China’s AI models challenge U.S. dominance, outperforming U.S. rivals as global AI race heats up

In August 2023, Alibaba entered into the global AI race with the launch of two large language models (LLMs): Qwen-VL and Qwen-VL-Chat. These models stood out for their ability to process images and engage in advanced conversations. By offering them as open-source tools, Alibaba allowed researchers, educators, and businesses worldwide to use the models to build AI applications without the hassle of training their own systems.

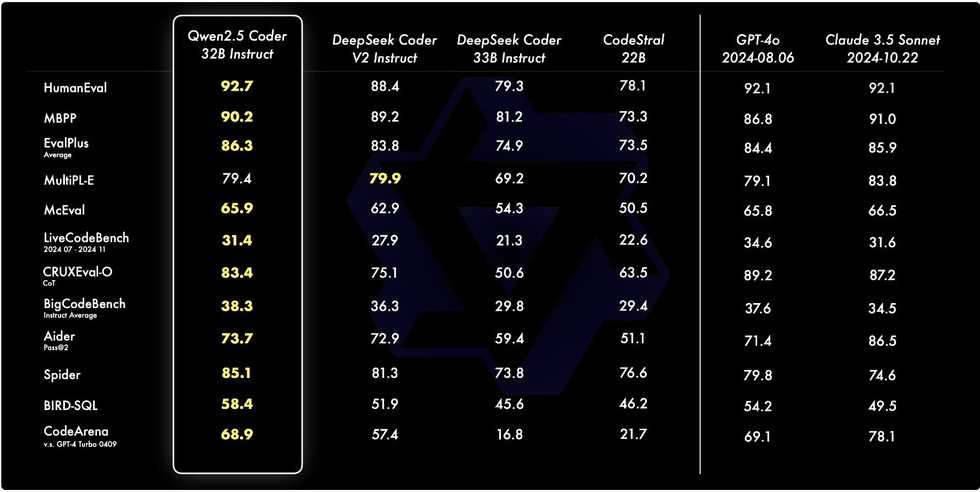

A year later, Alibaba’s Qwen models are gaining significant attention. Reports indicate that Alibaba’s Qwen has surpassed models from major US companies like Anthropic’s Claude 3.5 Sonnet and OpenAI’s GPT-4o. Platforms such as Hugging Face, which host LLMs, show Qwen climbing to the top with strong benchmark results and an appealing licensing model, according to another report from The Financial Times.

China’s growing dominance in AI development is starting to show real results. Analysts told CNBC that Chinese AI models are not just competing—they’re matching and, in some cases, surpassing their U.S. counterparts.

This emerging competition reflects a broader geopolitical dynamic. For both the U.S. and China, AI is seen as a critical technology. Washington has restricted China’s access to advanced chips used to train AI models, citing national security concerns. But China has taken a different path, focusing on open-source tools and building its own fast software and chips to remain competitive.

China’s Growing LLM Ecosystem

Chinese companies are now major players in LLM development, a space that U.S. firms like OpenAI and Meta dominated until recently. These models, trained on massive datasets, serve as the backbone for tools like chatbots and other AI applications.

The difference lies in the approach. While OpenAI’s ChatGPT runs on closed models, Chinese firms are leaning into open-source—or open-weight—models. Developers can download, adapt, and build on these tools for free, bypassing the strict licensing requirements often imposed by closed systems.

According to Tiezhen Wang, a machine learning engineer at Hugging Face, Chinese models are leading the download charts on their platform. Among them, Alibaba’s Qwen family is at the top.

“Qwen is rapidly gaining popularity due to its outstanding performance on competitive benchmarks,” Wang told CNBC. He added that Qwen’s flexible licensing makes it attractive to companies that don’t want to deal with complex legal reviews.

Qwen offers a range of models with varying sizes, balancing performance with computational costs. Whether developers need high power or efficiency, Wang says Qwen delivers some of the best results available today.

Startups like DeepSeek are also making waves. DeepSeek’s R1 model directly competes with OpenAI’s o1, a model designed for reasoning and complex tasks. Chinese firms are confident their models can hold their own against open-source options like Meta’s Llama and closed alternatives such as GPT-4.

“In the last year, we’ve seen the rise of open-source Chinese contributions to AI with really strong performance, low cost to serve, and high throughput,” Grace Isford, a partner at Lux Capital, told CNBC.

Pushing Open Source to a Global Stage

The open-source approach is strategic. By sharing technology with developers worldwide, Chinese companies are expanding their reach. It’s not just about innovation; it’s about creating ecosystems that attract developers, applications, and eventually users.

Paul Triolo, a partner at DGA Group, pointed out that this strategy is helping Chinese firms become global players in the AI space. “Chinese companies would like to see their models used outside of China,” he explained.

Much like operating systems—Windows, Android, or iOS—these AI models could become foundational tools for future applications. The stakes are high. Whoever dominates this space could set the course for global technology trends.

“They [Chinese companies] perceive LLMs as the center of future tech ecosystems,” said Xin Sun, a senior lecturer at King’s College London. He explained that their business models hinge on developers building applications around their LLMs, drawing in users and data that fuel long-term growth.

The Chip Battle and China’s AI Future

Training advanced AI models requires enormous computing power and access to specialized chips—where U.S. firm Nvidia leads the pack. However, U.S. export restrictions have cut off China’s access to Nvidia’s most advanced GPUs, forcing Chinese companies to look elsewhere.

Yet, Chinese firms are adapting. Many stockpiled Nvidia chips before sanctions took effect, while others are turning to domestic solutions. Huawei, Baidu, and Alibaba are among those investing in local alternatives to Nvidia’s GPUs.

“Major Chinese technology platforms currently have sufficient access to computing power to continue to improve models,” Triolo noted. He added that while Nvidia’s upcoming Blackwell chips are off-limits, China’s focus on building its own hardware ensures it will stay in the race.

Lux Capital’s Isford echoed this, pointing to China’s efforts to grow its domestic AI infrastructure. Companies like Baidu are developing their own high-performance AI chips to reduce reliance on Nvidia.

“Whether or not Nvidia chips are banned in China will not prevent China from investing and building their own infrastructure to build and train AI models,” Isford said.