Cash-strapped AI startups seek mergers & acquisitions to survive amid rising costs: Is the AI dream over for startups?

In November 2022, OpenAI made headlines with the launch of its ChatGPT AI chatbot. Within just five days of its release, ChatGPT attracted over 1 million users, reaching an impressive milestone of 100 million monthly active users by January 2023. The success of ChatGPT sparked a flurry of interest from investors, who quickly began pouring billions into promising AI startups.

Now, over a year into the AI boom triggered by ChatGPT’s debut, the initial excitement is giving way to a sobering reality check. Founders and venture capitalists who rushed to invest in AI startups are discovering that translating the hype surrounding chatbots into profitable businesses is no easy task.

Reports from the Wall Street Journal and The Information indicate that venture investors are reassessing their expectations regarding generative artificial intelligence. Doubts linger about the viability of the latest wave of AI startups, particularly in the face of entrenched competition from tech giants like Microsoft and Google.

“Almost a year into the boom ignited by the November launch of ChatGPT, some startups that epitomized the zeal for so-called generative AI are now navigating layoffs and reduced user interest. Investors are unsure whether the new crop of AI startups will be able to survive, especially as tech giants such as Microsoft and Alphabet’s Google solidify their dominance over the technology,” the Wall Street Journal reported.

Adding to the challenge, some AI startups that initially captured attention with their innovative approaches to generative AI are now grappling with layoffs and dwindling user engagement. Faced with soaring operational expenses and the exorbitant costs of maintaining AI infrastructure, some of these startups are contemplating selling themselves to stay afloat.

“The founders of artificial intelligence startups spent much of the past year seeking capital to fund the high cost of developing their software. Now those costs have pushed some to consider another alternative—merging with a larger company,” The Information noted.

Take, for example, Latitude, a small startup that gained traction with its AI Dungeon game, allowing users to craft imaginative stories using artificial intelligence. However, the emergence of ChatGPT overshadowed its success, leading to a sharp increase in operational costs for Latitude, CNBC reported. CEO Nick Walton recounted how the expenses associated with maintaining the text-based role-playing game became unsustainable as its popularity surged.

“We joked that we had human employees and we had AI employees, and we spent about as much on each of them,” Walton told CNBC. “We spent hundreds of thousands of dollars a month on AI and we are not a big startup, so it was a very massive cost.”

Facing mounting financial pressure, many cash-strapped AI startups are exploring alternative strategies to stay afloat. Some are actively seeking acquisition by larger companies, driven by the need to alleviate the burden of escalating operational expenses. The acquisition trend extends beyond struggling startups, with investors and venture capitalists also looking to snap up promising ventures that missed the initial wave of generative AI investments.

Another report from Business Insider suggests that running ChatGPT could potentially incur costs of up to $700,000 per day for OpenAI, attributed to the necessity of utilizing expensive servers.

“Using ChatGPT to write cover letters, generate lesson plans, and redo your dating profile could cost OpenAI up to $700,000 a day because of the pricey tech infrastructure the AI runs on, Dylan Patel, chief analyst at semiconductor research firm SemiAnalysis, told The Information,” Business Insider reported.

Recent months have seen a surge in merger and acquisition activity within the AI startup ecosystem. High-profile acquisitions, such as Databricks’ purchase of MosaicML and Thomson Reuters’ acquisition of Casetext, underscore the growing consolidation trend in the industry.

Last June, Thomson Reuters acquired Casetext, a legal services AI group, for a massive $650 million. Casetext is known for its AI legal assistant, which is powered by OpenAI’s GPT-4 technology. This acquisition was announced during the same month as other significant deals in the tech world.

Robinhood, the popular financial services platform, also made a strategic move by purchasing X1, a startup focused on credit card services, for $95 million. Meanwhile, Ramp, a finance automation company, expanded its offerings by acquiring Cohere.io, a startup specializing in AI-driven customer support tools. These acquisitions reflect the ongoing trend of companies seeking to strengthen their capabilities and offerings through strategic purchases in the rapidly evolving tech landscape.

Moreover, smaller-scale acquisitions, like Ramp’s acquisition of Cohere.io and Ascendion’s purchase of Nitor Infotech, further illustrate the broader consolidation underway. Industry experts predict that this wave of consolidation is just the beginning, driven by the need for startups to find viable paths to liquidity amid intensifying competition.

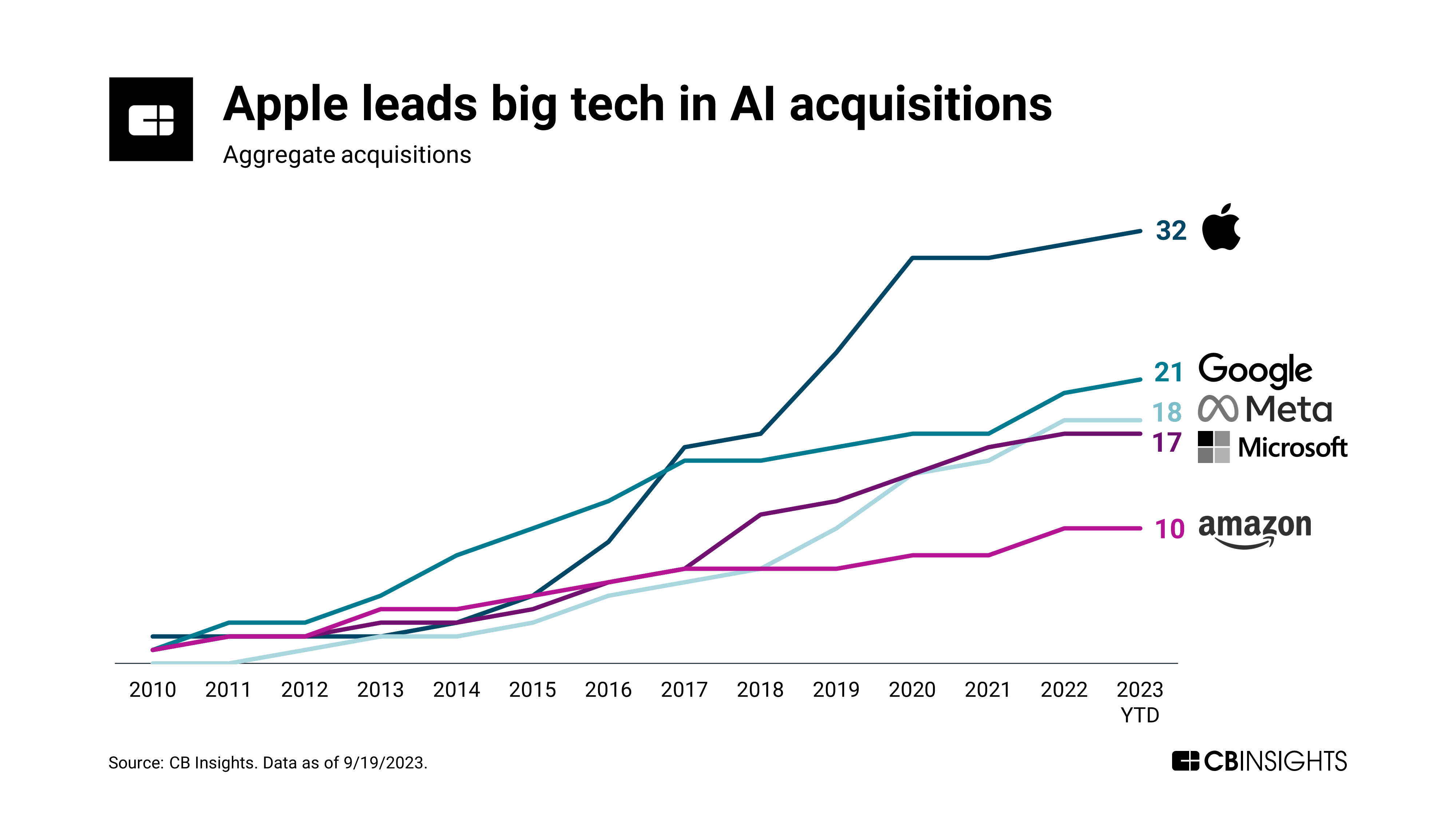

The Big Tech Companies Leading The AI Acquisitions

Beyond the realm of AI acquisitions, tech companies face additional challenges stemming from evolving financial landscapes. Rising interest rates have led to increased costs of debt capital, while the overall venture capital investment in startups has seen a notable decline from $246 billion in the previous year to $80 billion.

Moreover, there is a discernible trend of tech startup valuations aligning more closely with those of publicly listed counterparts. Additionally, venture-backed preferred equity in startups has witnessed a substantial decline of a quarter since the beginning of 2022.

In addition to reports from the Wall Street Journal, The Information, another report from PYMNTS indicates a significant downturn in venture capital spending, particularly affecting early-stage tech startups across the United States. In the second quarter of 2023, the number of startup deals backed by American investors saw a notable decrease, totaling 3,011 deals, which is one-third fewer than the corresponding period in 2022. Venture capital firms have also scaled back their investments, with the total expenditure hovering around $40 billion, representing nearly half of the previous year’s spending. The most substantial decline in funding was observed in angel or seed deals, especially for startups in the conceptual phase.

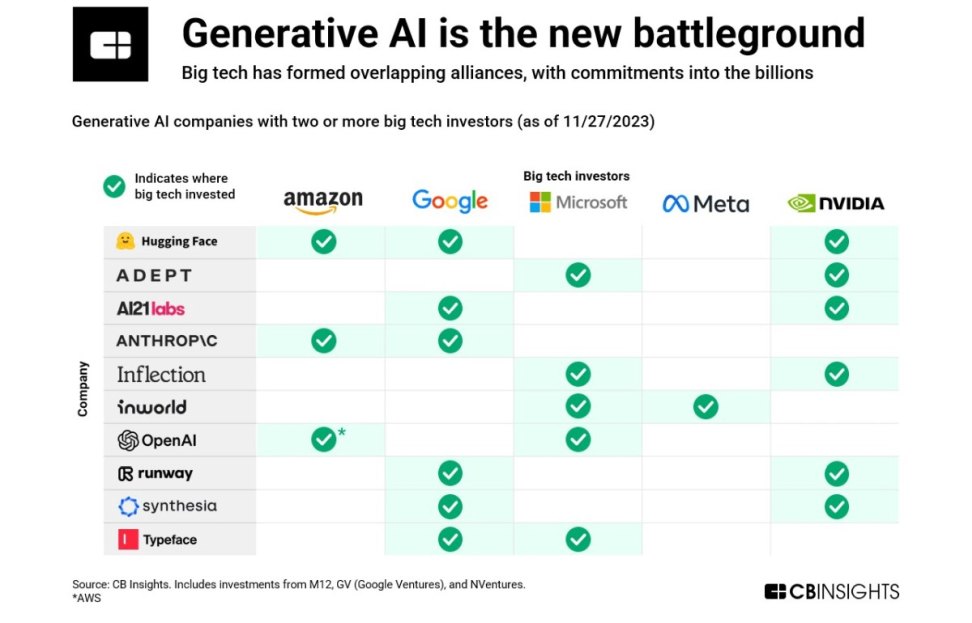

Despite the challenges, there remains a silver lining for the tech industry as big players continue to show interest in the realm of generative AI startups. According to a recent report by CB Insights in November, generative AI has emerged as the new battleground for technological innovation. Tech giants such as Amazon, Google, Microsoft, Meta, and NVIDIA are actively forming strategic alliances and pouring billions into prominent AI startups, signaling a continued investment in cutting-edge AI technologies.

While acquisitions offer potential economic benefits for all parties involved, regulatory scrutiny looms large over major tech deals. High-profile acquisitions, including Microsoft’s acquisition of Activision Blizzard and Broadcom’s purchase of VMware, are under increased regulatory scrutiny due to antitrust concerns.

In essence, the AI startup landscape is undergoing a significant transformation, marked by consolidation and recalibration of expectations. As the industry navigates these challenges, the outcome of major acquisitions will be closely watched amidst heightened regulatory oversight.