Nvidia loses $600 billion in just 2 hours as DeepSeek’s success raises questions about AI chip spending

Nvidia saw a sharp 17.55% drop on Monday, leading a global tech sell-off. This massive plunge hit other U.S. tech stocks as well, with companies like Micron, Arm Holdings, Broadcom, and Advanced Micro Devices all feeling the heat.

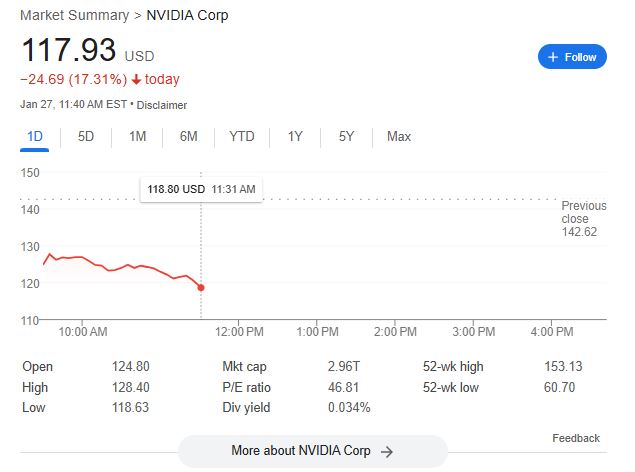

Nvidia’s market capitalization stood at $3.493 trillion at Friday’s close, according to Yahoo Finance. However, the chipmaker’s stock has since dropped to around $2.96 trillion, marking a loss of roughly $600 billion since the market opened today.

NVIDIA Market Cap Trends (Credit: Yahoo Finance)

Credit: Google

Nvidia Plummets 17.55% to Lead Global Tech Sell-off as China’s DeepSeek Raises Questions About AI Chip Spending

What triggered this downturn? A Chinese startup, DeepSeek, raised some eyebrows with its AI capabilities, causing concerns about the future of U.S. leadership in AI and chip manufacturing.

Nvidia’s losses were particularly notable, marking its worst day since March 2020. The drop dragged other chip-related stocks down with it, including Vistra and Constellation Energy, which both tumbled more than 12%. International stocks weren’t spared either. Companies like ASML and ASM International in Europe, and chip stocks like Advantest and Tokyo Electron in Japan, all saw sharp declines.

Wall Street in Shock: Nvidia Loses $600B as China’s DeepSeek Crushes AI Hype

Nvidia isn’t the only one taking a hit. The broader tech market was rocked as fears surrounding AI sent investors into panic mode. The Nasdaq dropped 3.46% as of the time of writing, with Nvidia leading the charge, plummeting 18% and losing over $600 billion in market value.

DeepSeek’s rapid rise is forcing a major shake-up in AI valuations. The Chinese startup has shown that advanced AI doesn’t necessarily require the most expensive chips, challenging the business models of companies that bet big on the idea that AI would always drive massive demand for hardware. The market’s response was swift and severe: ASML and AMD saw sharp declines, while stocks tied to the AI infrastructure boom also took a beating. Investors who had been riding high on the AI wave are now reconsidering whether they’ve overpaid for the hype. In stark contrast, money poured into safer assets—bonds surged, bitcoin dropped, and risk appetite evaporated almost overnight.

The timing couldn’t be worse for Big Tech. With Microsoft and Meta, two of the biggest AI investors, set to release earnings this week, all eyes are on them, watching for any signs that the AI spending spree might be slowing down.

So, what is DeepSeek’s role in all of this? The Chinese startup launched a free, open-source large language model in late December, claiming it was built in just two months at a cost of under $6 million. That’s a tiny fraction of what Western competitors are spending on similar technologies. DeepSeek recently released a reasoning model that reportedly outperformed OpenAI’s latest in several third-party tests, adding to the growing unease.

DeepSeek’s ability to achieve world-class results on a limited budget has sparked debates among investors and engineers. CNBC’s Brian Sullivan highlighted the dramatic cost difference in a recent interview: “What am I getting for $5.5 million versus $1 billion?”

Marc Andreessen called DeepSeek’s model “one of the most amazing and impressive breakthroughs I’ve ever seen” and described it as a “profound gift to the world.” This comment from the cofounder of Andreessen Horowitz only amplified the growing concern about the scale of investment in AI models, and whether the U.S. is still leading in the field, CNBC reported.

As Srini Pajjuri, a semiconductor analyst at Raymond James, noted, DeepSeek’s ability to develop such a competitive model with far fewer resources than its American counterparts could push U.S. hyperscalers—like Amazon and Microsoft—into a new level of urgency. These companies have access to massive GPU resources, but DeepSeek’s success raises questions about how much is really needed to compete in the AI space.

“DeepSeek clearly doesn’t have access to as much compute as U.S. hyperscalers and somehow managed to develop a model that appears highly competitive,” Srini said in a Monday note.

The conversation around AI chip spending is intensifying, especially since companies like DeepSeek are making headway without the massive infrastructure that U.S. giants rely on. That said, some analysts, like those from Bernstein, are skeptical of the claims about DeepSeek’s low-cost model. They suggest that the $6 million figure may omit other necessary costs like earlier research and development stages, and caution against jumping to conclusions.

Despite these concerns, DeepSeek’s emergence underscores an important shift in the AI sector. The U.S. may not have the clear-cut dominance it once did, but the big question remains: How much will this affect the future of AI development and chip manufacturing? Only time will tell, but for now, the markets are feeling the pressure.