How to Build and Scale a Global Instant Lending Service from Emerging Markets

By Aleksei Vert

Director in the FinTech Industry

Abstract

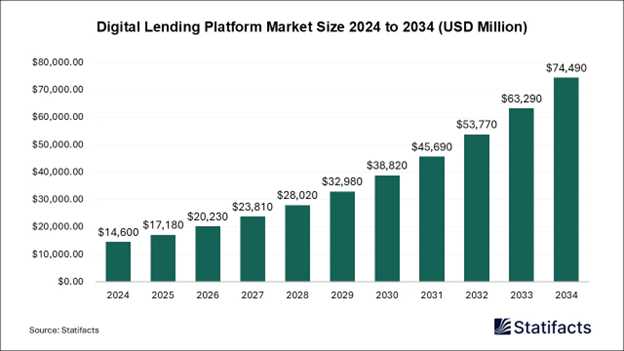

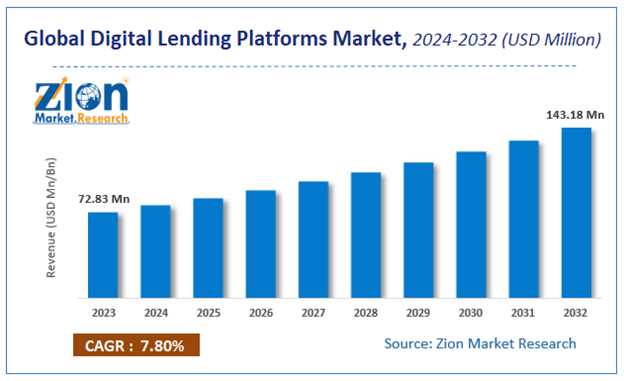

Digital lending has become one of the fastest-growing segments of fintech. According to a recent report by Zion Market Research, the global digital lending platform market is projected to reach approximately $143 billion by 2032, reflecting steady growth over the next decade. According to Spherical Insights, the digital lending market could exceed $68.5 billion by 2033, with double-digit growth.

Such rapid growth is especially noticeable in emerging economies, where banking infrastructure has historically been underdeveloped, while smartphone and digital payment penetration is growing explosively.

This article describes a practical approach to building and scaling an instant lending service: from launching an online microloan platform in Russia to entering the markets of Mexico, Nigeria, India, and Vietnam. It covers key elements of product architecture, approaches to scoring and risk management, and marketing and growth strategies in conditions of intense competition and strict regulation. It shows how a company can grow to over $100 million in revenue and several million active users per month while remaining attractive to investors.

Keywords

fintech startup; digital lending; instant lending; scaling; emerging markets; scoring; unit economics; fundraising

Introduction

In recent years, digital lending has become an arena of intense competition between banks, fintech startups, and “neobanks.” According to industry research, the global digital lending market could reach approximately $68.5 billion by 2033, reflecting double-digit growth. At the same time, the specialized market for digital lending platforms that provide infrastructure for such services could reach around $143 billion by 2032.

Growth is fueled by several trends:

- widespread adoption of smartphones and mobile internet in developing countries;

- development of online payments and digital wallets;

- investor focus on emerging markets as a source of “rapid growth”;

- an increase in the share of the population and small businesses previously not covered by traditional lending.

At the same time, emerging markets carry the highest risks: political and regulatory shocks, macroeconomic volatility, low repayment discipline, and weak collection infrastructure.

The experience of building an instant lending service, which over several years grew from a local Russian platform to an international player with projects in Mexico, Nigeria, India, and Vietnam, demonstrates which products and operational solutions work and which lead to dead-end development paths.

1. From a Local Startup to an International FinTech Business

The launch began in Russia with an online microcredit platform focused on the most straightforward and transparent customer experience. Key principles:

- small limits and short loan terms at the start;

- daily retraining of scoring models on fresh data;

- complete digitalization of application and repayment processes.

The result was a product integrated into users’ habitual digital behavior: fast decisions, clear terms, and convenient online payments.

Since 2019, international expansion began — first to Vietnam and Mexico, then to Nigeria and India. In these markets, the instant lending model enabled the company to become a top 2 player in the instant loan segment, serving several million active users per month. At the same time, the Russian market became a testing ground for scoring and product hypotheses, while emerging markets became the driver of scaling.

Digital Lending Platform Market Size 2024 to 2034

2. Product Architecture and Unit Economics

The success of digital lending is determined by the product architecture and discipline in managing customer economics.

2.1 Universal Core and Local Adaptations

The basic platform (scoring, billing, interest and fee calculation, risk management, analytics) remains unified. The following are localized:

- interfaces and communication language;

- marketing messages and tone;

- deposit and repayment methods;

- typical loan sizes and terms.

This approach reduces development costs and enables the transfer of working solutions between countries more quickly.

2.2 Strictly Calculated Customer Economics

For each market and each customer segment, the following are calculated:

- CAC (customer acquisition cost);

- LTV (lifetime value of the customer);

- target levels of delinquency and write-offs;

- unit economics by channels and products.

Scaling is allowed only with consistently positive unit economics, accounting for funding costs and expected losses.

2.3 Flexible Scoring Model

In emerging markets, a significant portion of clients has no formal credit history. Therefore, scoring relies on alternative data sources:

- in-app behavior;

- transactions and payment patterns;

- device characteristics;

- login frequency, behavior during application rejections, and interruptions.

This allows the gradual “unlocking” of credit limits for clients whom traditional banks are unwilling to lend to.

2.4 Modular Risk System

Loan parameters (limit, term, rate, fee structure) depend on:

- the country and its regulatory restrictions;

- the specific product;

- the client’s risk profile;

- the client’s behavior history and recovery after delinquencies.

Such modularity makes it possible to simultaneously:

- comply with local regulatory requirements;

- remain competitive on price for the client;

- manage portfolio profitability and write-off levels.

Digital Lending Platforms Market 2024 to 2032

3. Growth Engine: Marketing, Partnerships, and Product Growth

Scaling a moment-lending service in emerging markets is impossible without a sustainable growth engine.

3.1 Portfolio of Marketing Channels

Different combinations worked in different countries:

- Performance channels (search, social networks, UAC campaigns) — provide scale but require precise control of unit economics;

- Partnership channels and marketplaces — allow rapid trust acquisition through the partner’s brand;

- Offline channels and POS financing — relevant where online infrastructure is underdeveloped.

3.2 Ecosystem Partnerships

In Nigeria and India, partnerships with payment platforms and super-apps with large user bases played a key role. Embedding the credit product into the existing user journey:

- reduced CAC;

- increased conversion to repeat loans;

- allowed testing new products (installments, small business loans) without a separate marketing budget.

3.3 Product-Led Growth

Beyond acquiring new customers, significant growth came from:

- increasing limits for reliable clients;

- upsell and cross-sell: additional products for small businesses, payroll loans, flexible installments;

- creating a “product ladder” that allows clients to gradually increase available limits and loan terms.

3.4 Data-Driven Approach

All decisions — from creatives and offers to commission changes — are made through:

- A/B testing;

- cohort analysis;

- monitoring LTV by channels and segments.

This allows for quickly discarding non-working hypotheses and scaling successful ones.

4. Regulation and Risk Management

Digital lending in emerging markets grows faster than laws can adapt. India is a telling example: between 2017 and 2020, the volume of digital loans grew more than 12 times, after which the Reserve Bank of India issued strict Guidelines on Digital Lending (2022) and separate rules on Default Loss Guarantee (DLG, 2023), which were consolidated in 2025 into the unified Digital Lending Directions, 2025.

For an international instant lending service, three principles became critical:

Regulatory-by-Design

The product is initially designed to account for potentially stricter norms for KYC, limits, data storage and processing, and customer protection. The architecture embeds scenarios such as “what if tomorrow limits are halved” or “data must be stored only within the country.”

Local Legal and Compliance Teams

In key markets, lawyers familiar with the local regulator’s practices and industry associations work in-house. This allows not only reacting to new requirements but also anticipating regulatory trends.

Flexible Contract Architecture

Initial interaction schemes with banks, NBFCs, and payment partners include options for regulatory changes: risk redistribution, changes to DLG models, and transitions from co-lending to direct lending, and vice versa.

5. Attracting Investments and Entering New Countries

An instant lending service with revenue exceeding $100 million and several million active users per month naturally attracts investor interest. The investment case is strengthened by:

- transparent reporting on risks and portfolio quality (NPL, recovery, LGD, cohorts);

- revenue diversification across markets (Mexico, Nigeria, India, Vietnam);

- a clear strategy for entering new regions — African countries (including South Africa) and selected European markets.

An additional argument is the macro trend: research forecasts continued growth in digital lending and digital lending platform markets through at least the early 2030s, along with accelerated digital payments and increasing financial inclusion in emerging markets.

Conclusion

Building a global instant lending service in emerging markets is complex but achievable. Key success factors include:

- strict discipline in unit economics and portfolio management;

- modular product and scoring architecture;

- a strong data function;

- a strategic, regulatory-by-design approach to regulation.

Experience shows that with this configuration, even a startup that grew from a local microloan platform can, within a few years, transform into an international business with tens of millions of loans issued, stable revenue, and a clear investment track record. The next step is to expand our presence in Africa and Europe, where the combination of growing financial inclusion and demand for digital loans creates a favorable environment for further scaling.

References

- Zion Market Research. Digital Lending Platforms Market Size, 2023–2032.zionmarketresearch.com+1

- Spherical Insights & Consulting. Global Digital Lending Market Size, 2023–2033.Spherical Insights

- PwC, Oxford Business Group. Emerging markets and the payments transformation.PwC+1

- RBI, CGAP, legal briefs on India’s digital lending guidelines, and Default Loss Guarantee.Economic Laws Practice+3chase-advisors.com+3m2pfintech.com+3

- IFC. MSME Banking in the Digital Era (alternative data and SME finance).IFC+1

- World Bank. Global Findex Database (financial inclusion trends).World Bank+1