA, Covesting will collaborate with industry leaders in pursuit of ethereum-based enterprise technology best practices, open standards, and open-source reference architectures. Covesting is confident that thanks to its team’s combined trading experience of over 100 years and unparalleled professional expertise in the fintech and blockchain sectors, it will make a considerable contribution to the development of cryptocurrency area through the newly established partnership. Founded by former Saxo Bank traders, the Gibraltar-based Covesting provides a platform for investors and traders who are looking to utilize advanced tools and technology in order achieve maximum returns in cryptocurrency markets.

Covesting announced that it has joined the Enterprise Ethereum Alliance (EEA), the world’s largest open source blockchain initiative. As a member of the EEA, Covesting will collaborate with industry leaders in pursuit of ethereum-based enterprise technology best practices, open standards, and open-source reference architectures. Covesting is confident that thanks to its team’s combined trading experience of over 100 years and unparalleled professional expertise in the fintech and blockchain sectors, it will make a considerable contribution to the development of cryptocurrency area through the newly established partnership. Founded by former Saxo Bank traders, the Gibraltar-based Covesting provides a platform for investors and traders who are looking to utilize advanced tools and technology in order achieve maximum returns in cryptocurrency markets.

The world agricultural pesticide industry is about to witness the biggest revolution and disruption. The largest agrochemical companies such as Bayer, DowDuPont, BASF, and Syngenta, have a choice to make. They could either fight it, adapt or join the revolution. Artificial intelligence (AI) and robotics are about to change the way farmers fight weeds, do it more efficiently and save farmers some money. AI is about to solve the “chemical treadmill” farmers are trapped in to kill crop-choking weeds by reducing the need for herbicides and eliminate the need for genetically modified (GM) herbicide tolerant crops. EcoRobotix and Blue River are two AI-based agritech startups leading this revolution. The two companies are revolutionizing weed control in a world of herbicide resistance. With the rise of herbicide-tolerant weeds, there are fewer and fewer effective solutions. Farmers around the world need a new way to address the weed control challenge.

The world agricultural pesticide industry is about to witness the biggest revolution and disruption. The largest agrochemical companies such as Bayer, DowDuPont, BASF, and Syngenta, have a choice to make. They could either fight it, adapt or join the revolution. Artificial intelligence (AI) and robotics are about to change the way farmers fight weeds, do it more efficiently and save farmers some money. AI is about to solve the “chemical treadmill” farmers are trapped in to kill crop-choking weeds by reducing the need for herbicides and eliminate the need for genetically modified (GM) herbicide tolerant crops. EcoRobotix and Blue River are two AI-based agritech startups leading this revolution. The two companies are revolutionizing weed control in a world of herbicide resistance. With the rise of herbicide-tolerant weeds, there are fewer and fewer effective solutions. Farmers around the world need a new way to address the weed control challenge.

Pfizer, Merck invest $26 million in precision medicine startup Strata Oncology.

Strata Oncology is a precision medicine startup dedicated to transforming cancer care by systematizing precision oncology across a network of health systems and pharma companies. The company empowers health systems to deliver a cost-effective, system-wide precision oncology program, one that integrates cutting-edge molecular profiling and precision therapy trials with routine care, so that all advanced cancer patients have the opportunity to benefit. This large network of trial-ready health systems provides a mechanism to rapidly and predictably enroll precision therapy trials. The company announced it has raised $26 million USD in Series B funding round. The latest funding round is led by new investors Pfizer Ventures, Merck Global Health Innovation Fund, Deerfield Management and Renaissance Venture Capital Fund with participation from existing investors Arboretum Ventures and Baird Capital.

Strata Oncology is a precision medicine startup dedicated to transforming cancer care by systematizing precision oncology across a network of health systems and pharma companies. The company empowers health systems to deliver a cost-effective, system-wide precision oncology program, one that integrates cutting-edge molecular profiling and precision therapy trials with routine care, so that all advanced cancer patients have the opportunity to benefit. This large network of trial-ready health systems provides a mechanism to rapidly and predictably enroll precision therapy trials. The company announced it has raised $26 million USD in Series B funding round. The latest funding round is led by new investors Pfizer Ventures, Merck Global Health Innovation Fund, Deerfield Management and Renaissance Venture Capital Fund with participation from existing investors Arboretum Ventures and Baird Capital.

Open source networking company, Lumina Networks, announced it has raised $10 million Series A funding. The current financing round is led by Verizon Ventures with participation from new investors including AT&T and Rahi Systems. The company plans to use the funding to support the development of new products and innovative solutions using the Lumina SDN Controller powered by OpenDaylight™ and for expansion of business in Europe and Japan. Founded in 2017 by Andrew Coward, Ben Hickey and Nitin Serro, Lumina Networks is a new company built with the software-defined networking (SDN) controller assets from Brocade.

Open source networking company, Lumina Networks, announced it has raised $10 million Series A funding. The current financing round is led by Verizon Ventures with participation from new investors including AT&T and Rahi Systems. The company plans to use the funding to support the development of new products and innovative solutions using the Lumina SDN Controller powered by OpenDaylight™ and for expansion of business in Europe and Japan. Founded in 2017 by Andrew Coward, Ben Hickey and Nitin Serro, Lumina Networks is a new company built with the software-defined networking (SDN) controller assets from Brocade.

Rover announced that it has secured a $125 investment to continue global expansion, increase market share for on-demand walking and develop new services. The funding was led by T. Rowe Price Associates, Inc. and the closing of a $30 million credit facility with Silicon Valley Bank, bringing Rover’s available cash to over $200 million. Other key investors include Winslow Capital and Cross Creek. Existing shareholders TCV, Greenspring Associates and Spark Capital also participated. Rover will use the funding to expand internationally, increase share of market for its on-demand walking service, enhance its core offerings and introduce new service adjacencies. Rover is leader in this market. The company also the world’s largest network of pet sitters and dog walkers. Rover connects pet parents with the nation’s largest network of loving and trustworthy pet sitters and dog walkers.

Rover announced that it has secured a $125 investment to continue global expansion, increase market share for on-demand walking and develop new services. The funding was led by T. Rowe Price Associates, Inc. and the closing of a $30 million credit facility with Silicon Valley Bank, bringing Rover’s available cash to over $200 million. Other key investors include Winslow Capital and Cross Creek. Existing shareholders TCV, Greenspring Associates and Spark Capital also participated. Rover will use the funding to expand internationally, increase share of market for its on-demand walking service, enhance its core offerings and introduce new service adjacencies. Rover is leader in this market. The company also the world’s largest network of pet sitters and dog walkers. Rover connects pet parents with the nation’s largest network of loving and trustworthy pet sitters and dog walkers.

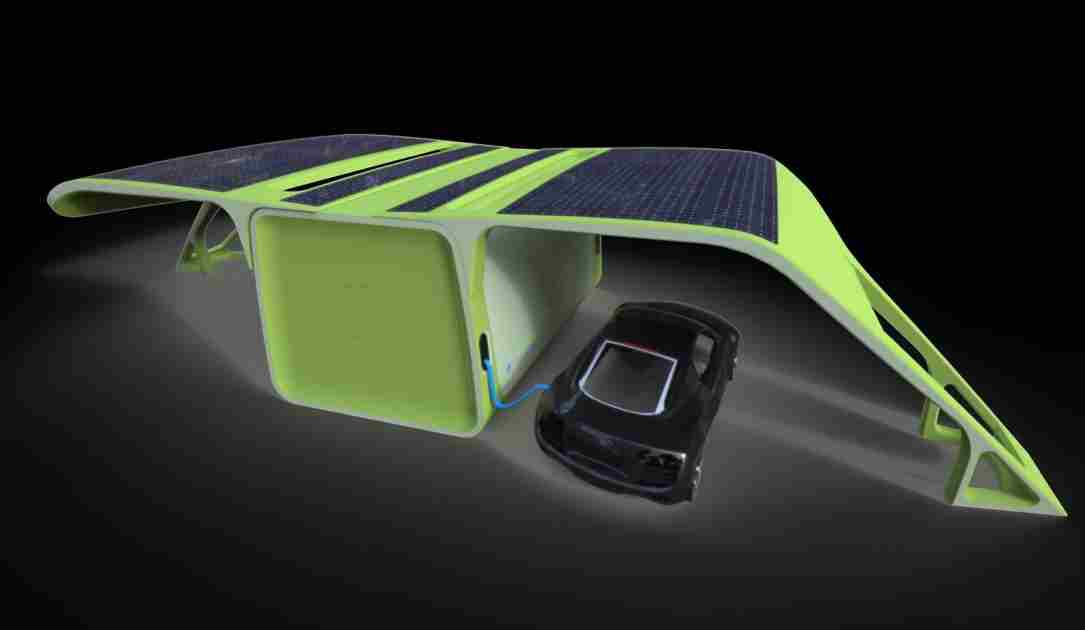

With growing popularity of electric cars, there is a growing need for accessible fast-charging stations to support millions of electric cars on our roads. Chakratec is a manufacturer of a patented kinetic storage that matches the needs of EV Charging Stations (EVCS) to provide high quality and reliable service. Its Kinetic Storage enables wide deployment of EVCS in rural areas and regions with weak grid and decreases the operational cost of EVCS by up to 70%. Chakratec’s battery provides unlimited charging and discharging cycles per day and is sustainable for a period of no less than 20 years of operation, easily deployable and eco-friendly. The Israeli-based smart storage startup announced Monday that it has completed its third financing round in which it raised $4.4 million to bring its innovative 5-10 minute charging technology for electric vehicles to market and enables the company to conduct its first three pilot projects in Europe with three of Europe’s leading utilities.

With growing popularity of electric cars, there is a growing need for accessible fast-charging stations to support millions of electric cars on our roads. Chakratec is a manufacturer of a patented kinetic storage that matches the needs of EV Charging Stations (EVCS) to provide high quality and reliable service. Its Kinetic Storage enables wide deployment of EVCS in rural areas and regions with weak grid and decreases the operational cost of EVCS by up to 70%. Chakratec’s battery provides unlimited charging and discharging cycles per day and is sustainable for a period of no less than 20 years of operation, easily deployable and eco-friendly. The Israeli-based smart storage startup announced Monday that it has completed its third financing round in which it raised $4.4 million to bring its innovative 5-10 minute charging technology for electric vehicles to market and enables the company to conduct its first three pilot projects in Europe with three of Europe’s leading utilities.