MrBeast expands into Fintech as Beast Industries acquires Gen-Z banking app Step Mobile

MrBeast is pushing his empire into an unexpected place: Fintech and banking.

Beast Industries is entering fintech for the first time. Jimmy “MrBeast” Donaldson’s company has agreed to acquire Step Mobile, a banking app focused on teens and young adults, with an announcement expected Monday. The deal extends Beast Industries’ ambitions beyond media and consumer products into financial services.

The acquisition broadens Donaldson’s reach far beyond YouTube, where his videos draw billions of monthly views. It also signals a shift in how creator-led companies are thinking about long-term growth. Media alone is no longer the endgame. Infrastructure matters.

“Beast Industries, the entertainment conglomerate founded by Jimmy ‘MrBeast’ Donaldson, has agreed to buy Step Mobile, a teen-focused banking app, the companies plan to announce Monday. The acquisition will expand the YouTube star’s reach beyond media, restaurants and packaged food into financial services,” The Information reported.

Beast Industries describes the acquisition as a turning point. In a press release, CEO Jeff Housenbold called it a “significant milestone,” linking Step’s technology with the company’s massive audience and social mission. “Financial health is fundamental to overall wellbeing, yet too many people lack access to the tools and knowledge they need to build financial security,” Housenbold said. “This acquisition positions us to meet our audiences where they are, with practical, technology-driven solutions that can transform their financial futures for the better.”

From YouTube to Banking: MrBeast’s Beast Industries Acquires Step Mobile

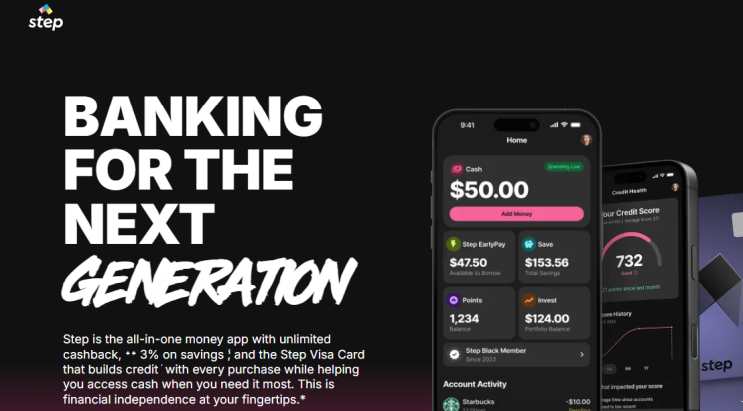

Step was founded by CJ MacDonald and Alexey Kalinichenko as an all-in-one money app for younger users. It offers fee-free banking, a secured Visa card that helps users build credit, high-yield savings, cashback rewards, and financial education tools. The company reports more than seven million users. Its investor roster includes Stephen Curry, Charli D’Amelio, Justin Timberlake, Will Smith, and The Chainsmokers.

Donaldson has framed the deal in personal terms. On X, he wrote, “Nobody taught me about investing, building credit, or managing money when I was growing up. That’s exactly why we’re joining forces with Step! I want to give millions of young people the financial foundation I never had.”

MacDonald echoed that message in the announcement. “Our goal has always been to improve the financial future of the next generation,” he said. “There are a lot of synergies between Step and what Jimmy, Jeff, and the team at Beast Industries believe in when it comes to helping people and giving back. We’re excited about how this acquisition is going to amplify our platform and bring more groundbreaking products to Step customers.”

The timing fits Beast Industries’ broader push into tech and finance. The company, valued at $5.2 billion, has steadily widened its scope over the past two years. It recently disclosed a $200 million investment from BitMine Immersion Technologies tied to DeFi ambitions. Plans for Beast Mobile, a wireless service, remain in development. Executives have also hinted at a larger financial platform that could blend banking, crypto, and advisory tools.

Philanthropy remains a central theme. Beast Industries has poured resources into initiatives like #TeamTrees, #TeamSeas, and Beast Philanthropy, which have delivered more than 20 million free meals. Step’s focus on financial literacy fits neatly into that narrative. The app operates through Evolve Bank & Trust and offers FDIC insurance up to $1 million, a key trust signal for parents and younger users alike.

Reaction online has been positive. Fans see potential for financial education that feels approachable. Skeptics have raised questions about the use of data and the risks of creator-led finance. Those debates are likely to intensify as entertainment brands move deeper into essential services.

What’s clear is that this deal places MrBeast at a growing intersection of influence and infrastructure. Attention can open doors. Ownership decides what happens next.