JPMorgan says Tether may need to sell Bitcoin to comply with proposed U.S. stablecoin regulations

Tether, the world’s largest stablecoin plagued with scandals and government investigations, may need to sell a portion of its Bitcoin holdings, valued at about $8 billion, to align with the proposed U.S. stablecoin regulations.

According to a recent report by JPMorgan analysts, Tether could be forced to offload a chunk of its Bitcoin holdings—worth around $8 billion—to comply with new U.S. regulations. Current estimates suggest that only 66% to 83% of Tether’s reserves align with the proposed requirements, which means a major shift in asset allocation could be on the horizon.

“Tether may have to sell non-compliant assets — including bitcoin, precious metals, corporate paper, and secured loans — to comply with proposed U.S. stablecoin regulations,” The Block reported, citing JPMorgan analysts.

Tether is one of the biggest Bitcoin buyers, currently holding around 85,000 BTC. If—or more likely, when—they decide to sell and stop buying, Bitcoin could easily plunge well below $10K again.

The proposed laws, including the “Stablecoin Transparency and Accountability Act” (STABLE Act) and the “U.S. Stablecoin Innovation Guidance and Establishment Act” (GENIUS Act), push for licensing, stricter risk management, and full reserve backing for stablecoin issuers.

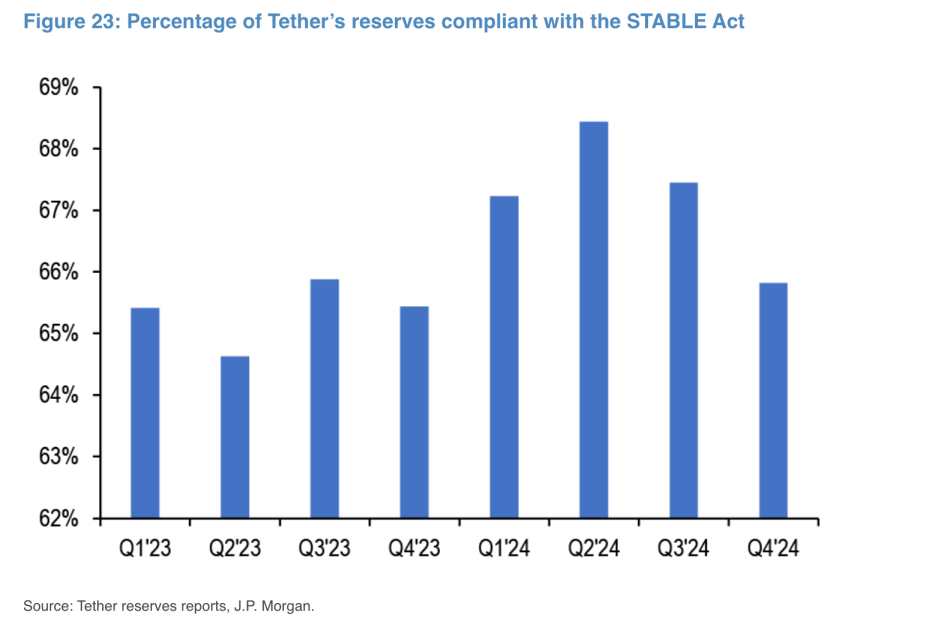

JPMorgan analysts, led by Nikolaos Panigirtzoglou, reported Wednesday that Tether’s reserves meet only 66% of the compliance requirements under the House’s STABLE Act and 83% under the Senate’s GENIUS Act. These numbers indicate that Tether’s compliance ratio has been slipping since mid-2024, coinciding with the rapid growth in stablecoin supply.

Credit: JPMorgan

To stay within the rules, Tether might need to liquidate assets like Bitcoin, precious metals, corporate paper, and secured loans, shifting its reserves to safer holdings like U.S. Treasury bonds.

Why Would Tether Need to Sell Bitcoin If It’s Fully Backed?

So, here’s the real question: If Tether is supposed to be backed 1:1 by USD or equivalent assets, why would it even need to sell Bitcoin to comply with stablecoin regulations?

This brings up two big concerns:

- Transparency of Reserves – If USDT was actually backed by cash or cash-equivalent assets, Bitcoin sales shouldn’t even be part of the conversation. The fact that it is raises eyebrows.

- Exposure to Volatility – A stablecoin is meant to be, well, stable. But if part of its reserves is in Bitcoin, what happens when the market tanks? It kind of defeats the whole purpose of being a “stable” coin, doesn’t it?

Tether’s CEO, Paolo Ardoino, didn’t hold back in his response, taking a jab at JPMorgan analysts by suggesting their perspective might be colored by the fact that they don’t hold Bitcoin themselves.

These regulations are still under discussion, and it’s unclear how they’ll eventually take shape. Whether Tether will be forced to sell off its Bitcoin stash depends on how these policies unfold.

As we reported back in 2023, Tether bought $222 million worth of bitcoin to back the world’s largest stablecoin, USDT. At the time, Tether also said it would invest 15 percent of its net profit into Bitcoin as part of the effort to “diversify” the reserves that back its USDT token, which means the company maintains $1.00 in reserves for each tether token issued.