Generative AI startups secure 40% of $79.2 billion in cloud venture funding for 2024

The rise of ChatGPT two years ago ignited a wave of AI adoption across industries, pushing artificial intelligence into the mainstream. Along with this rise came an influx of billions in investment, primarily benefiting generative AI startups—those leveraging AI to produce everything from text to video and even audio and images. These companies are capturing the most attention, as businesses increasingly look to harness AI’s creative capabilities for a wide range of applications.

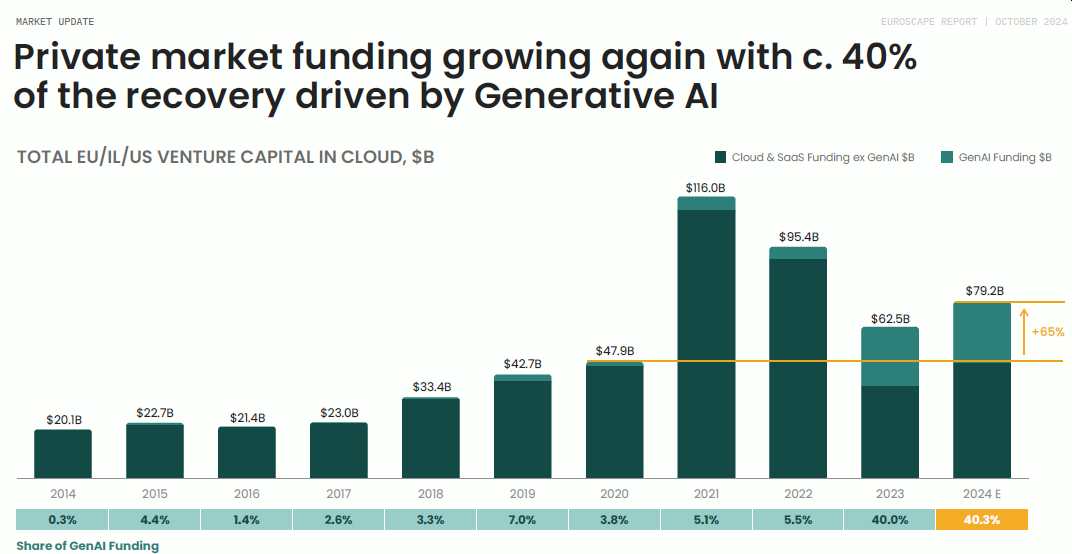

According to the latest annual Euroscape report published by VC firm Accel, generative artificial intelligence startups are taking a significant share of cloud venture capital funding, with 40% of all investments in cloud companies flowing to these AI-driven firms.

In its latest annual Euroscape report, which highlights key trends in cloud and AI, Accel reported that venture capital funding for cloud startups in the U.S., Europe, and Israel is expected to hit $79.2 billion this year, with much of the recovery driven by the buzz around artificial intelligence.

Generative AI startups secure 40% of $79.2 billion in cloud venture funding (Source: Accel)

Cloud startups saw a 27% annual increase in funding—the first growth in three years. In 2023, companies in the cloud space raised $62.5 billion across Europe, Israel, and the U.S., according to the report. That’s a 65% jump from the $47.9 billion raised four years ago.

This surge comes after OpenAI, the company behind the well-known AI chatbot ChatGPT, closed a massive $6.6 billion funding round, which valued the firm at $157 billion.

AI’s Impact on Cloud Funding

The growing excitement around AI has been a major factor in the increase in cloud investments. In a CNBC interview this week, Philippe Botteri, partner at Accel, said:

“AI is sucking the air out of the room” when it comes to cloud. This is both visible on the public market and the private market.”

As of September 30, Accel’s Euroscape index—a group of publicly listed cloud companies from the U.S., Europe, and Israel—was up 19% year-over-year. However, this lags behind the Nasdaq’s 38% rise this year, and the Euroscape index remains down 39% from its peak in 2021.

The cloud sector, outside of AI, has faced challenges, with enterprise software budgets constrained by economic and geopolitical uncertainties. Botteri noted that businesses are carefully reassessing spending priorities, given the current landscape.

None of the companies in Accel’s Euroscape index have reported revenue growth of more than 40% this year. In contrast, 23 companies achieved that milestone back in 2021. Botteri pointed out that IT budgets are gradually shifting toward AI, with spending on generative AI technologies reducing the resources available for other cloud initiatives.

AI Startups Lead the Charge

Accel’s report also highlighted that the top six generative AI firms in the U.S., Europe, and Israel accounted for roughly two-thirds of the funding raised by all generative AI startups. OpenAI dominated the scene of the top generative AI startups, raising $18.9 billion between 2023 and 2024, far ahead of any other competitor.

Anthropic came in second among U.S.-based generative AI firms, raising $7.8 billion, while Elon Musk’s xAI secured third place.

In Europe, the biggest funding rounds went to British startup Wayve, France’s Mistral, and Germany’s Aleph Alpha.

Across the globe, companies building foundational AI models—those that power today’s most popular generative AI tools—received the lion’s share of funding, making up two-thirds of total investments in generative AI firms.

Big Tech and AI Investments

The U.S. continues to lead the way in overall generative AI investment. Of the $56 billion invested globally in generative AI companies from 2023 to 2024, 80% went to U.S.-based firms, according to Accel.

Tech giants like Amazon, Microsoft, Google, and Meta are pouring $30 billion to $60 billion annually into AI, highlighting just how significant this technology has become. Major players like OpenAI, Anthropic, and xAI are spending billions, while smaller challengers such as Cohere, H, and Mistral are investing millions.

Dev Ittycheria, CEO of MongoDB, emphasized that only a few companies will likely control the most powerful AI models in the future. He noted that access to capital will play a crucial role in determining which companies dominate the space.

“My guess is that over time, the number of model providers will shrink, potentially leaving only one or two major players,” Ittycheria said in an interview with CNBC.