Free Startup Valuation Calculator

Determining the worth of your tech startup can often feel like a blend of art and science. While there are established methods and formulas to estimate value, the true measure is what the market is willing to pay.

How does a tech startup determine its valuation? The answer is multifaceted. While there are concrete methods—such as discounted cash flow models and comparable company analysis—that provide a numerical estimate, the true value often hinges on market sentiment. The intricacies of forecasting revenue, assessing growth potential, and evaluating competitive positioning all play a role. Yet, the ultimate valuation is shaped by what the market is prepared to pay.

How Much is Your Startup Worth?

The crux of startup valuation is that it’s as much an art as it is a science. A startup’s worth is fundamentally determined by the intersection of its potential and what investors are willing to invest. The numbers are important, but they are merely a framework. The real value is forged through market demand and investor confidence, underscoring the fact that a startup’s valuation is fluid and often influenced by external perceptions as much as internal metrics.

There are several valuation formulas and methods used to estimate the value of a startup. Each method has its own strengths and is suitable for different contexts. Here are some commonly used valuation formulas and methods:

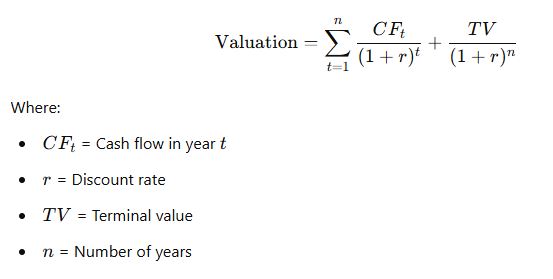

1. Discounted Cash Flow (DCF) Method

The DCF method values a company based on the present value of its projected future cash flows, discounted back to the present value.

Formula:

2. Comparable Company Analysis (CCA)

This method involves comparing the startup to similar publicly traded companies. Common multiples used include the Price-to-Earnings (P/E) ratio, Enterprise Value-to-Revenue (EV/R), and Enterprise Value-to-EBITDA (EV/EBITDA).

Formula:

Valuation = Multiple × Metric

Where:

- Multiple = Industry comparable multiple (e.g., EV/Revenue)

- Metric = The relevant financial metric of the startup (e.g., revenue)

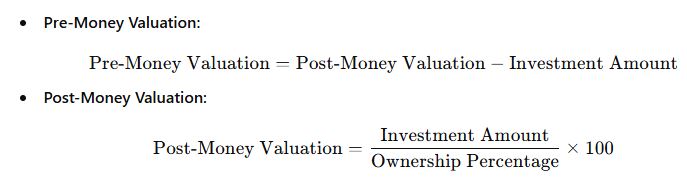

3. Pre-Money and Post-Money Valuation

This method calculates the startup’s value before and after receiving an investment.

Formulas:

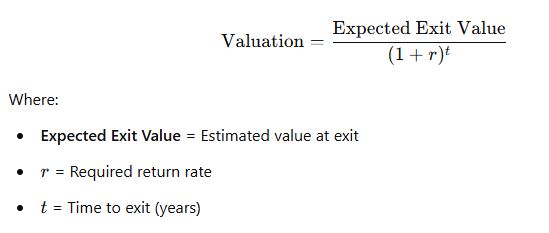

4. Venture Capital Method

This method estimates the value based on the expected return on investment (ROI) and the amount of equity the investor will own.

Formula:

5. Scorecard Valuation Method

This method adjusts the average valuation of comparable startups based on qualitative factors such as the team, market opportunity, product stage, and competitive landscape.

Formula:

Valuation=Average Valuation×Score Adjustment\text{Valuation} = \text{Average Valuation} \times \text{Score Adjustment}Valuation=Average Valuation×Score Adjustment

Where:

- Average Valuation = Valuation of comparable startups

- Score Adjustment = Factor based on qualitative assessment

6. Risk-Adjusted Return Method

This method adjusts the valuation based on the perceived risk and the expected return on investment.

Formula:

Valuation=Expected Return−(Risk Factor×Investment Amount)\text{Valuation} = \text{Expected Return} – (\text{Risk Factor} \times \text{Investment Amount})Valuation=Expected Return−(Risk Factor×Investment Amount)

Where:

- Expected Return = Anticipated return from the investment

- Risk Factor = Adjustment for the risk associated with the investment

- Investment Amount = Amount of investment

7. Revenue Multiple Method

This method values a company based on its revenue, applying a multiple derived from comparable companies or industry standards.

Formula:

Valuation=Revenue×Revenue Multiple\text{Valuation} = \text{Revenue} \times \text{Revenue Multiple}Valuation=Revenue×Revenue Multiple

Where:

- Revenue Multiple = Industry standard or comparable companies’ multiple

8. Book Value Method

This method values the company based on its book value, which is the difference between total assets and total liabilities.

Formula:

Valuation=Total Assets−Total Liabilities\text{Valuation} = \text{Total Assets} – \text{Total Liabilities}Valuation=Total Assets−Total Liabilities

Each valuation method provides a different perspective and can be used in combination to get a more comprehensive view of the startup’s value. The choice of method often depends on the stage of the startup, the industry, and the specific context of the valuation.

Free Business Startup Valuation Calculator

Determining the value of a startup is crucial for founders, investors, and stakeholders. Our Free Startup Valuation Calculator is designed to simplify this process by providing an estimate based on key financial metrics and growth projections.

How It Works

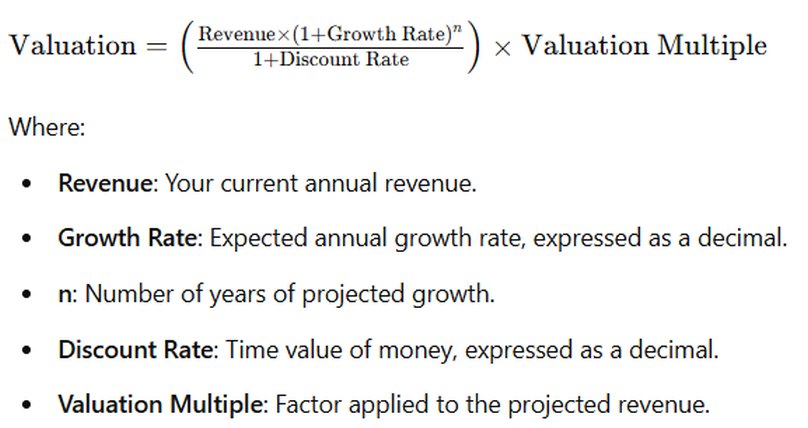

This calculator uses a more advanced formula to estimate the valuation of your startup, incorporating several essential factors:

- Annual Revenue: This is your current annual revenue, which serves as the baseline for valuation.

- Growth Rate: This percentage represents your expected annual growth rate. It helps project future revenue by accounting for the anticipated increase in sales.

- Valuation Multiple: This multiple reflects the value investors are willing to place on your startup’s projected revenue. It varies by industry and market conditions.

- Discount Rate: This percentage represents the time value of money. It discounts future revenue to present value, acknowledging that a dollar earned in the future is worth less than a dollar earned today.

- Years of Growth: This is the number of years over which you expect your startup’s revenue to grow.

The Formula

The valuation is calculated using the following formula:

Example

Suppose your startup currently generates $1,000,000 in annual revenue. You anticipate a 20% annual growth rate, apply a valuation multiple of 5, and expect a discount rate of 10% over the next 5 years. The calculator will project your future revenue, discount it to its present value, and then apply the multiple to estimate your startup’s current valuation.

By inputting these variables into our calculator, you’ll receive an estimated valuation that reflects your startup’s potential and financial outlook. This tool helps you make informed decisions, whether you’re seeking investment, planning for growth, or evaluating your company’s worth.