Mobile banking startup Varo Money raises $45 million to further explosive growth its banking app

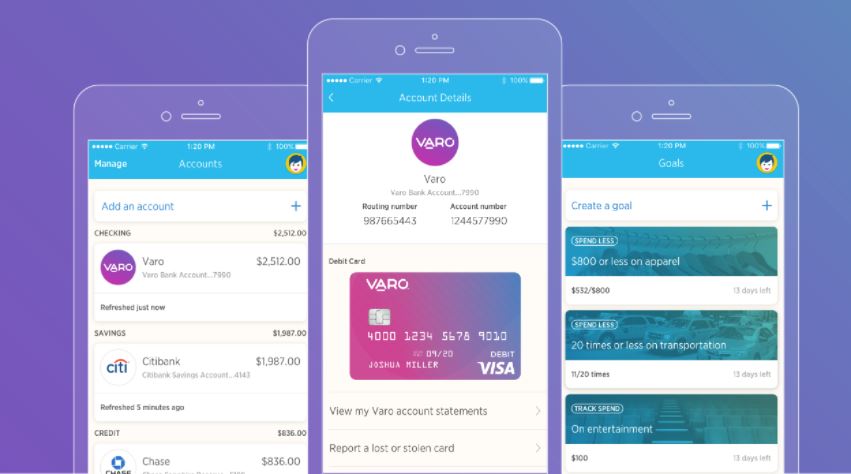

Intelligent mobile banking startup Varo Money has just raised a$45 million Series B funding round to further the explosive growth its banking app. The latest funding round is led by existing investor Warburg Pincus, a global private equity firm focused on growth investing, and The Rise Fund, a global impact fund led by private equity firm TPG. To date, the company has raised a total of $$78 million in funding. Varo Money is a mobile banking startup that is helping to put control back into the hands of customers. With its mobile app, customers get more out of their money without having to pay fees on their bank account. Varo’s bank account’ is backed by The Bancorp Bank, Member FDIC, and is insured to at least $250,000. Applying for Varo’s bank account takes less than 5 minutes or less with its in-app application.

Founded in 2015 by Assaf Guery, Colin Walsh, Mykola (Kolya) Klymenko and Roger Van Duinen, Varo is taking a different approach to banking. Varo’s machine-learned algorithms detect customer’s income and expenses, and then predict outcomes over the near-term future — linked to a system of notifications, recommendations and tracking. “We founded Varo because we believe that customers simply deserve better banking options,” said Colin Walsh, co-founder and CEO of Varo Money. “Millions of Americans are looking for an easier, more affordable way to manage their money and reach their financial goals. As a company, we are extremely motivated by our mission of improving consumer financial health, which is why we are so honored by this investment from The Rise Fund and continued support from Warburg Pincus and our community of investors. This funding round is a huge vote of confidence in our strategic direction and progress toward our goal to provide millions of Americans with access to a bank account that’s designed to help them get more out of their money.”

Unlike most traditional banks where banking used to be a relationship business, Varo is built to improve customers’ financial health. Varo’s idea is a world where every customer consistently spends less than they earn, gradually saves up a 3-month emergency fund in cash, steadily improves their credit profile, and plans ahead for insurance risks and big life events. Varo’s goal is to help customers to get ahead financially, and technology can enable more personalized help for more people. Fintech apps are trying to disrupt the traditional financial services model, but they only offer single-point solutions.

“We are pleased to continue supporting Varo and its mission to create a financial services firm for the future,” said David Coulter, Special Limited Partner at Warburg Pincus, former Vice Chairman of JPMorgan Chase & Co., and former CEO and Chairman of Bank of America Corporation. “Since our initial investment in 2016, Colin and his team have made significant progress in advancing Varo’s innovative platform and growing its user base. The company is well-positioned to deliver a unique banking service to its customers, and we look forward to supporting its continued growth.”

Varo is using mobile technology to change the future of banking by offering customers a frictionless bank account that integrates banking, saving and lending products with tools to help customers smooth cash flow and build savings—all from their phones. Varo eliminates the unfriendly fees that traditional banks often charge, such as overdraft fees, minimum balance fees and foreign transaction fees. In addition, Varo does not charge ATM fees at a network of over 55,000 Allpoint ATMs worldwide.