Alibaba launches Qwen 3.5, says new agentic AI model outperforms GPT-5.2, Claude and Gemini

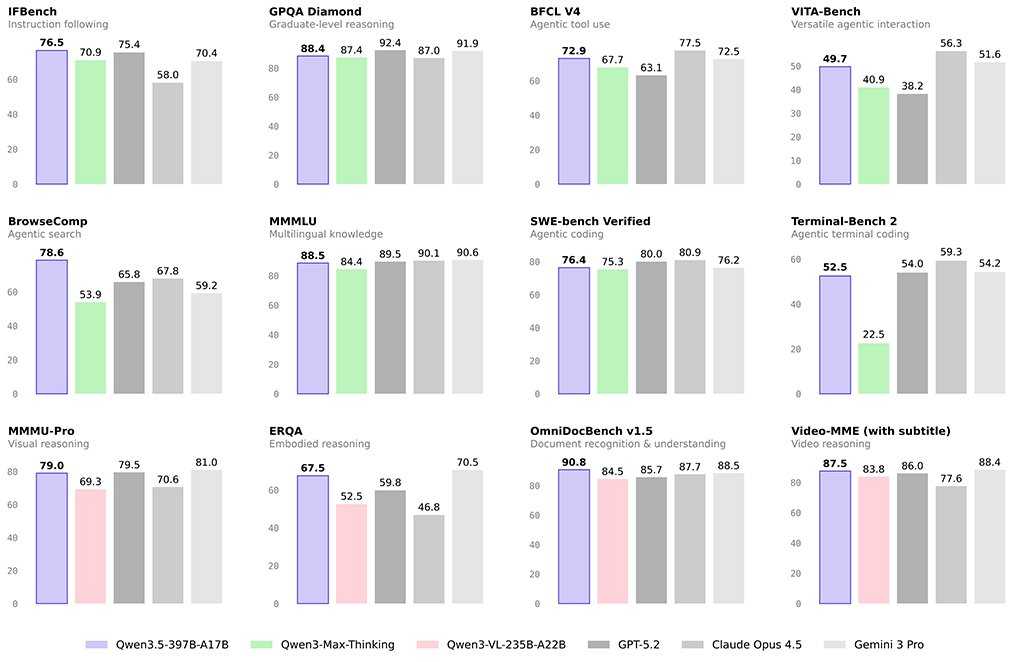

Alibaba is turning up the heat in China’s AI race. On Monday, the e-commerce giant introduced Qwen 3.5, its latest large language model built for what it calls the “agentic AI era.” The company says the new model can complete complex tasks on its own, process large workloads far more efficiently than its predecessor, and outperform leading U.S. systems such as GPT-5.2, Claude Opus 4.5, and Gemini 3 Pro on several internal benchmarks.

The timing is deliberate. Competition inside China’s AI market has intensified over the past year, with ByteDance’s Doubao emerging as the dominant chatbot platform and DeepSeek breaking out globally with a viral model release that shook tech markets. Alibaba is betting that Qwen 3.5 can help it close the gap at home and position itself as a serious global contender.

Alibaba’s Qwen 3.5 Promises Lower Costs and Higher Performance as AI War With China Heats Up

According to Alibaba, Qwen 3.5 is 60% cheaper to use than the previous version and up to eight times better at handling large workloads. Cost and efficiency are becoming central battlegrounds in AI, particularly for developers and enterprises that must manage inference expenses at scale.

Alibaba expanded on the release in a post on X, introducing what it described as the first open-weight model in the Qwen 3.5 lineup.

“Qwen3.5-397B-A17B is here: The first open-weight model in the Qwen3.5 series.

🖼️Native multimodal. Trained for real-world agents.

✨Powered by hybrid linear attention + sparse MoE and large-scale RL environment scaling.

⚡8.6x–19.0x decoding throughput vs Qwen3-Max

🌍201 languages & dialects

📜Apache2.0 licensed,” Alibaba said on X.

The company’s description signals a push beyond closed commercial models. By releasing an open-weight version under an Apache 2.0 license, Alibaba is positioning Qwen 3.5 as accessible infrastructure for developers who want transparency and flexibility. The model supports 201 languages and dialects and introduces native multimodal capabilities, allowing it to process text and images in the same workflow. Alibaba says performance gains are significant, with decoding throughput between 8.6 and 19 times faster than Qwen3-Max, powered by a hybrid linear attention architecture combined with sparse mixture-of-experts and large-scale reinforcement learning environment scaling.

The company says the model introduces what it calls “visual agentic capabilities,” meaning it can take actions across mobile and desktop apps rather than simply respond to prompts. In a statement, Alibaba described the release this way: “Built for the agentic AI era, Qwen3.5 is designed to help developers and enterprises move faster and do more with the same compute, setting a new benchmark for capability per unit of inference cost.”

That focus on agents is no accident. ByteDance rolled out Doubao 2.0 just days earlier, framing its own upgrade around the same shift toward AI systems that can act autonomously rather than function as passive chat interfaces. Doubao currently commands the largest user base in China, approaching 200 million users, Reuters reported, citing the company disclosures.

Alibaba has momentum of its own. The previous version of the Qwen app crossed 10 million downloads within one week of entering public beta on November 17, placing it among the fastest-adopted AI products to launch in China. A recent coupon campaign that allowed users to buy food and drinks directly in the chatbot drove a sevenfold increase in active users, though early adopters reported occasional glitches.

Last year, Alibaba was one of the first companies to respond to DeepSeek’s surge by releasing Qwen 2.5-Max, which it said outperformed one of DeepSeek’s popular models. This time, Alibaba’s benchmark comparisons highlighted improvements over its own earlier versions and over major U.S. rivals. DeepSeek was not mentioned in the Qwen 3.5 announcement.

Investors are watching closely. DeepSeek is expected to introduce a next-generation model in the coming days, and memories are still fresh from the global tech selloff triggered by its breakthrough release last year. Each major launch now carries broader market implications, far beyond domestic competition.

For Alibaba, Qwen 3.5 represents more than a model upgrade. It signals a strategic push to compete on efficiency, autonomy, and enterprise appeal at a moment when AI is shifting from chat interfaces to systems that act. The race is no longer just about who has the smartest model. It is about who can deliver performance at scale, at lower cost, and turn that capability into sustained user growth.