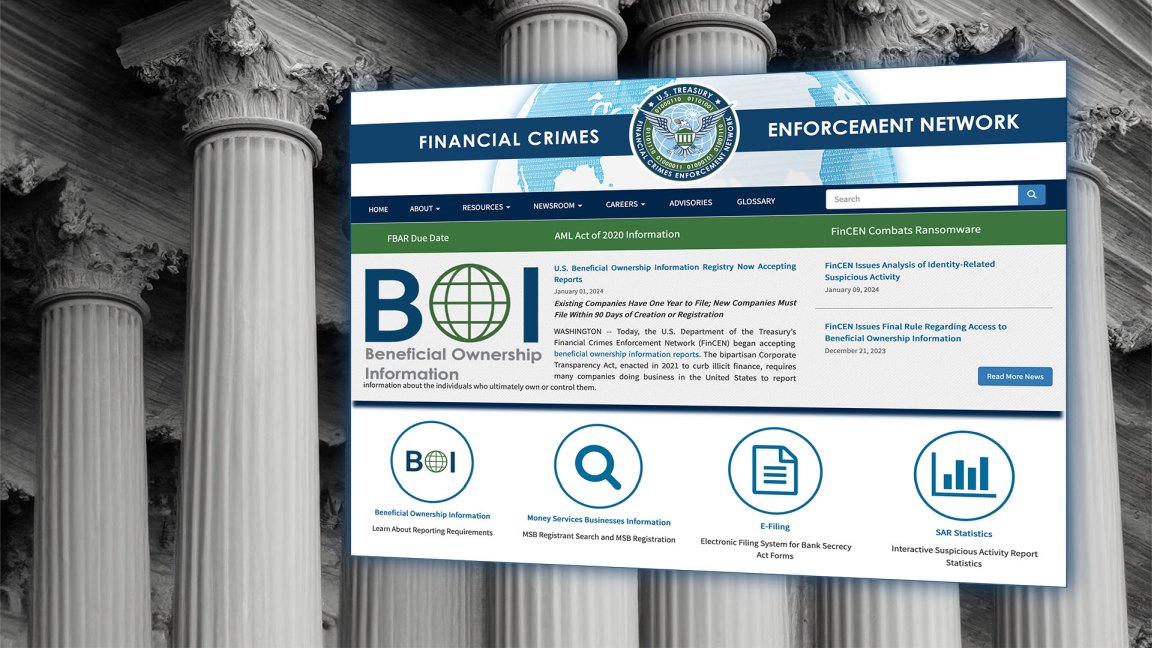

Beneficial ownership information reporting requirements: What startups need to know

Posted On July 8, 2024

0

1.6K Views

Trending Now

Top Tech News Today, January 26, 2026

January 26, 2026