The Press Release Problem in Crypto: When Paid Visibility Replaces Journalism

Crypto has no shortage of information. What it increasingly lacks is separation.

A recent independent analysis of nearly 3,000 crypto press releases highlights a structural issue that many readers, founders, and journalists have sensed for years but rarely seen clearly: in large parts of the crypto media ecosystem, paid visibility has quietly replaced editorial judgment.

This is not about one bad actor or one irresponsible outlet. It’s about how press release distribution itself has evolved in crypto—and why that evolution matters.

When Press Releases Stop Supporting Journalism and Start Replacing It

In traditional media, press releases are inputs. They give journalists a starting point for deciding whether something is newsworthy, verifying claims, and exercising independent judgment before publishing.

Crypto-specific press release “wires” flipped that relationship.

Rather than feeding newsrooms, many of these services sell guaranteed placement across partner sites, allowing projects to publish directly to readers without editorial review. Content that would normally be filtered out as routine, promotional, or speculative now appears alongside reported articles—often with minimal labeling.

The result is a parallel distribution system that looks like news, reads like marketing, and carries none of journalism’s safeguards.

What the Research Found (High-Level)

The Press Release Problem in Crypto: When Paid Visibility Replaces Journalism

According to the analysis:

-

Most crypto press releases are not substantive news.

Fewer than 2% of releases examined involved events traditionally considered newsworthy, such as funding rounds, acquisitions, or major research breakthroughs. The majority covered routine product updates, exchange listings, token launches, or promotional milestones. -

Hype dominates the tone.

Neutral, fact-based language was the exception, not the rule. Most releases leaned heavily on exaggerated or overtly promotional framing—language that would typically be challenged or edited in a newsroom. -

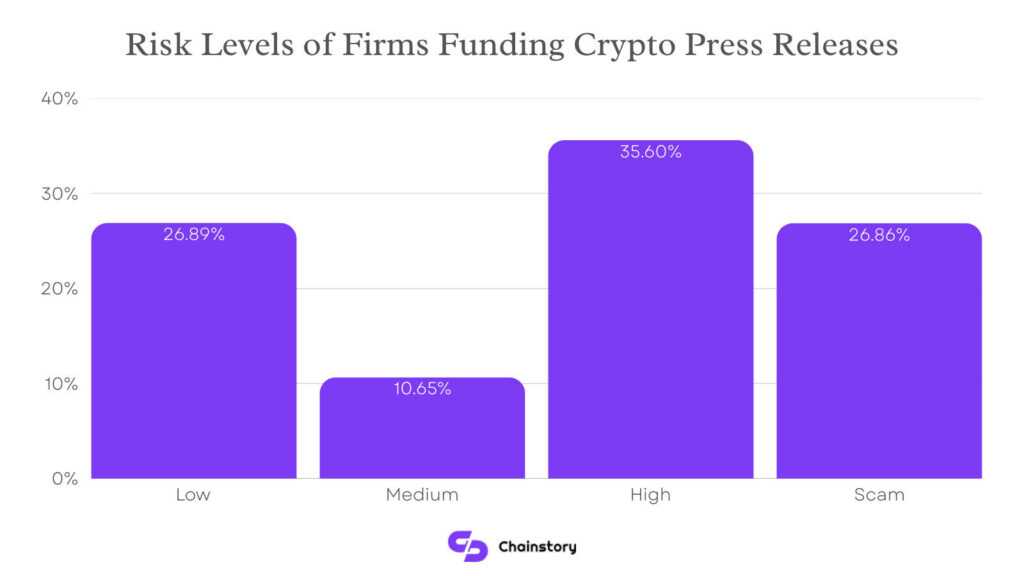

High-risk issuers are overrepresented.

A disproportionate share of releases came from projects flagged as high-risk or outright scams, while established, lower-risk companies relied far less on press release distribution.

In simple terms, the louder the press release activity, the lower the credibility often was.

Risk Levels of Firms Funding Crypto Press Releases (Credit: ChainStory)

Why Press Releases Feel Like News (Even When They Aren’t)

The effectiveness of this system doesn’t come from readership alone—it comes from association.

Press releases are frequently distributed across recognizable domains and aggregated feeds. To a casual reader, a headline on a known site looks indistinguishable from reported journalism. The presence of a “Press Release” label is easy to miss and rarely understood.

For issuers, the real prize isn’t engagement—it’s perception. Paid placements are reused as proof points: “as seen on” logos, investor decks, partner pitches. The URL becomes a proxy for legitimacy.

This dynamic blurs the line between reporting and advertising in ways that disadvantage readers, especially retail investors who may not realize how the content reached them.

The Exchange Listing and Buzzword Effect

The research also highlights patterns that help explain why crypto news feeds feel so noisy.

Exchange listing announcements, for example, account for a large share of press release volume. Most are not meaningful developments on their own, but press releases ensure every listing produces a permanent, searchable headline.

At the same time, certain sectors—cloud mining, passive-income platforms, fringe DeFi launches—lean heavily on buzzwords and trend-jacking. Terms like “AI,” “Web3,” or “next-generation” are inserted liberally, often without technical substance, because they trigger attention and, in some cases, automated trading responses.

This isn’t accidental. It mirrors long-documented tactics from penny-stock promotion: flood the information channel, create perceived momentum, and let repetition do the work.

Why This Matters for Media Credibility

Crypto media didn’t create this incentive structure alone. Many outlets operate on thin margins, and selling press release placement or sponsored content can be a survival strategy.

But there’s a cost.

When paid content that would never survive editorial scrutiny appears next to reported articles, trust erodes. Readers lose the ability to distinguish independent journalism from issuer-authored promotion. Over time, the credibility of the entire platform is diluted—even if disclaimers technically exist.

For media brands, the risk isn’t just reputational. Publishing misleading claims, even indirectly, can create legal exposure when projects collapse, and readers feel misled.

A Problem Legitimate Founders Should Care About Too

This isn’t just an investor issue. It affects founders building real companies.

When low-credibility projects flood the ecosystem with press releases, legitimate announcements get drowned out. The signal-to-noise ratio collapses. Serious teams find themselves competing for attention with marketing copy that promises everything and proves nothing.

In that environment, credibility stops being earned through execution and becomes conflated with the distribution budget.

That’s bad for markets, bad for media, and bad for builders.

The TechStartups Takeaway

Press releases are not inherently deceptive. Used responsibly, they are a valid communication tool.

The problem arises when distribution replaces verification—and when paid placement is mistaken for endorsement.

For readers, the lesson is simple:

Treat press releases as claims, not confirmation. Look for independent reporting, third-party validation, and substance beyond the headline.

For media platforms, the challenge is harder but unavoidable: deciding where revenue ends and responsibility begins.

Trust, once diluted, is hard to rebuild. And in crypto—where credibility is already fragile—that distinction matters more than ever.

This commentary cites an independent analysis of crypto press release distribution patterns and issuer risk profiles from June to November 2025. TechStartups did not conduct the underlying data collection.