Bitcoin hits new all-time high of $82,000 as crypto euphoria over Trump’s election victory continues

Bitcoin reached a new milestone on Monday as the cryptocurrency rally picked up steam following Donald Trump’s presidential election victory. This surge comes just after Bitcoin broke the $80,000 mark on Sunday, setting a fresh all-time high.

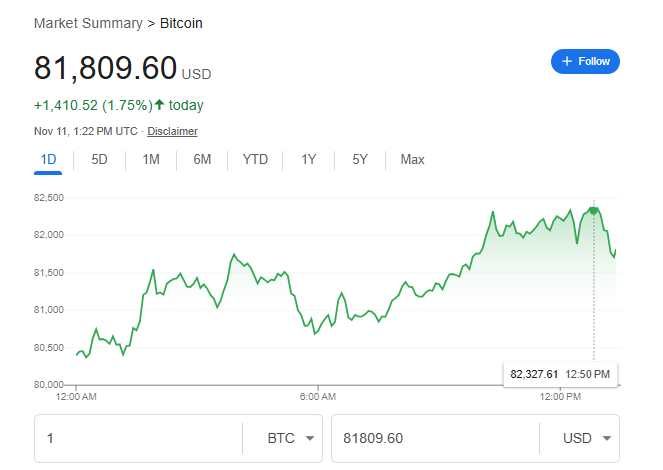

By 6:58 a.m. EST, Bitcoin was trading 3.6% higher at $82,216, driven by optimism that a pro-crypto regulatory environment might emerge under Trump’s leadership and with the support of crypto-friendly candidates in Congress. Bitcoin pulled back slightly a few hours later and is now trading at $81,809 at the time of writing.

Bitcoin is not alone. Other cryptocurrencies also benefit from the surge. Ether rose 1.8%, reaching around $3,204 after crossing $3,000 over the weekend. The DeFi token connected to Cardano gained 2.7%, and while XRP remained steady, meme coins like Dogecoin and Shiba Inu showed notable growth, climbing nearly 11% and 5% respectively, as reported by Coin Metrics.

This latest leap sent Bitcoin past $82,000, fueled by expectations that Trump’s administration might introduce more lenient regulations around digital assets. With Bitcoin now more than doubling from its year’s low of $38,505, it reached a high of $82,527 on Monday.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, told CNBC that the recent surge reflects a sense of “euphoria” in the market, spurred by Trump’s recent win. In a research note Monday, Streeter said:

“His pledge to go all in on crypto has sent Bitcoin to fresh heady heights. He’s made an about turn on supporting the industry and is now vowing to turn the U.S. into the crypto capital of the world. Bitcoin speculators are betting on a more clement regulatory environment, and have expectations that the authorities may build up a reserve crypto fund, helping lift ongoing demand.”

“His pivot to backing the crypto industry has pushed Bitcoin to new highs,” Streeter noted in a research note on Monday. “Speculators are banking on a friendlier regulatory stance and betting that authorities might even consider establishing a national crypto reserve, which could drive further demand.”

Throughout his campaign, Trump signaled strong support for digital assets, vowing to make the U.S. the “crypto capital of the planet” and promising that all Bitcoin mining would take place within the country. He also floated the idea of building a national Bitcoin reserve.

“Bitcoin’s Trump-driven surge is holding steady,” Matt Simpson, senior market analyst at City Index told Reuters. With Republicans likely to take control of the House, the crypto community is seeing this as a sign of possible deregulatory shifts in Congress.

In a research note last week, Citi strategists pointed out that crypto has been one of the “few Trump trades that has yet to retrace.”

“Part of the reason is due to the anticipated crypto-friendly nature of Trump’s administration, which investors hope will translate into regulatory clarity in the U.S.,” said the strategists, led by David Glass.

They observed that since the election, spot crypto ETFs have experienced some of their highest inflows to date.

“Specifically, net inflows for BTC and ETH ETFs in the two days post-election were $2.01bn and $132mn, respectively,” they noted. “We continue to see ETF flows as the main driver of Bitcoin returns.”

Looking ahead, several analysts predict that crypto may keep climbing, with some forecasting that Bitcoin could reach the $100,000 milestone by year-end.