Anthropic’s Claude plugins spark $285 billion software stock selloff as AI targets entire SaaS workflows

A quiet release from Anthropic set off one of the most violent software selloffs in years, erasing roughly $285 billion in market value across software, legal tech, financial services, and asset management. The trigger was not a new model. It was not a flashy demo. It was a set of plugins.

The market did not wait for earnings. It did not wait for adoption data. It did not even wait for U.S. trading hours to begin.

It sold first.

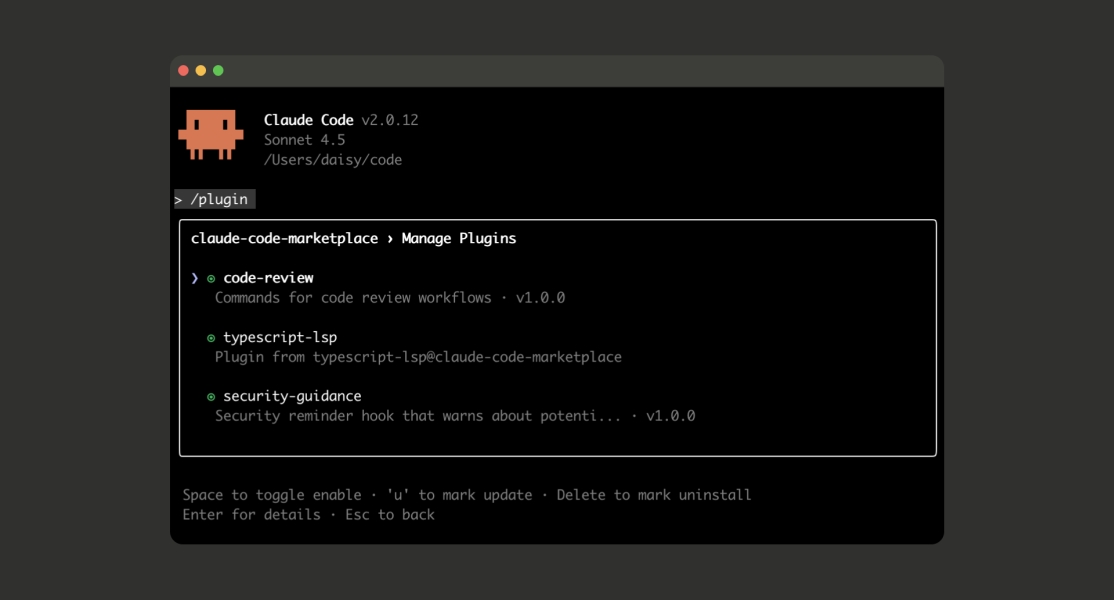

On January 30, Anthropic released a collection of open-source Claude plugins to GitHub. Simple files written in Markdown and JSON. No launch event. No marketing blitz. The plugins let Claude handle real work: contract review, compliance checks, sales preparation, legal intake, and internal research. Tasks that sit at the center of high-margin SaaS products.

By February 3, investors had connected the dots.

Legal and data firms took the first hit. Thomson Reuters shares dropped 16 percent. RELX fell 14 percent, marking its worst trading day since 1988. Wolters Kluwer slid 13 percent. LegalZoom lost about 20 percent of its value. In Europe, the damage spread across data providers and exchanges. In Asia, Indian IT services giants felt the shock, with Infosys down more than 7 percent and Tata Consultancy Services down nearly 6 percent.

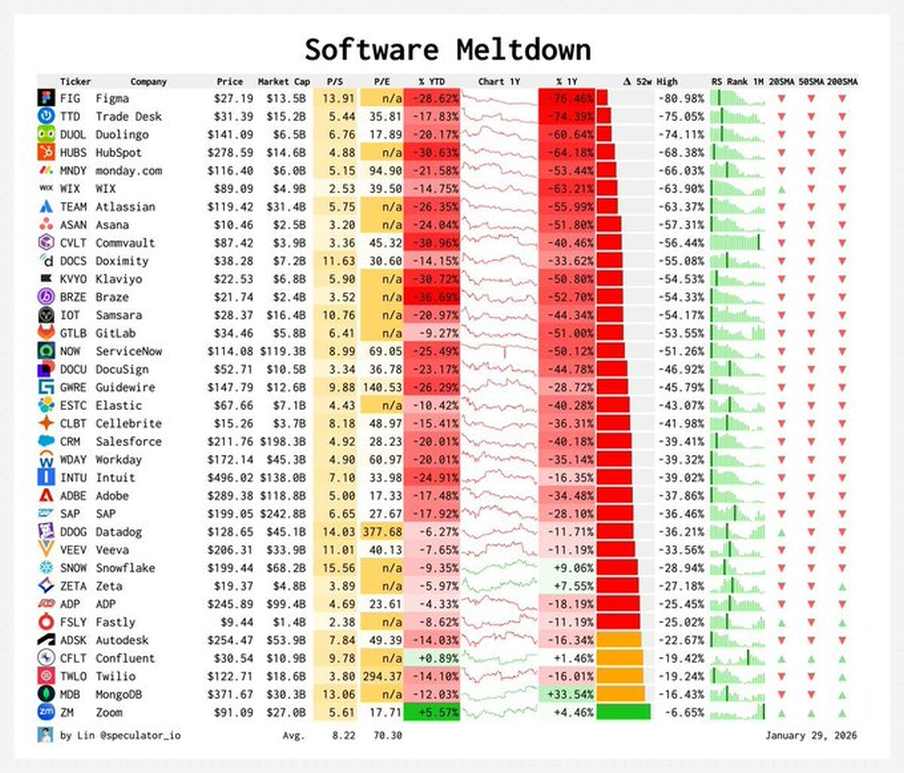

The selloff moved fast and wide. A Goldman Sachs basket of U.S. software stocks sank 6 percent in a single session. Financial services names followed, dragging the sector down almost 7 percent at its worst point. The Nasdaq 100 briefly dropped 2.4 percent before paring losses.

$285 Billion Wiped Out After Anthropic’s Claude Plugins Trigger Wall Street’s ‘SaaSpocalypse’

Bloomberg summed up the market reaction succinctly:

“A new AI automation tool from Anthropic PBC sparked a $285 billion rout in stocks across the software, financial services, and asset management sectors on Tuesday as investors raced to dump shares with even the slightest exposure.”

What spooked the market was not raw intelligence. It was placement.

Anthropic did something foundation model companies usually avoid. It moved up the stack. Instead of selling access through APIs and letting startups build products on top of it, it shipped workflows directly inside Claude. The plugins act as replacements for narrow software categories rather than helpers for them. Contract review systems. Sales enablement platforms. Compliance dashboards. Internal research tools. All handled inside a single interface.

This shift landed at a sensitive moment. Software valuations already sit under pressure. Growth has slowed. Pricing power looks thinner. Buyers question renewals. When a foundation model provider starts offering workflow-level tools at consumer pricing, investors start doing the math.

Traders quickly gave the moment a name. “SaaSpocalypse.”

Anthropic’s Claude Plugins

The concern was simple. Why pay tens of thousands per year for software licenses when a general AI system can handle similar tasks for a fraction of the cost? Why sign multi-year contracts when a model vendor owns the interface and the workflow?

Anthropic positioned the legal plugin as an assistant rather than a substitute. The company stressed that outputs require review by licensed attorneys. That message did little to calm markets. Efficiency still cuts into revenue. Even partial automation compresses margins in industries built on billable time and seat-based pricing.

The release builds on Claude Cowork, Anthropic’s agentic system introduced earlier this year. Cowork handles multi-step tasks across documents, tools, and internal data. The new plugins extend that system into specific domains. Firms can customize them, modify prompts, and slot them into internal processes. The open-source approach lowers friction and speeds experimentation.

That combination raised alarms across the legal tech ecosystem.

Startups like Harvey AI and Legora have raised capital at multi-billion-dollar valuations to build AI-first legal tools. Their products sit on top of large models. Anthropic now offers similar capabilities at the platform level, tightly integrated with its own system. That structural advantage matters.

Bob Ambrogi, writing in LawNext, framed the moment clearly:

“For the first time, a foundation-model company is packaging a legal workflow product directly into its platform, rather than merely supplying an API to legal-tech vendors.”

Markets treated that sentence as a warning.

The damage did not stop with legal software. Asset managers and private equity firms with exposure to software and IT services sold aggressively. Blue Owl Capital dropped double digits. Ares, Apollo, KKR, TPG, and Blackstone all fell sharply during the session. In Australia, Xero suffered its worst day since 2013.

Reuters pointed to a broader fear taking shape. Automation no longer threatens tasks at the edges. It targets core revenue drivers in IT services, data analytics, and compliance-heavy sectors. Earnings season offered little comfort. Fewer software companies beat revenue expectations compared to the broader tech sector.

Some analysts urged restraint. The plugins remain in early release. Adoption remains unproven. Enterprise data access stays limited. Nvidia CEO Jensen Huang dismissed the idea of AI fully replacing enterprise software as illogical in the near term.

Markets did not wait for those caveats.

This episode fits a pattern. Each time AI steps closer to owning workflows rather than assisting them, valuation models break. Alphabet’s Project Genie rattled gaming stocks. Automation tools have pressured coding services. Anthropic’s move landed closer to the revenue core of the white-collar software market.

The message investors heard was blunt. In an AI-first market, distribution and ownership of workflows matter more than feature depth. Foundation model companies no longer sit quietly beneath the application layer. Some plan to own it.

The panic may fade. Prices may recover. Products may stall.

The signal remains.

Software companies built on “we automate X” now face a competitor that charges consumer pricing, ships faster, and controls the interface. The market just priced that risk in real time.