Top Startup and Tech Funding News – February 11, 2025

It’s Wednesday, February 11, 2026, and we’re back with today’s top startup and tech funding news. Investors are deploying major capital into advanced robotics, industrial automation, AI infrastructure, and defense-grade software. From fusion-powered energy systems to real-time enterprise resilience, today’s funding reflects a growing appetite for foundational technologies that operate at the intersection of hardware, software, and infrastructure.

Late-stage and strategic rounds surged around AI and robotics, while early-stage deals focused on compliance, cybersecurity, and operational reliability. Inertia Enterprises raised $450 million to commercialize laser-driven fusion, and Apptronik secured $520 million to scale humanoid robots for logistics and industrial use. Meanwhile, Resolve AI and Complyance landed major Series A rounds to reshape how enterprises manage downtime and data risk in real time.

Here are the top funding highlights from February 11:

Tech Funding News

Funding Highlights

- Inertia Enterprises raised $450M Series A to develop grid-scale laser fusion power systems

- Apptronik secured $520M Series A extension to accelerate humanoid robot manufacturing

- Anthropic added $200M to expand Claude AI infrastructure at a $350B valuation

- Bedrock Robotics raised $270M Series B to automate heavy construction machinery

- Resolve AI closed $125M Series A to power autonomous incident detection in enterprise systems

- Lema AI landed $24M Series A to monitor third-party supply chain threats with AI agents

- Complyance raised $20M Series A to automate enterprise data compliance and GRC

- Integrate secured $17M Series A to support secure project collaboration in defense programs

- Winn.AI raised $18M Series A to build a real-time AI assistant for sales teams

- Algorized closed $13M Series A to deploy predictive safety systems for industrial robotics

Investor Activity

Today’s rounds attracted a mix of top-tier venture firms, institutional investors, and strategic backers betting on AI-native platforms, robotics, and critical infrastructure automation. Across early and growth stages, the signal is clear: investors are concentrating capital into companies building system-level solutions — from autonomous incident response and supply chain security to fusion energy and humanoid labor. Participation from Bessemer, GV, Lightspeed, Blackstone, and corporate arms such as Google and Salesforce Ventures underscores strong cross-sector demand for technologies that operate reliably, securely, and at scale.

Here’s the full breakdown of today’s most significant startup and tech funding announcements.

Inertia Enterprises Raises $450M Series A for Laser-Driven Fusion Power

Inertia Enterprises, a fusion energy startup, has secured a massive $450 million Series A to develop one of the world’s most powerful laser systems for grid-scale fusion power. Co-founded by Twilio CEO Jeff Lawson alongside leading fusion scientists, Inertia aims to leverage laser inertial confinement technology pioneered at Lawrence Livermore’s NIF facility to achieve reliable, net-positive fusion energy.

This huge capital injection will enable Inertia to build lasers capable of firing 10-kilojoule pulses at high frequency – a critical step toward its goal of starting construction on a commercial fusion power plant by 2030. The round’s size underscores investor confidence in fusion breakthroughs and positions Inertia among the best-funded fusion ventures globally.

-

Startup: Inertia Enterprises

-

Investors: Bessemer Venture Partners (lead), GV, Modern Capital, Threshold Ventures, others

-

Amount Raised: $450M

-

Total Raised: $450M

-

Funding Stage: Series A

-

Funding Date: Feb 11, 2026

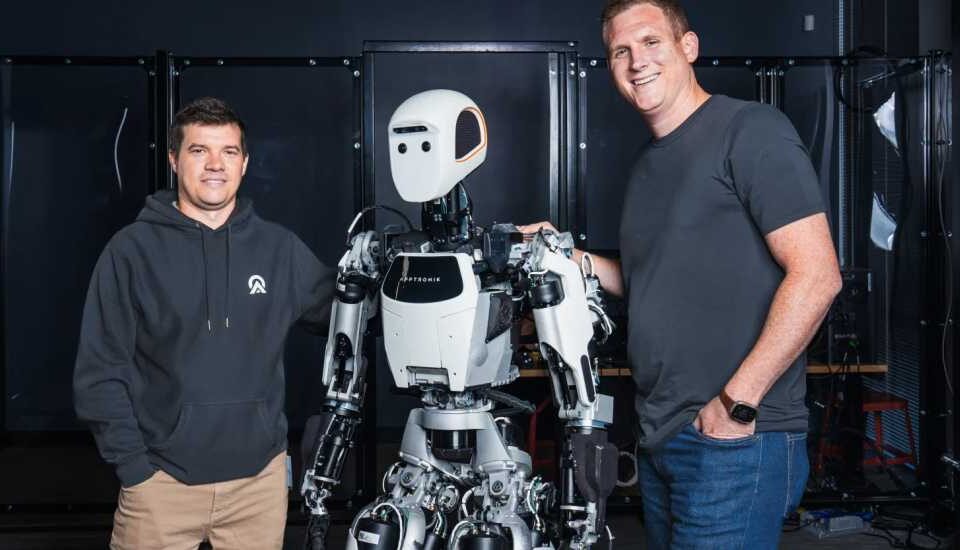

Apptronik Raises $520M Series A Extension for Humanoid Robots

Apptronik, the Austin-based maker of humanoid robots, has raised $520 million in a Series A extension round to accelerate production of its human-like robots. The new funding – which values Apptronik at over $5.5 billion, roughly tripling its valuation in one year – builds on a prior $415 million tranche and brings its total Series A financing to more than $935 million.

Apptronik’s flagship robot, “Apollo,” is designed to work safely alongside people in industries like logistics and manufacturing. With backing from strategic investors including Google and AT&T, Apptronik plans to scale up robot manufacturing, invest in training facilities, and continue pioneering human-centered robot designs. The raise underscores surging investor enthusiasm for humanoid robotics startups as advances in AI drive the field forward.

-

Startup: Apptronik

-

Investors: B Capital (lead), Google, Mercedes-Benz, AT&T Ventures, John Deere, Qatar Investment Authority

-

Amount Raised: $520M

-

Total Raised: $935M+ (Series A total)

-

Funding Stage: Series A (extension)

-

Funding Date: Feb 11, 2026

Anthropic Secures $200M in Funding at $350B Valuation for Claude AI Expansion

AI powerhouse Anthropic has received an additional $200 million investment at a staggering $350 billion valuation as part of an ongoing late-stage funding round. The latest capital comes from Blackstone, which is upping its stake in the San Francisco-based AI lab behind the Claude AI assistant. This infusion is part of a mega-round that has attracted major institutional investors amid unprecedented demand for cutting-edge AI models.

Anthropic has more than doubled its initial fundraising target due to investor interest, signaling strong confidence in its advanced AI systems. The new funding will fuel Anthropic’s efforts to scale up its AI computing infrastructure and accelerate development of next-generation AI assistants, further intensifying the race among AI labs to build ever more capable models.

-

Startup: Anthropic

-

Investors: Blackstone (additional $200M in ongoing round, joining Coatue, GIC, and others)

-

Amount Raised: $200M (latest tranche)

-

Total Raised: $10B+

-

Funding Stage: Series F (late-stage ongoing)

-

Funding Date: Feb 11, 2026

Bedrock Robotics Raises $270M Series B for Autonomous Construction Machinery

Bedrock Robotics, a construction tech startup automating heavy equipment, has raised $270 million in Series B financing to retrofit bulldozers and excavators with autonomous driving systems. The fresh funding vaults Bedrock’s valuation to $1.75 billion and brings its total funding above $350 million. Bedrock’s technology – the “Bedrock Operator” – is a hardware kit with advanced lidar, GPS, and sensors that can be installed on existing construction machines in hours, enabling them to navigate and work without human drivers.

This major round, co-led by Alphabet’s growth fund CapitalG and Valor Atreides, highlights the booming interest in “contech” automation as the building industry looks to boost productivity amid labor shortages. Bedrock plans to use the capital to scale deployments of autonomous equipment fleets on job sites and to further develop its AI-driven control software for heavy machinery.

-

Startup: Bedrock Robotics

-

Investors: CapitalG (co-lead), Valor Atreides AI Fund (co-lead), Tishman Speyer, MIT, others

-

Amount Raised: $270M

-

Total Raised: over $350M

-

Funding Stage: Series B

-

Funding Date: Feb 11, 2026

Resolve AI Raises $125M in Series A Funding for AI-Driven System Reliability

Resolve AI, an enterprise software startup, has raised $125 million in Series A funding to help companies automatically detect and fix IT system failures using intelligent software agents. The San Francisco-based company’s platform acts as an autonomous Site Reliability Engineer (SRE), monitoring complex cloud applications and infrastructure for issues, pinpointing root causes, and even executing fixes to prevent downtime.

This funding round, which values Resolve at $1 billion, was led by Lightspeed Venture Partners with participation from Greylock and others, reflecting a wave of investor interest in AI tools for IT operations. Resolve AI’s technology is already reducing outage response times at early customers like Coinbase, highlighting why this infusion of capital matters: it will allow the company to scale its “AI ops” solution to more enterprises seeking to avoid costly outages through automation. The funds will fuel product development and the expansion of Resolve’s engineering and go-to-market teams.

-

Startup: Resolve AI

-

Investors: Lightspeed Venture Partners (lead), Greylock Partners, Unusual Ventures, Artisanal Ventures

-

Amount Raised: $125M

-

Total Raised: ~$160M

-

Funding Stage: Series A

-

Funding Date: Feb 11, 2026

Lema AI Raises $24M in Series A Funding for AI-Powered Supply Chain Security

Stealthy cybersecurity startup Lema AI has raised $24 million in Series A funding to tackle third-party risk in enterprise supply chains with an “agentic” AI platform. New York-based Lema’s software continuously monitors how outside vendors and partners interact with a company’s systems, tracking data access, permission changes, and potential points of compromise to flag security risks in real time. This replaces the old approach of periodic questionnaires and checklists with an automated, always-on analysis of vendor behavior and vulnerabilities.

The round was led by Team8 with notable backing from Salesforce Ventures and F2 Capital, highlighting the market’s appetite for technologies that go beyond compliance to actively harden supply chain security. Lema plans to invest the funds in R&D and scaling its go-to-market efforts as enterprises seek stronger defenses against breaches originating from their third-party relationships.

-

Startup: Lema AI

-

Investors: Team8 (lead), F2 Venture Capital, Salesforce Ventures

-

Amount Raised: $24M

-

Total Raised: $24M

-

Funding Stage: Series A

-

Funding Date: Feb 11, 2026

Complyance Raises $20M in Series A Funding for Enterprise Data Compliance Automation

Complyance, a data governance and compliance automation startup, has closed a $20 million Series A led by GV to help large companies manage risk and privacy requirements with AI. Founded by former privacy engineer Richa Kaul, the New York-based company provides an AI-driven platform that integrates into a company’s tech stack and continuously checks incoming data against custom policies and risk thresholds.

By automating tedious governance, risk, and compliance (GRC) tasks, Complyance enables enterprises to run real-time audits and vendor risk assessments that would otherwise take weeks. The new funding will support product development and customer expansion as Fortune 500 clients embrace more proactive compliance tools. Complyance’s AI-native approach is positioned as a modern alternative to legacy GRC software, appealing to investors seeking practical applications of AI in enterprise security and data protection.

-

Startup: Complyance

-

Investors: GV (lead), Speedinvest, Everywhere Ventures, and angel backers from Anthropic and Mastercard

-

Amount Raised: $20M

-

Total Raised: $28M

-

Funding Stage: Series A

-

Funding Date: Feb 11, 2026

Integrate Raises $17M in Series A Funding for Secure Defense Project Management

Seattle-based Integrate has raised $17 million in a Series A round to expand its ultra-secure project management platform used in defense and aerospace programs. Integrate’s software is designed to manage complex, classified projects involving multiple organizations and clearance levels, providing a controlled collaboration space that meets stringent military security standards. The startup already won a $25 million contract from the U.S. Space Force last year to deploy its tool for coordinating work between government teams and space industry contractors.

The new capital, led by FPV Ventures, will help Integrate broaden its platform’s capabilities beyond defense into other sectors such as energy, automotive, and maritime, where security and project complexity are paramount. With former military and space industry professionals at the helm, Integrate is poised to address the growing demand for commercial off-the-shelf solutions in government tech. The Series A brings Integrate’s total funding to $22 million and adds veteran investor Wesley Chan to its board.

-

Startup: Integrate

-

Investors: FPV Ventures (lead), Fuse VC, Rsquared VC, with returning backers New Vista, Hyperplane, Riot Ventures

-

Amount Raised: $17M

-

Total Raised: $22M

-

Funding Stage: Series A

-

Funding Date: Feb 11, 2026

Winn.AI Raises $18M in Series A Funding for Real-Time AI Sales Assistant

Tel Aviv-based Winn.AI has raised $18 million in Series A financing to scale its real-time AI sales assistant platform. Winn.AI’s software acts as a live co-pilot on sales calls: it listens to conversations and provides on-screen prompts and guidance to sales representatives in real time, helping them ask the right questions and remember key details. This proactive approach differentiates Winn from many sales intelligence tools that only analyze call recordings after the fact.

The Series A was co-led by Insight Partners and S Capital, with participation from Mangusta Capital and other VCs, bringing Winn’s total funding to $35 million since its 2022 founding. With the new funding, Winn.AI plans to grow its U.S. presence and continue investing in R&D. The startup has already tripled its recurring revenue last year and counts companies like Deel and Kaseya among its dozens of customers. Investors are betting that AI “co-pilots” like Winn will transform how sales teams operate, improving productivity and consistency across an organization.

-

Startup: Winn.AI

-

Investors: Insight Partners (co-lead), S Capital (co-lead), Mangusta Capital, Moneta VC, HighSage Ventures, Alumni Ventures, Sarona Ventures, OurCrowd

-

Amount Raised: $18M

-

Total Raised: $35M

-

Funding Stage: Series A

-

Funding Date: Feb 11, 2026

Algorized Secures $13M in Series A Funding for Edge-Based Industrial AI Safety

Swiss-American startup Algorized has secured $13 million in Series A funding to advance its “Physical AI” platform, which gives robots a nervous system for safety and awareness. Algorized is pioneering an edge-native Predictive Safety Engine that uses signals from wireless sensors (like ultra-wideband radio and Wi-Fi) to detect human presence and predict human intent in real time on factory floors. The technology allows industrial robots and machines to operate at full speed around people without the frequent emergency stops required by traditional safety systems.

By analyzing micro-movements and vital signs via ambient sensors (rather than cameras alone), Algorized’s system can “see” through obstacles like walls or dust to prevent accidents with very low latency. The Series A round was led by Run Ventures with participation from Amazon’s Industrial Innovation Fund and Acrobator Ventures. After a debut at CES 2026 and initial deployments with partners like KUKA, Algorized will use the funding to expand installations in Europe and the U.S., further develop its intent-prediction AI models, and grow its engineering teams in Switzerland and Silicon Valley. The goal is to set a new safety standard for factories and warehouses, unlocking greater productivity by enabling truly human-aware robots.

-

Startup: Algorized

-

Investors: Run Ventures (lead), Amazon Industrial Innovation Fund, Acrobator Ventures, others

-

Amount Raised: $13M

-

Total Raised: $15M+ (incl. prior seed funding)

-

Funding Stage: Series A

-

Funding Date: Feb 11, 2026

Tech Funding Summary Table

| Startup | Investors (Lead and notable investors) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| Inertia Enterprises | Bessemer Venture Partners (lead); GV; others | $450M | $450M | Series A | Feb 11, 2026 |

| Apptronik | B Capital (lead); Google; Mercedes-Benz; AT&T | $520M | $935M | Series A (extension) | Feb 11, 2026 |

| Anthropic | Blackstone; Coatue; GIC; others | $200M | $10B+ | Series F (ongoing) | Feb 11, 2026 |

| Bedrock Robotics | CapitalG (co-lead); Valor Atreides (co-lead); others | $270M | $350M+ | Series B | Feb 11, 2026 |

| Resolve AI | Lightspeed (lead); Greylock; Unusual; Artisanal | $125M | ~$160M | Series A | Feb 11, 2026 |

| Lema AI | Team8 (lead); Salesforce Ventures; F2 Capital | $24M | $24M | Series A | Feb 11, 2026 |

| Complyance | GV (lead); Speedinvest; others | $20M | $28M | Series A | Feb 11, 2026 |

| Integrate | FPV Ventures (lead); Fuse VC; others | $17M | $22M | Series A | Feb 11, 2026 |

| Winn.AI | Insight Partners (co-lead); S Capital (co-lead); others | $18M | $35M | Series A | Feb 11, 2026 |

| Algorized | Run Ventures (lead); Amazon Industrial Innovation Fund; others | $13M | $15M+ | Series A | Feb 11, 2026 |