Crypto market cap hits $3.2 trillion, surpassing France’s GDP

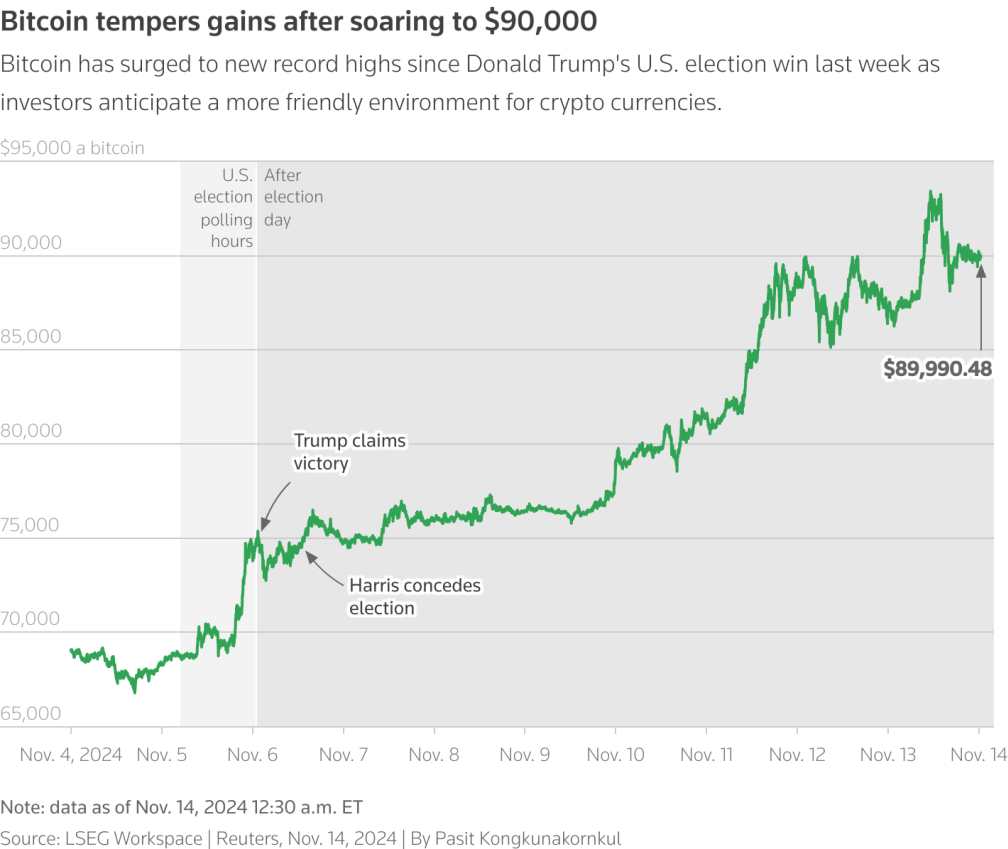

The crypto boom sparked by Trump’s recent November 5 victory shows no signs of slowing down, with Bitcoin reaching $90,000 and driving the global cryptocurrency market beyond the $3 trillion mark. On Thursday, crypto market capitalization hit a record $3.12 trillion.

According to CoinGecko, the combined market value of cryptocurrencies soared to nearly $3.2 trillion in early trading on Nov. 14 in Asia, with Trump’s election driving optimism around more crypto-friendly U.S. regulations, spurring fresh momentum in the sector.

For comparison, the global crypto market cap of $3.2 trillion now exceeds France’s gross domestic product (GDP), valued at $3.031 trillion as of November 2024. However, it remains small next to the S&P 500, which has a market cap of $50.6 trillion.

Bitcoin leads the way, and the market value high coincides with Bitcoin’s record rise to $93,480. Since then, it’s pulled back, trading at $88,075 at the time of writing. Meanwhile, Bitcoin’s market cap has now surpassed $1.77 trillion, making it larger than Spain’s GDP, according to data from the International Monetary Fund.

“Generally the way this market goes is bitcoin will break out and then the rest of the altcoins will follow,” explained Matthew Dibb, CIO at cryptocurrency asset manager Astronaut Capital. “So there is that gradual rotation of capital…and then we can expect the total market cap to increase.”

The election of Trump, along with several pro-crypto members in Congress, has sparked enthusiasm by potentially easing regulatory uncertainty around crypto in the U.S.

Bitcoin, currently trading around $91,500, has doubled in value this year and is up 30% since Trump’s election on Nov. 5. Smaller cryptocurrency Ether also rose about 33% since the election, reaching $3,220.

Bitcoin isn’t the only crypto seeing gains from Trump’s win. Dogecoin, the meme-driven token backed by Trump ally Elon Musk, has surged by 140%.

Crypto exchange-traded funds have also seen a spike in activity, likely reflecting institutional interest in the sector. Spot Bitcoin ETFs have attracted $4.05 billion in inflows since Nov. 6, about 15% of total inflows since they launched in January, according to Refinitiv Lipper.

“People wanted more exposure to crypto, clearly, from the Trump presidency and they wanted more risky asset exposure in general,” commented David Glass, digital assets strategist at Citi.

“Investors are clearly looking for more exposure to crypto following Trump’s win, as well as higher-risk assets in general,” commented David Glass, digital assets strategist at Citi. “From the crypto front, there’s the story of removing regulatory headwinds and the potential strategic bitcoin reserve,” he added.

Unlike previous rallies, this one appears more sustainable. Recently, Trump floated the idea of a potential “strategic bitcoin reserve” for the U.S., akin to the national gold reserve, though details remain sparse.

There may still be more room for this rally to grow. “Bitcoin enthusiasts are known for bold predictions, but hitting $100,000 by year-end seems feasible,” said Carl Szantyr, founder and managing partner at Blockstone Capital.

This chart tracks Bitcoin’s price movements over time.

Credit: Reuters

A LOOK BACK AT BITCOIN HIGHS AND LOWS

This latest surge is just another chapter in Bitcoin’s volatile history. Bitcoin was trading below $20,000 last year, still reeling from the “crypto winter” that followed the FTX collapse and other industry challenges.

Still, crypto’s total market value remains relatively small next to traditional assets. The World Gold Council estimates that the value of all mined gold sits around $19 trillion, and the S&P 500’s market cap is a staggering $50.6 trillion, Reuters reported.

Some sectors of the crypto space show signs of caution. Non-fungible token (NFT) prices, for example, have hovered around $2,000 since May, according to NonFungible.com, and only recently edged up to about $2,700.

In Singapore, DBS Bank’s digital exchange reported a surge in trading volumes, executing a third of last year’s total in the first 10 days of November. However, investors seem cautious, steering clear of more niche areas of the market.

“We’ve not seen our clients shift their assets towards more exotic platforms or decentralized exchanges,” David Hui, chief commercial officer of DBS Digital Exchange, told Reuters. Still, renewed interest is breathing life into the market.

“There’s increased interest and willingness to look at DeFi and other possibilities associated with blockchain,” said Danny Chong, co-founder of Tranchess, a decentralized asset-tracking platform.

“Interest is growing around DeFi and blockchain applications,” said Danny Chong, co-founder of Tranchess, a decentralized asset-tracking platform. “The heightened market capitalization, which if sustained for a longer period, would likely also invite deeper interest into new and existing themes,” he said, including tokenization of real-world assets and blockchain-based payment services.

Meanwhile, software firm and Bitcoin investor MicroStrategy disclosed a $2 billion Bitcoin purchase between Oct. 31 and Nov. 10, boosting its stock by 26% on Monday.

Nick Twidale, chief market analyst at ATFX Global in Sydney, summed it up: “Trump’s stance on crypto is energizing both the stock and currency sides of the industry. Bitcoin was already near record highs when the election results came in, giving it clear skies ahead.”

Crypto investors anticipate reduced regulatory pressure from the SEC, with Trump’s pledge to replace current Chair Gary Gensler. In September, Trump also launched World Liberty Financial, a crypto venture.

Reflecting on the ongoing crypto momentum, Justin D’Anethan, head of Asia-Pacific business development at Keyrock, told Reuters, “This isn’t just about price; it’s a sign of growing acceptance of Bitcoin as a stable, possibly even politically-backed, asset.”

Looking ahead, several analysts predict that crypto may keep climbing, with some forecasting that Bitcoin is on track to reach the $100,000 milestone by year-end.