Top Tech News Today, February 11, 2026

It’s Wednesday, February 11, 2026, and today’s global tech headlines reveal how quickly the AI era is reshaping infrastructure, markets, and power dynamics across the industry. From Microsoft experimenting with new power technologies for AI data centers to governments treating chips and models as strategic assets, the race to scale intelligence is colliding with energy limits, regulation, and investor scrutiny.

At the same time, startups are securing large rounds to push the frontier in AI video, robotics, and agent infrastructure, while cybersecurity incidents and policy shifts expose new risks for platforms and public services. Here are the 15 tech stories defining the moment.

Here are the 15 global technology news stories shaping the next phase of the digital economy today.

Technology News Today

Trump’s chip-tariff carve-out could shield Big Tech’s AI supply chain as Taiwan talks intensify

The Trump administration is preparing to spare Amazon, Google, and Microsoft from the next wave of semiconductor tariffs, according to the Financial Times, in a move tied to a broader trade framework involving Taiwan and investment commitments linked to chip supply. The practical effect is a potential “fast lane” for the companies most exposed to AI infrastructure buildouts, at a moment when chips, servers, and power are the limiting inputs for model training and deployment.

For the startup ecosystem, this is less about politics and more about cost structure and capacity. Any tariff delta flows downstream into cloud pricing, GPU availability, and enterprise AI budgets. If the largest cloud platforms get a relative advantage, it can compress margins for smaller infrastructure players and raise the bar for independent AI compute providers. It also underscores how quickly AI has become a national industrial policy priority: the “AI stack” is now treated as strategic infrastructure, not just a tech sector.

Why It Matters: Tariff policy is becoming a quiet lever that can reshape AI compute costs and who can scale.

Source: Financial Times.

Microsoft tests superconducting power lines to unlock tighter, denser AI data centers

Microsoft says it is exploring high-temperature superconducting power cables for data centers, aiming to deliver the same amount of electricity with a dramatically smaller physical footprint. The experiment is a direct response to a bottleneck facing the entire AI industry: data centers are being built faster than grids can be upgraded, and local communities are increasingly pushing back against massive substations and transmission buildouts.

If superconducting lines prove deployable at scale, the benefit isn’t just efficiency. It’s time-to-power. AI infrastructure projects routinely stall due to permitting delays, interconnect queues, and constrained local capacity. Any technology that increases “power density” without expanding hardware footprint can accelerate deployments and reduce friction with municipalities. For startups, the ripple effects touch everything from advanced materials and cryogenics to power management software and grid-optimization services.

Why It Matters: The AI race is increasingly a power-and-grid race, and Microsoft is hunting for physical-world shortcuts.

Source: Reuters.

Cisco launches an AI networking chip to challenge Nvidia and Broadcom in data-center plumbing

Cisco unveiled a new AI networking chip designed to speed data movement inside large AI clusters, positioning it against entrenched players like Nvidia and Broadcom. As model training scales, performance depends not just on GPUs but also on how quickly data can move across tens of thousands of connections without bottlenecks or failures.

This matters because networking is becoming a first-class AI constraint. When inference and training workloads run across massive clusters, latency spikes and packet loss can translate into real compute waste. Cisco’s pitch is improved end-to-end efficiency, including automated routing around network problems in microseconds. For the broader market, it signals a continuing shift: AI infrastructure is pulling legacy enterprise vendors into a new arms race, while also creating room for startups building optical interconnects, fabric management software, and observability for AI clusters.

Why It Matters: AI performance is now a networking problem as much as a GPU problem, and incumbents are retooling fast.

Source: Reuters.

China’s top chipmaker warns AI capacity could sit idle as the buildout outruns real demand

Bloomberg reports that China’s leading chip manufacturer is warning about rushed AI infrastructure investment that could end up underutilized. After years of “build at any cost” momentum in AI, this is a rare public signal that the market may be entering a phase where execution quality and demand forecasting matter more than raw capex volume.

For startups and investors, the takeaway is not that AI is slowing down, but that the easy-money phase can flip. If parts of the ecosystem overbuild—especially data centers or model-training capacity—pricing pressure follows, squeezing smaller operators and pushing consolidation. It also raises the premium on “differentiated workloads”: enterprise contracts, sovereign compute needs, and specialized inference pipelines that can keep utilization high even if generic capacity floods the market.

Why It Matters: The AI infrastructure boom is starting to face the question every cycle eventually asks: how much of this capacity will actually be used?

Source: Bloomberg.

Nebius to buy Tavily for $275M as “AI agent search” becomes a strategic layer

Bloomberg reports that cloud provider Nebius has agreed to acquire Tavily, a company focused on helping AI agents fetch up-to-date information for tasks such as coding and finance. The deal highlights a trend that’s easy to miss: as AI agents proliferate, the “tooling layer” around retrieval, verification, and live data access becomes a competitive moat, not a side feature.

In practice, agentic systems fail most often at the edges: stale data, brittle browsing, and weak source grounding. A purpose-built retrieval stack can lift reliability, reduce hallucinations, and improve task completion rates—especially in regulated or high-stakes domains. For startups, this validates a growing category: agent infrastructure (secure connectors, retrieval pipelines, audit logs, permissions, and evaluation). For incumbents, it’s a reminder that the AI platform war isn’t only about base models; it’s also about who owns the agent runtime and its trusted data rails.

Why It Matters: AI agents are only as good as their live data access, and that capability is now valuable enough to buy.

Source: TechStartups via Bloomberg.

AI jitters spread from Big Tech into finance as markets price disruption risk into software and services

The Wall Street Journal reports that AI-driven market anxiety broadened beyond tech into financial services, dragging down segments like wealth management as investors reassess who wins and loses in an AI-heavy economy. The underlying concern: automation doesn’t stop at code and customer support; it moves into advisory workflows, compliance, onboarding, and the “white-collar middle.”

For founders, this kind of market move signals where buyers may hesitate and where they may accelerate. If executives believe AI can compress operating costs, they may delay new software purchases and demand clearer ROI—especially from incumbents selling broad suites. At the same time, it can create openings for startups with sharper positioning: tools that reduce cost per case, shorten cycle times, or harden risk controls in finance. In other words, fear can freeze spending, but it also forces budget reallocation toward solutions that directly protect margins or reduce headcount load.

Why It Matters: AI’s perceived threat is reshaping investor expectations—and that filters directly into enterprise software buying behavior.

Source: The Wall Street Journal.

Super Bowl ads spotlight the new AI marketing race as giants and startups fight for mindshare

The Wall Street Journal’s print edition notes that this year’s Super Bowl featured a notable wave of AI-focused advertising, with major tech brands and lesser-known startups using the biggest media stage to position themselves as the next default tool for consumers and businesses. Even in a crowded AI market, brand trust still matters, and mass-market events are being used to normalize AI as a mainstream utility rather than a novelty.

For the ecosystem, the strategic point is that distribution is becoming more expensive and more important. As AI tools converge in core capabilities, companies are competing on packaging, safety messaging, and integration narratives. The Super Bowl is an extreme example, but it reflects a broader shift: AI isn’t only an engineering competition; it’s a perception and channel competition. Startups that can’t afford premium awareness plays may lean harder into partnerships, embedded distribution, and vertical specificity—while incumbents use brand reach to blunt switching.

Why It Matters: AI products are entering the mass-market branding era, where attention can be as decisive as model quality.

Source: The Wall Street Journal.

Tech workers push back as companies stay quiet on ICE ties and government contracts

The Verge reports growing frustration among tech employees over corporate silence regarding ICE-related issues and the expansion of government contracts under the current administration. Workers describe internal pressure to avoid public stances and “focus on the mission,” a shift from earlier cycles when employee activism had more visible impact at major firms.

This matters for the broader tech ecosystem because it intersects with hiring, retention, and culture risk at exactly the moment companies are competing intensely for AI talent. Government-facing revenue can be large and durable, but it also raises questions about internal legitimacy—especially when contracts involve enforcement, surveillance-related workflows, or sensitive data operations. For startups, the lesson is practical: enterprise and government sales can scale quickly, but founders need clear governance, transparent comms, and defensible red lines, or cultural debt builds quietly until it detonates in public.

Why It Matters: As tech leans into government work, internal legitimacy becomes a real operational risk, not just a PR issue.

Source: The Verge.

AI video Startup Runway raises $315M at $5.3B valuation as “world models” heat up

Runway raised a $315 million round at a $5.3 billion valuation, underscoring how fast capital is moving toward next-generation generative video and the broader push toward more capable simulation-style models. Video sits at the intersection of compute intensity, copyright friction, and product usefulness, making it a high-stakes arena for both breakthroughs and backlash.

For startups, the financing signals that investors still believe there’s room for large independent platforms in creative AI—especially those that can ship reliable tools, secure distribution into professional workflows, and navigate legal constraints. For Big Tech, it’s another reminder that model competition is not only about text. Video generation drives GPU demand, raises new safety concerns (including deepfakes and synthetic propaganda), and prompts regulators to act. The “world model” framing also matters: it implies ambitions beyond content creation toward systems that can simulate environments and actions, which have downstream implications for robotics, gaming, advertising, and training data generation.

Why It Matters: Mega-rounds in AI video show the market is betting on models that simulate reality rather than just generate media.

Source: TechStartups.

Chile launches Latam-GPT, an open-source AI model built around Latin American language and culture

The Associated Press reports that Chile launched Latam-GPT, described as the first open-source language model trained with an explicit focus on Latin American cultures and Spanish-language contexts. The push reflects a growing global realization: AI systems trained primarily on US- and Europe-centric datasets can miss local nuance, policy context, and even basic linguistic variation.

For the region, open-source matters because it enables local research, transparency, and adaptation without depending entirely on US or Chinese platforms. For startups, it can lower barriers to building region-specific applications in education, legal workflows, public services, and local commerce—especially where English-first products struggle. It also ties into sovereignty: governments increasingly want models that reflect local values and reduce dependency on foreign infrastructure. The longer-term signal is that AI is fragmenting into “global foundation + local specialization,” and Latin America is trying to control the specialization layer rather than importing it.

Why It Matters: Local-language models are becoming critical infrastructure for regions that don’t want to outsource cultural context to foreign AI stacks.

Source: Associated Press.

Discord faces backlash after breach exposure fuels stricter age checks and ID verification demands

Ars Technica reports Discord is facing criticism over new age-verification pressure following a data breach that exposed tens of thousands of IDs, with users questioning whether tighter verification creates new privacy and security risks. The core tension is familiar across platforms: protecting minors and limiting harmful content often leads companies to collect more sensitive data, which becomes dangerous when breaches occur.

For the consumer internet, this is a case study in how trust collapses. A platform may frame verification as a matter of safety, but users experience it as surveillance unless the security model is airtight and the data minimization story is credible. For startups building identity, safety, or trust-and-safety tooling, the opportunity is clear—but so is the liability. Solutions that reduce data retention (privacy-preserving verification, on-device checks, third-party attestations) become more attractive as centralized ID databases continue to be compromised. Regulators are also watching: age gating is moving from a niche debate to a mainstream policy requirement in multiple jurisdictions.

Why It Matters: Platforms can’t “verify their way to safety” if the verification data becomes the next breach.

Source: Ars Technica.

Ransomware hits a municipal utility payment vendor, disrupting online billing systems in Texas

KERA News reports a ransomware attack on BridgePay Network Solutions, a third-party contractor used for online utility bill payments, disrupted services for Denton Municipal Utilities. Even when card data isn’t confirmed to have been compromised, outages alone impose real-world costs: payment friction, customer support overload, and loss of trust in public services.

The broader takeaway is supply-chain exposure. Governments and public utilities increasingly rely on specialized vendors for billing, identity, and payments, and those vendors become high-leverage targets. For cybersecurity startups, this reinforces demand for vendor risk monitoring, incident response readiness, and segmentation strategies that limit the blast radius when contractors are compromised. For policymakers, it adds weight to debates about minimum security standards for contractors handling critical public infrastructure, including requirements for logging, backups, and breach-reporting timelines.

Why It Matters: Ransomware is increasingly attacking the “outsourced plumbing” of public services—and the public feels the impact immediately.

Source: KERA News.

AI rivals team up on a European startup accelerator as the ecosystem war shifts to developers

Wired reports that major AI players—including Meta, Microsoft, Google, Anthropic, OpenAI, and Mistral—are collaborating on a European accelerator program based at Station F. The goal is straightforward: help startups build on their models and tooling, while ensuring the next wave of applications grows inside their ecosystems, not a competitor’s.

This is a strategic signal about where the platform battle is heading. As model performance differences narrow, the real moat becomes developer loyalty: credits, integrations, distribution help, and the “default stack” that startups choose early. For Europe, it’s also about competitiveness—an attempt to keep talented founders from relocating and to accelerate commercialization. Notably, the program reportedly offers significant compute credits and partnerships, even if it doesn’t directly invest cash. That structure reflects a belief that access and acceleration can be more valuable than small checks in the earliest phase of AI app building.

Why It Matters: The AI platform war is becoming an ecosystem war, and accelerators are now strategic distribution weapons.

Source: Wired.

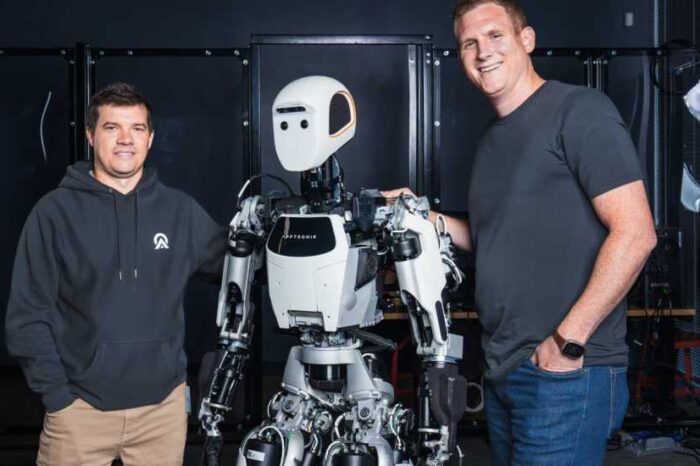

Robotics Startup Allonic raises €6M to industrialize “robot body” manufacturing

Budapest-based robotics startup Allonic raised €6 million to scale its manufacturing platform for producing complex robotic bodies more efficiently. Hardware remains the hard part of robotics—supply chains, repeatability, and cost curves—and investors are increasingly looking for “picks-and-shovels” approaches that make physical AI scalable.

The deeper story is that robotics is shifting from prototype spectacle to production math. If Allonic’s approach reduces unit cost or time-to-build for dexterous systems, it becomes an enabling layer for a broader robotics boom—especially as AI models improve at perception and planning, while hardware remains the bottleneck. For startups in the space, this validates a trend: not every winner will be the robot brand. Some winners will be the factories, tooling, components, and processes that make robots manufacturable at scale, much as contract manufacturing did for consumer electronics.

Why It Matters: Physical AI needs manufacturable bodies, and investors are backing the infrastructure that makes robotics scalable.

Source: EU-Startups.

Japan selects Astroscale for electric refueling tech to support future satellite servicing in GEO

SpaceDaily reports Astroscale Japan has been selected under a JAXA-related program to develop electric propellant refueling technology for future geostationary-orbit servicing missions. In plain terms: space is moving toward logistics—repair, refuel, reposition—rather than one-and-done satellites.

For the space economy, on-orbit servicing can extend satellite lifetimes, reduce replacement costs, and enable more flexible mission planning. For startups, it’s a sign that defense, communications, and earth-observation customers increasingly want “space infrastructure” capabilities, not just spacecraft. The technical challenge is significant: docking, propulsion interfaces, fuel transfer, and reliability under extreme constraints. But the upside is a recurring-revenue service model in an industry historically dominated by large, infrequent procurement cycles. As more assets accumulate in orbit, logistics becomes inevitable—and early movers can define standards that others will have to follow.

Why It Matters: Space is evolving into an operational economy, and orbital servicing is the logistics layer that makes it sustainable.

Source: SpaceDaily.

That’s your quick tech briefing for today. Follow @TheTechStartups on X for more real-time updates.