Investing in AI after ChatGPT: How the Venture Capital Landscape Is Changing

In an era in which AI appears all set to revolutionize how we work, it becomes vitally important to understand what’s really driving it. Elon Musk is fond of reminding all of us that technology doesn’t automatically improve over time. He points to the fact that the shifts that appear inexorable only actually occur when a large number of highly skilled people work very hard for a prolonged period. And yet, at the same time, to many of us, AI seems to have appeared out of nowhere back in November 2022.

To truly understand how the venture capital landscape is changing, we need to return to the AI landscape itself.

Understanding the AI Landscape

AI may give the impression that the computers and software packages we are all innately familiar with are now, by some measure, sentient. The truth is that they are actually just mimicking human responses but doing so at a scale that no individual human will ever be able to keep pace with. The key point here is that AI can gradually be shaped, honed, and fine-tuned for over a decade.

As with any other breakthrough, this process has been driven by multiple teams working in close competition. Each team has been supported by capital investment to fund its projects, and our point of focus here is how this capital is to be allocated going forward.

Where Is AI Investment Going This Decade

A recent Statista study found that while $200 billion was invested in AI in 2023, the figure is expected to grow beyond the $1.8 trillion mark as soon as 2030. This is approaching an order-of-magnitude shift in less than a decade, something that is typically only seen in startup-driven tech spaces.

Other industries within the tech space that have experienced these types of seismic growth profiles include:

- The dot com boom of the early 2000s;

- The rise of social media on the back of Facebook;

- The secondary growth of messaging platforms driven by WhatsApp;

- The proliferation of remote work platforms like Zoom during lockdown;

- Businesses moving online.

Turning High-Risk Startups into Success: AI and Strategic Investment Insights

While there are notable success stories, much money was lost along the way. This is not to say that money cannot be made. You only have to look at the success of the gambling industry, which is predominantly moving online, to realize that.

AI can help by offering tailored bonuses like the ones on this site or personal gaming experiences. Any given startup is high-risk by its very nature, but a strategic series of investments becomes much less so. You only have to look at the demise of Viber in its race to win against Whatsapp and Whatsapp’s subsequent purchase by Facebook to see this in action.

Evaluating the AI Investment Landscape: Pros, Cons, and Strategic Considerations

An overview of the investment landscape can be gained with a simple comparison of the pros and cons of the AI industry itself:

| Pros | Cons |

| Highly scalable with options to bootstrap; | One player typically has to come to dominate; |

| Highly niche by its very nature; | Not all niches are profitable business; |

| High speed of secondary rollout. | Viral errors can rapidly damage reputations. |

Scalability, speed, and specificity continue to make AI an attractive proposition for VC investors. They’re looking for openings that allow them to set the tone for a strategic profile of investments where risk is sufficiently hedged. As the inner workings of AI become increasingly widely available to a growing number of startups, in many ways, the heavy lifting is complete.

The core functionality of LLM code is no longer something that has to be attacked from a first principles perspective. Instead, it is now something that can be readily adapted and fine-tuned to make sure that it is suitably adapted to the specific niche it is being applied to. AI startups are now approaching something of a secondary stage in which they can be more creative from a user perspective. This leads to a natural question.

How Has AI Investment Functioned to Date

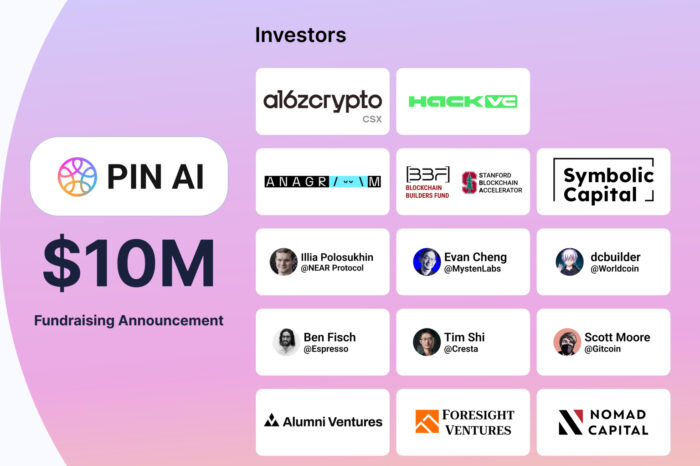

You only have to look at the latest tech startups to get a clear picture of how many AI startups are currently raising seed capital. The need for high liquidity for businesses that may experience rapid growth but may also be deemed high risk lends itself to the VC world. Traditional banks and more conservative lenders typically avoid these types of arrangements because they are concerned by the overall sharpness of the risk profile.

VC enterprises and lending houses have historically been far more aggressive and forward-thinking, driven in large part by their willingness to acquire equity stakes. The key point here is that they can quickly gain footholds in multiple startups and use these varied positions to hedge against one another. This widespread and yet highly strategic distribution of capital has long been the central tenant of the VC model. What’s interesting is how this pivots when an industry explodes and enters the mainstream.

Go back just five years, and AI was dominated solely by Google and Microsoft. Smaller companies like OpenAI were bought out and became for-profit enterprises under the umbrella of some of the tech world’s largest parent companies. Now that AI has reached a critical mass where startups can bootstrap existing technology, this is already starting to change.

Is AI Investment Going to Fuel a Bubble

Whenever a ten-fold increase in investment is predicted, there will inevitably be some financial casualties along the way. Aside from the obvious case of a couple of high-profile bad actors (as there are in any nascent industry), there is also the core question of competence. Not every AI startup has the critical mass of talent that leads to the bright ideas and universal appeal that are needed. Others will simply crowd one another out, only to be replaced by something more universal and far-reaching in the near future. MySpace, Friendster, and Bebo are all examples of what becomes of very similar products that come up against something slightly better — in their case, it was Facebook.

While AI is too new for there to be any high-profile failures yet, that’s not to say there won’t be any casualties along the way. But there’s also something different about AI as an investment landscape that leading VC houses have known from the very beginning.

The highly scalable nature of AI and the rapid proliferation and exchange of information may very well make it a far more secure investment landscape. No longer will Silicon Valley startups be able to spend several years acquiring investment and producing very little in terms of end product. The pace of change in AI is unlike anything that has come before it because AI itself can be used to generate code, images, content, and so much more.

AI’s Fail-Fast Culture: Shaping the Future of Venture Capital Investment

Rather than a bubble that will gradually expand without anyone noticing, only to suddenly pop over the course of one day of dark trading, AI is set to deliver a fail-fast culture. Ideas will need to be created, tested, and rolled out at a speed not seen before in the tech space. For this reason, AI is predicted to be leaner, more agile, and more willing and able to pivot to new ideas.

VC houses will increasingly look to invest in teams of AI talent rather than specific brands or startups because they understand the need to pivot at pace. The result will be a highly dynamic competition in which new niches currently not in existence will be carved out and created from scratch. The investment landscape when it comes to AI is set to become one in which money follows talent and reputations rather than the largest players in the industry.