Top tech startup news stories you need to know this Thursday, May 3

Good morning! Here are some of the top tech startup news stories today Thursday, May 2.

Wedding-planning startup Zola tied the knot with $100 Million funding. Wedding startup, Zola, just tied the knot on a big financing round to try to do the same for the costly and complex business of weddings. The startup said Thursday it raised $100 million in funding. The funding is led by former Gilt Groupe executive Shan-Lyn Mawith participation from other investors including Comcast Corp. and Goldman Sachs Group Inc. The deal values Zola at about $600 million, according to a person familiar with the deal.

Reddit co-founder predicts Ethereum price will reach $15,000 in 2018. Co-founder of the world’s largest social news aggregation with monthly visitors of over 1.69 billion visitors, Alexis Ohanian, said that he predicts the Ethereum price will reach $15,000 in 2018, rocketing its market cap into the trillions of dollars and enabling it to surpass bitcoin as the world’s largest cryptocurrency.

London-based Homecare services startup Cera announces $17 million Series A. The London-based homecare platform Cera has landed $17 million in Series A funding amidst reports of misconduct. Investors include Guinness Asset Administration, Yabo, and Kairos. The two-year old company has some big names behind it, like former Deputy Prime Minister of the UK Sir Nick Clegg, who is serving as an advisor to the company. It has also has had some large profile wins in its time, like scoring a Pfizer Healthcare Hub: London competitive grant in 2017.

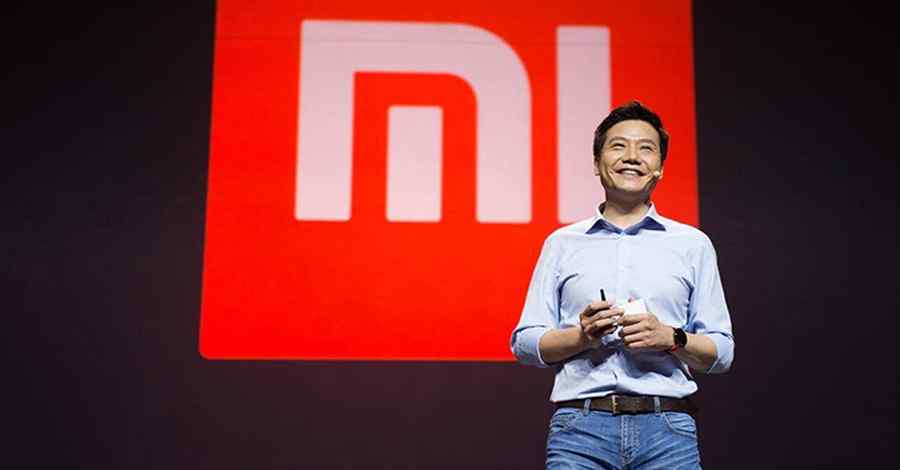

Chinese smartphone maker Xiaomi files for huge Hong Kong IPO. Xiaomi, one of the world’s biggest smartphone makers, has filed to go public in Hong Kong in what’s expected to be a massive IPO. The Chinese company submitted documents Thursday to list shares on the Hong Kong stock exchange. Xiaomi did not elaborate on the size of the planned IPO, but reports have suggested it could be worth around $10 billion.

Upbound grabs $9M Series A to automate multi-cloud management. Upbound announced today it has raised $9 million in Series A investment led by GV (formerly Google Ventures) along with numerous unnamed angel investors from the cloud-native community. As part of the deal, GV’s Dave Munichiello will be joining the company board of directors.

Winnebago launches an all-electric RV platform. Winnebago, a maker of commercial vehicles better known for its motor homes, is launching a new all-electric RV platform, but the applications for the vehicle will be limited at first and therefore, it will not be used as an electric motorhome just yet.

China’s internet companies often expect employees to work 12 hours a day for six days a week. And some of them are open about not wanting to hire workers over 30 years old who might be expensive or too busy with family obligations to work really long hours.

Israel-based heart device maker startup V-Wave raised $70 million in funding. The largest investment in an Israeli company during April 2018 was $70 million raised by Caesarea, Israel-based V-Wave, which is about to start multicenter clinical trials of its minimally invasive implanted interatrial shunt device for treating patients with severe symptomatic heart failure.

Fintech startup OYE Fintech bags $2.25 million funding from GAIN Credit. OYE Fintech, which operates a consumer-focused lending platform called OYE! Loans, announced in a blog post today that it has raised $2.25 million from GAIN Credit, Inc. OYE! Loans currently serves new-to-credit and new-to-workforce consumers with simple, timely and affordable One Year EMI loans (hence the brand OYE!), with ticket-sizes ranging between 10K and 1L INR.

Goldman Sachs to open a Bitcoin trading operation. Wall Street giant, Goldman Sachs, is about to begin using its own money to trade with clients in a variety of contracts linked to the price of Bitcoin, the New York Times reported yesterday. The price of Bitcoin jumped by about $200 after the news. This decision is likely going to lend legitimacy to virtual currencies and create new concerns for Goldman.