B2B marketplace tech startup Negotiatus rebrands to Order after raising $30 million in new funding

Negotiatus, a New York-based tech startup and provider of guided B2B marketplace, announced today it has changed its name to Order after raising 30M in Series B funding. The rebranding reflects the company’s mission to optimize, simplify, and streamline the purchasing and procurement process for businesses.

The latest round was led by Stage 2 Capital via a direct investment from MIT’s Endowment, a $30B+ fund. Other round participants included Clocktower Ventures, Collaborative Fund, Seven Peaks Ventures, Ankona, and a number of strategics, including Mark Hawkins, former President & CFO Emeritus at Salesforce, who also joined as an Advisor.

Order said it will use the new capital infusion to continue accelerating their payments business in addition to advancing product development and innovation. To date, Order now oversees nearly half a billion in annualized spend across hundreds of customers like WeWork, SoulCycle, Lume, and High Level Health. Since its inception six years ago, Order has raised about $80M in funding from industry-leading investors like MIT, Stage 2 Capital, Rally Ventures, 645 Ventures, and more.

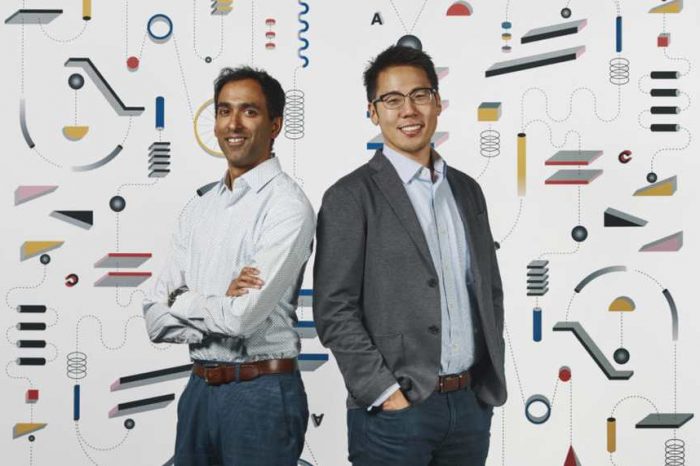

Founded in 2016 Zachary Garippa and Thomas Jaklitsch, Order makes it easy for businesses to place and track purchases across all their vendors, control spending, and make payments in a single, consolidated bill. Tailored insights and purchasing recommendations fuel smarter spending decisions so businesses can easily save time and money on what they need to grow.

“Why would anyone want to manage hundreds of vendors, sign in to different websites, and buy at inconsistent prices? If we can delight users and bring order to their purchasing workflow while saving them money, it’s a no brainer,” said Jay Po, Managing Partner and Co-Founder at Stage 2 Capital. “From our first investment 2 years ago, we’ve been so impressed by the Order team and what they’ve built. From their integrated payments and financial services to the modernization of their purchasing tools, every team that buys anything for their business needs this.”

“MITIMCo is impressed by the first principles and mission-driven approach Order has taken to solve a large and acute pain point in business purchasing,” said Seth Alexander, Chief Investment Officer at MIT Investment Management Company. “In partnership with Stage 2, MITIMCo is thrilled to be a long-term investor supporting Order’s work in streamlining business purchasing.”

Order operates in a new wave of business known as SaaS+. In addition to a base subscription fee, they also employ embedded fintech as a secondary model. The company also leverages embedded fintech to deliver tailored solutions up and down the entire buying process, beginning at the point of purchase. Order’s approach blends software and predictive applications to upstream pain points faced by finance, operations, and procurement teams when buying things for their business.

“When you’re a business, the seemingly simple act of buying a pen is unnecessarily complex – a number of workflows need to take place across a number of systems and departments. And a business is obviously buying much more than just a pen,” said Zach Garippa, Co-Founder & Chief Executive Officer at Order. “If you can intercept this process at the point of purchase, you can radically simplify buying for businesses without needing to reinvent the wheel. You can, though, make it less excruciating for them to turn.”