China’s gallium export sanctions put 20 U.S. companies worth $8 trillion at risk

A recent report from the Center for Strategic and International Studies (CSIS) has raised alarms over China’s grip on gallium, a mineral vital for producing high-performance microchips used in advanced U.S. military technologies and AI chips. The report highlights how China’s decades-long industrial policies have allowed the country to achieve a near-monopoly on gallium, a material essential for manufacturing the microchips that power critical defense systems.

This issue gained prominence on July 3, 2023, when China’s Ministry of Commerce announced new restrictions on gallium exports, which took effect on August 1, 2023. These restrictions have already disrupted global supply chains, serving as a reminder of China’s willingness to use critical minerals as leverage in geopolitical conflicts.

“Decades of sweeping industrial policies have afforded China a near-total monopoly over gallium, a critical mineral used to produce high-performance microchips that power some of the United States’ most advanced military technologies.” the report said.

Gallium’s unique properties are crucial in the manufacturing of microchips, which power technologies ranging from advanced weaponry to sophisticated communication systems. The report underscores concerns about China’s control over gallium refining, emphasizing the urgent need to diversify supply chains to reduce dependency.

According to the U.S. Geological Survey, China produced 98% of the world’s gallium and 60% of its germanium in 2022. This dominance stems from China’s leadership in aluminum production, from which most gallium is extracted. Generous government subsidies and tax incentives have driven the growth of China’s domestic metals industry, outcompeting global producers and leaving China as one of the few remaining suppliers of gallium.

The new export restrictions have caused gallium prices in Europe to nearly double over the past year. China justifies these measures as necessary for protecting national security in response to U.S. sanctions.

“Recent moves by Beijing to restrict the export of gallium have laid bare the need for Washington and its allies to de-risk their critical mineral supply chains. Failing to address glaring vulnerabilities in the gallium supply chain could pose serious national security and economic challenges for the United States and its allies.”

China has used its dominance in gallium as a countermeasure against Western trade pressures. With the country supplying nearly 80% of the global market, the announcement of gallium and germanium export restrictions sent shockwaves through the industry.

China’s Gallium Dominance: A National Security Risk

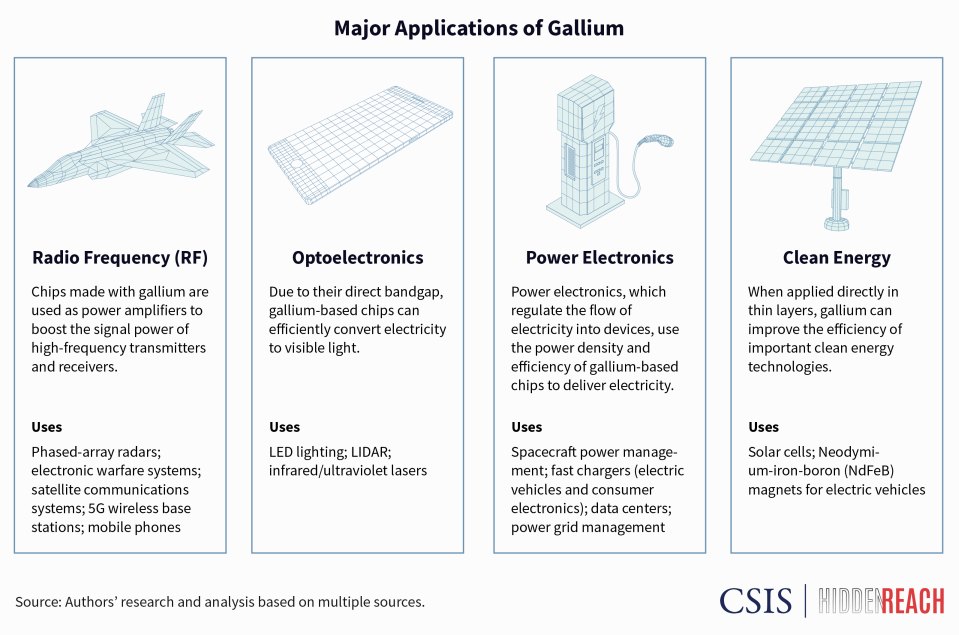

Gallium may be an unfamiliar term to many, but it plays an indispensable role in modern electronics, especially in the defense sector. Its properties enable the production of specialized semiconductors essential for advanced military capabilities, including next-generation missile defense, radar systems, electronic warfare, and communications equipment. Any disruption in the gallium supply chain could significantly impact U.S. and allied defense industries, leading to potential economic losses worth hundreds of billions of dollars.

China’s tight grip on gallium supply is a major vulnerability for the U.S. and its allies—a vulnerability that Beijing appears ready to exploit. However, there are clear measures the U.S. and its partners can take to mitigate this risk and reduce their reliance on China’s critical minerals.

Gallium has long fueled advances in military technology. In the 1970s, the U.S. Defense Advanced Research Projects Agency (DARPA) played a crucial role in developing gallium arsenide (GaAs), a compound that revolutionized the U.S. Global Positioning System (GPS), precision-guided weapons, and radar. GaAs remain widely used in modern electronics, including smartphones.

Credit CSIS

More recently, DARPA’s support has led to the development of gallium nitride (GaN), a compound enabling significant technological breakthroughs. GaN is transforming modern radar systems, allowing them to track smaller, faster, and more numerous threats from greater distances. Many of these advanced radar systems rely on thousands of gallium-enabled chips.

U.S. and allied armed forces are rapidly adopting GaN-enhanced radars for key platforms. In 2019, Raytheon secured a $383 million contract to build six GaN-enabled active electronically scanned array (AESA) radars for the U.S. Army’s Lower-Tier Air and Missile Defense Sensor (LTAMDS). These radars are being integrated into Patriot missile defense units and other systems. In June 2023, Poland became the first foreign buyer of the LTAMDS radar system, with other U.S. allies expected to follow suit.

China’s Gallium Export Restrictions: A Ticking Time Bomb for AI

China’s export controls on critical semiconductor materials are already affecting the supply chain, raising concerns about potential shortages of advanced chips and military optical hardware. These shortages could also impact the minerals needed for developing AI chips.

Interest in semiconductors has surged over the past year, driven by the AI boom. Gallium, with its unique properties, is essential for producing advanced AI chips. Any disruptions in gallium supply could have significant consequences for AI development and deployment.

Gallium is a key component in AI chip production. Gallium arsenide (GaAs), widely used in high-frequency transistors and integrated circuits, is critical for AI chips’ high-speed processing capabilities, which are necessary for tasks like machine learning and natural language processing.

Another report from the Financial Times highlights the critical situation, with an industry source revealing significant reliance on China’s gallium supply. Companies affected by the export controls have reported that while some bulk shipments continue, overall export volumes have dropped by about half since the restrictions were implemented. If China further reduces gallium exports, reserves could be depleted, leading to shortages.

“The situation with China is critical. We are depending on them,” a source from a major semiconductor materials company told the Financial Times. “If China reduces gallium exports as it did in the first half of the year, then our reserves will be consumed and there will be shortages,” the source added.

Gallium Export Sanctions Put 20 U.S. Companies Worth $8 Trillion at Risk

China’s sanctions on gallium exports could jeopardize 20 major U.S. companies, worth a combined $8 trillion, including Nvidia, Intel, Qualcomm, Apple, MicroVision, Apple, Microsoft, AMD, Broadcom, Texas Instruments, and Analog Devices.

Others include Raytheon, Northrop Grumman, Skyworks Solutions, Lumentum Holdings, II-VI Incorporated, ON Semiconductor, Cree (Wolfspeed), Qorvo, Marvell Technology, GlobalFoundries, Lam Research, and Applied Materials. These companies rely heavily on gallium-based chips, which are increasingly vital in both the commercial and defense sectors.

Gallium’s role in radio frequency technologies has made it critical for 5G base station hardware, which requires high-frequency receivers. Gallium nitride (GaN) is also gaining traction in power devices, helping to efficiently supply electricity to smartphones, laptops, electric vehicles, and data centers. Consumer electronics giants like Apple have begun incorporating GaN in next-generation chargers, signaling a broader industry shift. Gallium is also crucial for green technologies like solar cells and electric vehicles.

Gallium’s importance is expected to grow as advances in chip-making push the limits of silicon-based technologies. Industry experts predict 25% annual growth in the global market for GaN chips through 2030, with defense applications driving much of this increase, underscoring gallium’s strategic value to U.S. and allied military modernization.

In 2023, a top Raytheon executive noted that GaN is central to nearly all the advanced defense technologies they produce.

Final Thoughts

The report concludes with a stark warning: if the U.S. loses ground to China in developing advanced semiconductors, it will fall behind in crucial military and economic technologies. China’s strong domestic ecosystem for gallium-based chips has already given it an edge in military development. If China continues to dominate the gallium supply chain and advances its chip production capabilities, it could shield itself from global supply chain disruptions while inflicting damage on others. China’s recent gallium export restrictions signal growing confidence in its ability to impose costs on rivals while minimizing repercussions for Chinese companies.