Vendor management startup Candex raises $3.5 million to address the pain of enterprise payments

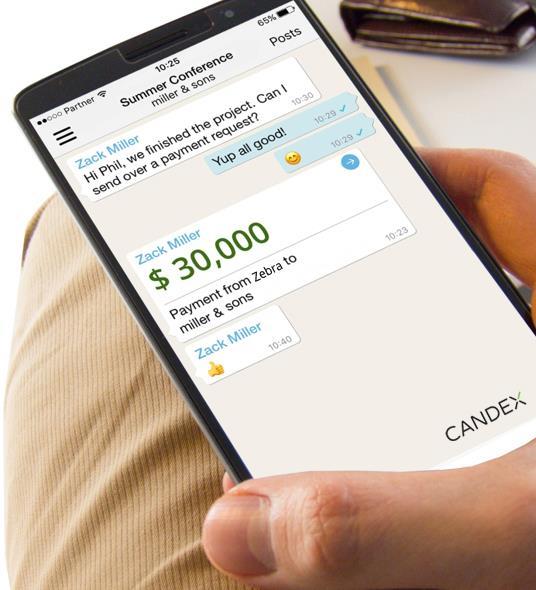

London-based Candex is a provider of a vendor management system designed to simplify business communication and payments. The company’s system provides a sourcing and vendor management tool that offers real time feed of partner payments, engagements and reviews, streamlines business dealings, harmonizes teams and significantly reduces email, enabling large companies to engage freelancers, agencies and service providers, pay small vendors and improve visibility on their spending.

The company announced today it has raised $3.5 million of series seed funding from Edenred Capital Partners, Partech Ventures, Advisors.Fund, Camp One Ventures, NFX, Tekton Ventures, Big Sur Ventures and fintech angel Mark Goines. The financing positions Candex to accelerate its business in Fortune 500 customers and beyond. Founded in 2010, Candex is the easy way to engage, track and pay for business services under $100,000. Companies are taking advantage of the gig economy and using more vendors than ever to compete and stay nimble. In the typical large enterprise organization, admin layers across departments inefficiently cope with the 90 percent of tail service vendors that account for only five percent of spend. Sometimes the administrative costs exceed what is actually paid. The company works with thousands of organizations including Fortune 500s, supporting payments in more than 50 countries.

Using Candex is simple, customers simply create activities and control who can access them. For deals, access is controlled by both companies. Data feeds show the people, companies and payments involved while contents exchanged stay strictly confidential. The company claimed that its system is free to use forever.

Candex usage

“It is amazing how much time and effort gets wasted when a typical organization tries to work with small vendors,” says Candex co-founder and CEO Jeremy Lappin. “Candex brings the speed and ease of consumer payment apps to large businesses, leveraging a private blockchain to ensure compliance and massively streamline financial system records.”

Candex allows creation of private eMarketplaces where employees engage with approved vendors through a chat interface, track activities and performance, and authorize payments below $100,000 with a few clicks. It empowers companies to remove thousands of vendor records from their financial systems and gives them a single counterparty for tax and compliance purposes.

“Candex fulfills stringent compliance requirements while also providing value to line managers,” says Philip Bodell of First Data. “Their demonstrated success serving many companies, including our own, is a key reason we invited Candex to join the Commerce.Innovated program.”

Enterprises that work with Candex are freed from repetitive admin burdens in vendor setup, payment exchange, taxes, and audits. Candex charges a small percentage of each payment and works with existing approval methodologies across hundreds of entities.

“The Candex eMarketplace approach is a brilliant solution for the tail spend needs of today’s enterprise, and this financing is perfectly timed to enhance the company’s leadership position,” says new Candex board member Mark Goines.