History of DeFi – From Humble Beginnings to Accessibility For Mass Adoption

Unshackling the centuries-old foundation of central banking, decentralized finance is all set to revolutionize traditional financial infrastructure.

The system is secured by blockchain technology and functions as a balance between cryptocurrency and smart contracts. Removing system buffers, Defi ensures risk-free transactions and secured asset management.

The blockchain has been consistently on the move, with increased adoption leading to $552 million already being spent by financial institutions on DeFi. However, these were just a few early transformations witnessed, with decentralized finance standing out at a horizon of permissionless opportunities. Slow but steady, it is permeating into various industries, integrating the systems with newer technological tools to streamline their processes.

In this article, we’ll give an overview of DeFi’s early progress to ground-breaking developments, pointing to how its vast scope can be applied in the near future.

What is DeFi?

Decentralized finance, or DeFi for short, shifts the powers of financial regulations from the central controlling bodies to its users. It decentralizes the system and adds greater transparency by eliminating the need for existing middlemen, such as brokerage and banks.

Simply put, it is a financial application developed on and with blockchain technology. It enables multiple parties to carry out financial transactions using digital currencies without having to rely on a larger institution. Users can borrow, sell, and invest in cryptocurrencies without any controlling parties.

The movement to blockchain technology has introduced a range of financial concepts into this space, some of which include:

● Asset Management

● Compliance and KYT

● Analytical and MSK Management

● Derivatives & Synthetic Assets

● Infrastructure Management

● Payment Solutions

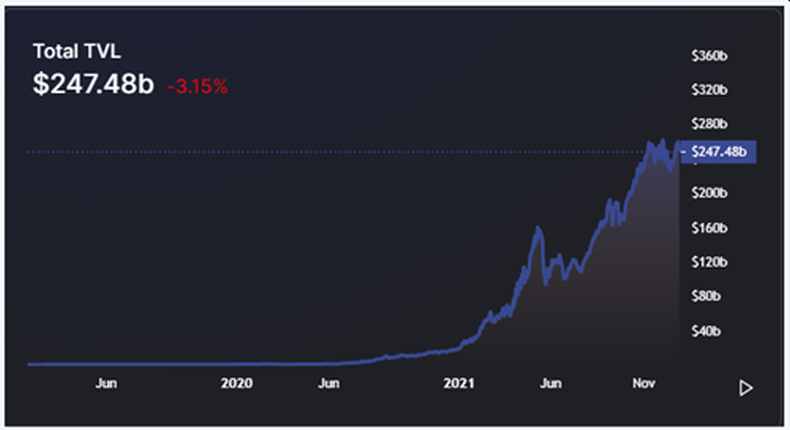

Although DeFi’s infrastructure and regulations are still under debate, its total value locked (TVL) surpassed $240 billion in 2021, attracting many venture capitalists.

Source: Difilama.com

A Deep Dive Into The Progressive Journey of DeFi

The origin of DeFi is believed to be with the beginning of Bitcoin in 2009 – this acted as the first domino that fell in order that DeFi could rise.

However, while Bitcoin is a renowned decentralized digital currency, DeFi is a financial framework that operates on digital currencies. Over the years, it went through some major developments.

Development Stage 1- Proficient Value Transfers

The first beneficial outcome of DeFi was to provide value transfer through centralized wallets and exchanges. It enables a common user to swap FIAT money against a digital currency, which can be stored in wallets. Users can safely store cryptocurrencies and transfer them directly to unknown parties.

Based on this framework, some of the renowned exchanges and wallets include Bisq, Coinbase, Cash App, and Binance. Let’s dig deep into two of these crypto-companies.

Coinbase

Coinbase is known as a pioneer crypto-asset exchange. Operating since 2012, it has gained huge popularity among crypto-investors and enthusiasts, allowing users to buy, sell and store digital assets, including Ethereum and Bitcoin.

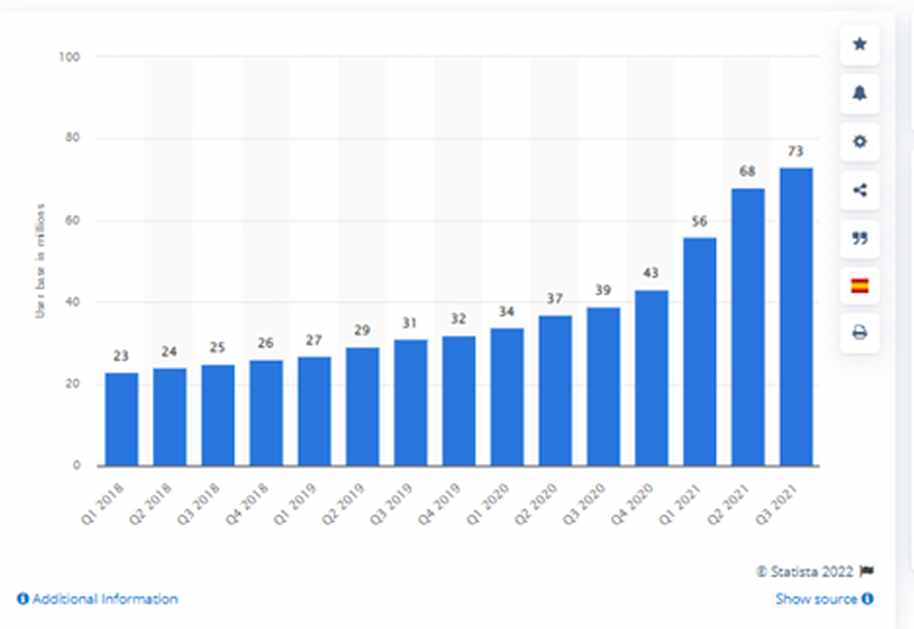

The company has secured around $540M in equity financing from renowned VCs of the industry, demonstrating the financial backing that follows this platform. Back in April 2021, Coinbase got listed in the Nasdaq, further raising its valuation to over $112B. Alongside this, its verified user-base increased three folds between 2018 to 2021, showing the mass community adoption of this DeFi platform.

Binance

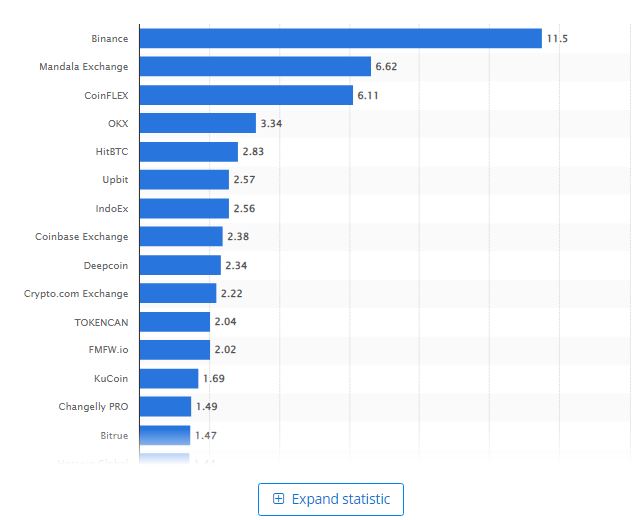

Launched back in 2019, Binance became one of the leading peer-to-peer crypto platforms for users across the world. Ranked at the top among the 100 best cryptocurrency exchanges in February 2022, it is a reliable and safe platform for crypto users.

Source: Statista

Binance attracts newbies with its simple interface and seamless functionality. It introduces beginners to the world of crypt-trading with real-time updates, reports, safer transactions, and massive trading opportunities.

Development Stage 2- Brings Savers and Borrows Closer

DeFi contributed to establishing platforms that connect borrowers and savers. Its financial system created a smooth flow of funds with its introduction of borrowing/lending protocols, decentralized exchanges, and stablecoins.

The DeFi ecosystem also then began to flourish with the advancements achieved that concerned the lending/borrowing protocols by Compound. Back in June 2020, COMP initiated the distribution of its governance tokens which gave a trajectory uplift to the entire DeFi ecosystem.

The Compound protocols enabled users to lend and borrow a specific set of digital currencies, mainly Ether (ETH), Dai (DAI), and USD Coin (USDC). This change helped DeFi to save time, effort, and the cost associated with investing through a centralized platform.

COMP Gave Rise to Safuu

Safuu, based on its unique SAP protocol, offers a decentralized financial asset that rewards its token holders with a fixed compound interest model. The DeFi 2.0 protocols now offer a safer and simplest way to maximize fixed returns from staking. Furthermore, Safuu Autostaking Protocol (SAP) based on DeFi 2.0 offers a high return of 382,945% APY from staking. It offers users the following benefits:

● Automatic Payments

● Easy and Safe Staking

● Low Risk

● Automatic Payments

● Highest Fixed APY

While Safuu took the DeFi model that Compound laid out and ran with it, not all companies have seen similar success.

The Compound Protocol Gone Wrong

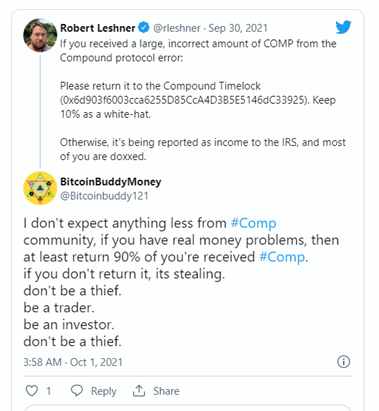

Back in October 2021, a tweet from Robert Leshner, founder of Compound Labs, stirred a buzz in the crypto world. A recent update in the compound protocol went wrong and accidentally caused a huge payout of $90.1 million to users of the platform.

As the project was still in its early stages, it was prone to errors – this payout making those that didn’t believe in DeFi slightly skeptical of its validity.

The Roadblock In DeFi’s Next Evolutionary Stage

DeFi and traditional financial institutions are both competing for the same funds. However, DeFi, being an encapsulated system, has no regulatory bodies. Without the ability for regulatory policies to be enforced, DeFi has a significant edge over centralized finance firms.

On the other hand, due to the absence of common political principles and legislation, DeFi comes with certain disadvantages. It creates confusion among investors, not ever certain if DeFi is stable enough to be a lucrative and secure investment opportunity.

What Can We Expect to See in 2022?

As the TVL quadrupled, crossing a peak of $112.07 billion in 2021, many new trends are expected to arrive in the DeFi space. The foremost of which is the traditional financial products to enter the Defi ecosystem.

Simultaneously, top DeFi startups are creating protocols to resolve issues related to DeFi adoption: compliance, security, reporting, monitoring, execution, and research.

One of these is HyperDex, a DeFi asset management platform that offers efficient and effective finance to users. The platform provides a passive strategy with the use of algos and staking to create easy and intuitive channels for users to invest in.

HyperDex is the first DeFi investment platform for digital assets. It offers an automated and decentralized business model that offers investors greater benefits than centralized platforms. A typical investor will be able to explore opportunities to invest and participate in the incubation of major projects as well.

The business operations are highly transparent, laying out exactly how they work to further boost their reliability and trust with users. Hyperdex offers different Cubes with specific investment strategies and expected income for the users. There are no hidden fees or unauthorized mechanisms associated with these cubes. Their three major investment strategies include:

● Fixed Income

● Algorithm Trading

● Race Trading

Each one of these investing cubes is right for a different type of investor. With a range of risk ratings and potential returns, someone looking to invest with HyperDex will be able to select a cube that aligns with their own investment philosophy.

As these cubes then pool users and make trades with even more leverage than a single trader, this grouped form of investment also has much more stability than a sole investor could achieve.

This mix of innovative features and refined staples of the investing space make this DeFi asset management platform a fantastic stepping stone for the progression of DeFi into major markets.

Final Thoughts

DeFi has had a turbulent history, but one that’s always continued to build and gain traction over time. While there are still pitfalls of this system, the attraction of major VC firms has ensured that the funds are available for companies willing to turn to fix these issues.

Over time, we’ve seen that DeFi has become more complicated, now offering alternatives to traditional pathways of investing with centralized firms. Only time will show how much more DeFi has to give, with future developments continuing to revolutionize this financial system.