Google is disrupting the travel industry, killing Expedia, Priceline and Travelocity with $14 billion revenue in 2017

If you think Google is just a search engine company, then think again! Google is taking over the travel world. In 2017 alone, Google is expected to generate $14 billion in revenue from its travel business that is estimated to be worth $100 billion, according to a report from Wall Street Journal. Google’s travel business is currently worth more than Priceline. To understand how Google is making its money, you first have to understand the magnitude and the size of the travel industry and how online travel agencies (OTAs) like Expedia, Priceline and Travelocity work.

An online travel agency or OTA allows travelers to book flight tickets, hotel rooms, train tickets etc. on their websites or their mobile apps using smartphone or your computer. Travel products sold by these agencies vary from agency to agency. Some agencies like Priceline, Expedia and Travelocity sell travel products including flights, hotels, car rentals, cruises, activities, and vacation packages. Others specialize in the sale of tours and activities. In all cases, the OTAs have agreements with suppliers of these travel products to resell their products to the consumer and pays net rates to the suppliers. In essence the OTAs purchase travel product inventory from suppliers of travel products and then market the rooms at a discount to consumers in addition to flights, rental cars and travel packages. Many travel product suppliers also have agreements with other companies like American Express, Costco and Delta to market their inventory. Overall, it is win-win for both sides because OTAs help suppliers sell their excess inventory that would have been otherwise goes unused.

The OTAs continue to thrive and making huge revenue. At the same time, the online world is changing and new startups like AirBnb started to disrupt the hotel industry. Special interests from the hotel industry lobbied governments in many states to stop AirBnB but they failed. At the same time, Google also took notice of the search volume from online visitors searching for phrases like: “best hotel in Boston.” In 2011, Google launched an experimental search tool called Hotel Finder, which is specifically designed to help users find the perfect hotel. By late 2016, Google’s Hotel Finder has grown into full blown “hotel search service.” Also in a stunning move in 2016, Google partnered with ITA Software to launch a Flight Search product — with booking links to airline websites only. The OTAs were not happy and lodged a complaint.

Then Google responded in a blog post. Google said: “… Our booking links point to airline websites only. We’re working to create additional opportunities for our other partners in the travel industry to participate as well.”

Google’s official take on the issue is this:

Like any other partner, Google needs to honor the airlines’ distribution decisions. It has long been known in the industry that the control of pricing data and distribution of the same by airlines is tightly held. That means that we can only show airlines in the booking links.

We will be exploring advertising opportunities within the page to showcase the products and services from other relevant partners, including OTA and metasearch partners. We’d also like to give users and advertisers alike the opportunity to provide feedback so that we could iterate.”

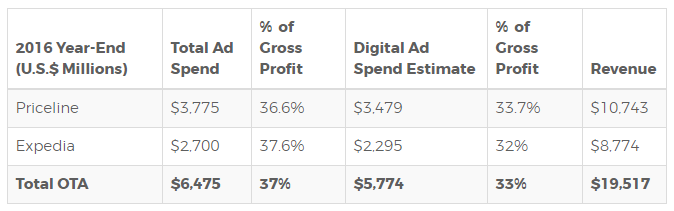

With hotel and flight services added to its search, Google now makes it possible for travelers to search directly on Google.com to find the best and the cheapest flights and hotels without ever have to go through the OTAs. Google now work directly with hotels and airlines to stifle competition and eating into OTAs’ bottom line. It is a win-win for travel product suppliers like hotels and airlines because they want to drive more travelers to their websites to avoid paying any commissions to the OTAs. OTAs are not taking chances also. Both Priceline and Expedia spent over $6 million in advertising in 2016.

Source: Company Filings, Skift Estimates

Unlike the traditional travel agents of the past, it is almost impossible for the OTAs to compete with the search-giant like. OTAs also have other competitors: AirBnB and new startups competing for a share of the market. Will the OTAs survive? Yes! However, their share of the travel industry will continue to shrink as AirBnB, Google and new innovative startups work with hotels and airline to make the hotel industry more competitive and disrupt the industry.