Top Tech News Today, December 1, 2025

Top Tech News Stories Today – Your Quick Briefing on the Latest Technology News, Global Innovation, and AI-Driven Shifts Reshaping the Future

It’s Monday, December 1, 2025, and we’re back with your in-depth look at the most important developments shaping the global tech landscape — from AI infrastructure and sovereign AI projects to Big Tech cloud alliances, regulatory pressure, cybersecurity breaches, and fresh capital flowing into frontier startups.

Today’s headlines cut across the stack: governments forcing new cyber and AI rules onto smartphones and data centers, Amazon and Google teaming up on multicloud, ByteDance pushing an AI assistant deeper into Chinese hardware, Ukraine building its own AI system with Google’s technology, banks and e-commerce platforms doubling down on generative AI, and venture money pouring into visual AI, defense tech, climate innovation, and fintech infrastructure.

Across markets, one pattern keeps surfacing: control over compute, data, connectivity, and AI decision-making is becoming a core lever of geopolitical and economic power. States are tightening their grip, hyperscalers are partnering where they once only competed, and startups are racing to own narrow but mission-critical slices of this new stack.

Whether you’re a founder, investor, policymaker, engineer, or just trying to stay ahead of the curve, this briefing gives you the context that matters — highlighting not just what happened, but why it matters and where it might be heading next.

Here’s your comprehensive roundup of the latest tech news making waves today.

Latest Tech News Today

1. India orders undeletable cyber safety app on all new smartphones, putting Big Tech and privacy in the spotlight

India’s telecom ministry has told smartphone makers that all new devices sold in the country must come preloaded with a state-owned cyber safety app that users cannot remove. The directive applies to Apple, Samsung, Vivo, Oppo, Xiaomi, and other manufacturers, and is framed as a response to rising fraud, hacking, and phone theft. The app is meant to help authorities block stolen devices, monitor cyber threats, and promote government-backed digital services. For now, the order has been communicated privately to handset makers rather than through public regulation, which has already raised concerns within the industry about processes and transparency.

Executives and privacy advocates worry the move could expand the state’s ability to collect data and push official apps deep into phone ecosystems without meaningful user consent. India has more than 1.2 billion telecom users, and smartphones are the primary means of internet access for hundreds of millions of people. Hence, a mandatory, non-removable app effectively becomes a national digital touchpoint. That places Apple and other global brands back in a familiar dilemma: whether to comply with an intrusive requirement in a key growth market or risk regulatory backlash and potential share loss.

Why It Matters: The mandate turns India’s smartphone base into an extension of state infrastructure, raising fresh questions for Big Tech around privacy, data governance, and how far they are prepared to bend to country-specific rules to protect growth in strategic markets.

Source: Reuters.

2. Amazon and Google launch joint multicloud networking service to keep AI-era internet traffic flowing

Amazon Web Services and Google Cloud have taken an unusual step for fierce rivals: they unveiled a jointly developed multicloud networking service that lets enterprise customers connect workloads across both platforms in minutes instead of weeks. The offering combines AWS Interconnect–multicloud with Google Cloud’s Cross-Cloud Interconnect, promising private, high-speed links between the two environments. The companies pitched the move as a response to rising dependence on cloud and the financial damage of even brief outages — pointing to the significant AWS disruption in October that knocked out popular apps like Snapchat and Reddit and is estimated to have cost U.S. firms up to $650 million.

The partnership reflects how AI has changed the economics of cloud. As organizations train and deploy larger AI models, they increasingly spread workloads across multiple providers for resilience, specialized chips, or regional coverage. That has made connectivity and data movement as critical as compute pricing. Early adopters like Salesforce are already using the new multicloud setup, and both Amazon and Google stressed that the service is designed to make it easier for customers to shift and replicate AI and data-intensive applications between clouds. The move also signals that, when it comes to infrastructure for AI, even hyperscalers are willing to cooperate if it keeps workloads inside their combined orbit rather than letting them drift to on-prem or niche providers.

Why It Matters: This alliance shows how the AI race is forcing even the biggest cloud platforms to collaborate on core networking, tightening their grip on enterprise workloads while setting a new baseline for multicloud connectivity.

Source: Reuters.

3. ByteDance rolls out Doubao AI voice assistant on ZTE smartphones, challenging rivals and Apple’s delay in China

ByteDance has launched a new AI voice control assistant powered by its Doubao large language model, debuting first on ZTE’s Nubia M153 smartphone in China. The assistant lets users perform tasks such as finding content, booking tickets, and navigating apps using natural, spoken commands. ByteDance says the tool will expand to other phone makers over time, positioning it as a direct competitor to AI features already being rolled out by Huawei and Xiaomi. The new Nubia device, currently available as a limited prototype at about 3,499 yuan (roughly $495), is designed as a showcase for the assistant’s capabilities.

The timing is critical because Apple’s Apple Intelligence suite is still not available in China, leaving a gap that domestic players are rushing to fill. Alibaba has already said it will collaborate with Apple to add AI capabilities for iPhones in the country. Still, in the meantime, ByteDance is making a play to become the default AI layer on Android phones. For ByteDance, better known globally for TikTok, owning an AI assistant on hardware gives it a new channel for user data, engagement, and monetization beyond its content feeds. It also deepens the company’s role in China’s homegrown AI ecosystem, where government pressure and competition are pushing firms to integrate generative AI into everything from search to hardware.

Why It Matters: The launch underscores how Chinese tech giants are using AI assistants embedded in smartphones to lock in users and fill the gap left by Apple’s delayed AI rollout in one of the world’s largest mobile markets.

Source: Reuters.

4. Ukraine builds sovereign AI system using Google’s open technology to reduce dependence on foreign platforms

Ukraine’s digital ministry is working with Google to develop an independent AI system based on Google’s open technology, aiming to give the country its own secure AI infrastructure for government and critical services. The project is framed as part of a broader effort to harden digital systems amid an ongoing war and persistent cyberattacks. Rather than simply consuming off-the-shelf cloud AI, Ukraine wants a system it can operate and control domestically, tailored to local languages, data, and security needs. Officials have indicated they intend to apply for European Union funding for AI data centres and high-performance computing to support the build-out.

Strategically, this pushes Ukraine closer to the emerging concept of “sovereign AI”—where states insist that training data, model hosting, and inference occur within trusted jurisdictions. It also strengthens Google’s position as a partner for governments that want more than just a generic cloud contract. If successful, Ukraine’s system could support everything from battlefield intelligence analysis and public-service chatbots to tax collection and document processing, all without placing sensitive data on foreign commercial platforms. For Europe, the initiative is a test case that could inform how EU-funded AI infrastructure is deployed in smaller, high-risk countries. Reuters+1

Why It Matters: Ukraine’s push for a homegrown AI stack underscores how AI infrastructure is becoming a national security asset, with governments demanding greater control over where models run and how sensitive data is handled.

Source: Reuters.

5. HSBC signs multi-year deal with Mistral AI to embed generative AI across global banking operations

HSBC has signed a multi-year partnership with French startup Mistral AI to deploy its generative AI models across the bank’s operations. Under the deal, HSBC will run Mistral’s commercial models — and future upgrades — in a self-hosted setup, combining the bank’s internal engineering teams with Mistral’s model-building expertise. Use cases range from financial analysis and risk assessment to multilingual translation, internal research, and personalized client communications. The bank expects the tools to significantly cut the time employees spend on routine, document-heavy tasks such as credit analysis and structured financing.

HSBC already has hundreds of AI use cases live across fraud detection, transaction monitoring, compliance, and customer support, but the Mistral partnership is meant to accelerate and standardize its generative AI rollout. Crucially, the bank says it will keep the deployment within its existing “responsible AI” framework, stressing governance, transparency, and data protection to calm regulatory concerns. For Mistral, landing a global Tier-1 bank is a significant validation that European-built foundation models can compete with U.S. giants in high-stakes environments. For the broader market, it signals that large financial institutions are moving beyond experiments and pilots and starting to weave AI into core workflows at scale.

Why It Matters: The deal shows how generative AI is moving from sandbox projects into regulated financial infrastructure, and underscores Europe’s ambition to build competitive AI champions like Mistral.

Source: Reuters.

6. Meesho leans on AI, logistics tech, and new business lines ahead of multi-billion-dollar IPO

Indian e-commerce marketplace Meesho, backed by SoftBank, is doubling down on AI and adjacent businesses as it prepares for an IPO that could value the company at up to $5.6 billion. CEO Vidit Aatrey told Reuters that Meesho plans to invest heavily in chat- and voice-based AI agents to make shopping easier, especially for first-time users in smaller towns where many people are coming online for the first time. The marketplace has built its brand around low-priced goods with zero seller commission. It is now focusing on using AI to improve search, recommendations, and support while keeping operating costs in check.

The company is also scaling Valmo, its logistics aggregation platform, to cut delivery costs and improve margins, and is preparing to introduce financial services, such as buy-now-pay-later for buyers and short-term credit for sellers. That mirrors the playbook of global e-commerce giants that have boosted profitability by adding logistics and finance on top of basic marketplace functions. Meesho’s revenue rose about 29% to 55.78 billion rupees (around $623 million) in the first half of fiscal 2026, while losses narrowed by more than 70%, according to its prospectus. With India’s online retail market expected to reach up to $190 billion by 2030, Meesho is positioning itself as a low-cost, AI-driven alternative to Amazon and Walmart-owned Flipkart.

Why It Matters: Meesho’s strategy shows how AI, logistics tech, and embedded finance are becoming standard tools for e-commerce startups competing with global giants and convincing public investors they can reach profitability.

Source: Reuters.

7. Coupang confirms massive data breach hitting nearly 34 million users, sparking new cybersecurity alarm in e-commerce

South Korean police have opened an investigation into a major data leak at e-commerce giant Coupang, after the company disclosed that personal information for tens of millions of customers and merchants was exposed. Reuters reported that national police are probing the breach, while TechCrunch says nearly 34 million user accounts were affected, including names, phone numbers, email addresses, partial payment details, and order histories. Coupang, which is listed in the U.S., said the incident stemmed from a third-party partner and emphasized that full payment card numbers and passwords were not compromised.

Even so, the breach is one of the largest in South Korea’s recent history and comes amid growing regulatory scrutiny of how platforms secure customer data. E-commerce companies hold rich troves of behavioral and financial data, and incidents like this highlight the systemic risk concentrated in a handful of logistics and delivery platforms that underpin daily life. Investigators are now examining whether Coupang and its partners complied with security obligations and incident response rules. For cybersecurity teams globally, the episode is another reminder that third-party vendors and service providers often represent the weakest link in the stack.

Why It Matters: The scale of the Coupang breach underscores how vulnerable modern commerce platforms are to third-party failures and is likely to trigger tougher security and disclosure expectations across the global e-commerce and logistics sector.

Source: Reuters, TechCrunch.

8. Databricks in talks to raise at $134 billion valuation as AI infrastructure demand accelerates

Data and AI platform Databricks is reportedly in talks to raise around $5 billion in new capital at a valuation of roughly $134 billion, according to investor documents cited by The Information and summarized by Reuters. That valuation would be about 32 times the company’s expected 2025 revenue of roughly $4.1 billion, and reflects multiple upward revisions to its sales forecast this year, from $3.8 billion to $4.0 billion and now slightly higher, with growth projected at about 55%. At the same time, Databricks has told investors that gross margins are slipping faster than planned, down to about 74% from an earlier target of 77%, in part because its AI products are more compute-intensive.

Databricks has long been seen as a top-tier IPO candidate in the AI infrastructure space, offering a unified data and AI platform used by enterprises to ingest data, run analytics, and build AI applications. A round at this scale and valuation would cement it as one of the most valuable private software companies in the world, alongside firms like Stripe. It would also signal that investors are still willing to pay premium multiples for core AI infrastructure providers even as public markets have cooled on more speculative consumer AI plays. For customers, the company’s margin pressure underscores a broader theme in AI: delivering sophisticated models at scale is expensive, and infrastructure providers are still figuring out how to balance usage growth with profitability.

Why It Matters: A $134 billion raise would confirm that AI infrastructure — not just chatbots — remains one of the hottest corners of tech investing, and would give Databricks a massive war chest to compete with Snowflake and hyperscalers.

Source: TechStartups via Reuters and The Information

9. Deutsche Telekom and Schwarz Group plan “AI gigafactory” data centre in Germany to tap EU funding

Deutsche Telekom and retail giant Schwarz Group are planning to jointly build what they call an “AI gigafactory” in Germany, according to a Handelsblatt report cited by Reuters. The facility would be a large-scale data centre explicitly engineered to handle the compute demands of AI workloads. The partners are reportedly in talks to apply for support under a European Commission plan that sets aside about $20 billion to fund AI data centres across the bloc, part of Europe’s push to close the gap with the U.S. and China on AI infrastructure.

The project is still in negotiation, and no formal agreement has been signed, but the discussions are said to be advanced. For Deutsche Telekom, the move extends its role beyond connectivity into the core hardware layer that AI developers and enterprises increasingly rely on. For Schwarz Group, which owns chains like Lidl, the investment represents a bet that owning compute capacity will be as crucial to retail and logistics as owning physical warehouses. More broadly, the plan reflects how industrial and telecom incumbents across Europe are repositioning themselves as AI infrastructure providers, hoping to anchor locally controlled alternatives to U.S. hyperscalers and Chinese cloud giants.

Why It Matters: An EU-backed AI “gigafactory” would strengthen Europe’s homegrown AI infrastructure and shows how traditional telecom and retail players are repositioning as providers of compute in the AI age.

Source: Reuters.

10. Visual AI startup Black Forest Labs reportedly raises $300M Series B to scale FLUX image models

German visual AI startup Black Forest Labs has raised around $300 million in a Series B round to expand its FLUX family of image-generation models, according to a Vestbee report. The round, which reportedly includes Coatue and other major investors, would mark one of the largest European AI funding deals this year. Black Forest Labs focuses on high-quality visual generation and licenses it to enterprises for design, advertising, gaming, and creative workflows. Unlike some open-source-only projects, the company combines open- and commercial-licensing strategies to monetize enterprise-ready models while remaining part of the broader research ecosystem.

The deal underscores investor appetite for specialized AI model providers that focus on specific modalities rather than trying to be everything to everyone. As businesses move from generic image models to finely tuned systems that reflect brand guidelines, safety rules, and domain-specific needs, vendors like Black Forest Labs are positioning themselves as the “visual engine” underneath a wide range of creative tools. A large Series B also gives the startup more runway to pay for the expensive compute needed to train and iterate on flagship models, and to compete with global players in a space where open-source projects and proprietary tools are evolving quickly.

Why It Matters: The Black Forest Labs raise highlights how visual AI remains a major investment theme and shows European AI startups can attract late-stage capital when they focus on targeted, commercially relevant model capabilities.

Source: Vestbee.

11. Milestone raises $10M seed to give engineering teams real AI ROI tracking and transparency

Enterprise AI startup Milestone has closed a $10 million seed round to help companies understand whether their AI initiatives are actually delivering value, according to AI Insider. The company is building an observability and analytics layer that sits on top of AI systems and software engineering workflows, tracking metrics like productivity gains, latency, model quality, and cost per task. The goal is to turn AI experiments into measurable business outcomes instead of vague productivity claims. Milestone’s platform integrates with existing tools used by engineering and data teams, surfacing dashboards and alerts that show where AI is working, where it’s underperforming, and how changes to prompts or models affect downstream KPIs.

As more organizations deploy AI copilots, agents, and automation into production, CFOs and engineering leaders are demanding proof that these investments justify their compute and integration costs. Milestone is betting that the next phase of the AI cycle will be less about flashy demos and more about disciplined measurement and governance. The seed round provides the company with capital to expand its product and sales efforts at a time when enterprises are re-evaluating AI budgets and seeking tools to help them identify which projects to double down on and which to kill.

Why It Matters: By focusing on ROI and transparency, Milestone is tapping into a growing need for “AI analytics for AI itself,” a layer that could heavily influence which AI tools survive enterprise scrutiny over the next few years.

Source: AI Insider.

12. Defense Tech startup funding hits record levels as governments rearm and embrace dual-use AI

A new Crunchbase analysis finds that Defense Tech startups — companies building dual-use technologies for both military and civilian applications — have attracted record investment this year. The report highlights rising funding for areas like autonomous systems, AI-powered surveillance, cyber defense, space infrastructure, and battlefield communications platforms. A mix of traditional VCs, defense-focused funds, and government-backed vehicles is participating in rounds, reflecting a shift in attitudes toward backing companies that work directly with defense ministries and intelligence agencies.

The funding boom is being driven by geopolitical tensions, wars in Europe and the Middle East, and a broader recognition that modern defense is as much about software, sensors, and AI as it is about hardware. For founders, the opportunity is significant but complex: procurement cycles are long, export controls are strict, and public scrutiny is high. Still, a growing number of startups see defense as one of the most reliable buyers for advanced AI and robotics tech, and governments are under pressure to modernize faster than traditional contractors alone can support. The trend also raises questions about how dual-use AI capabilities might spill over into domestic surveillance and policing.

Why It Matters: Record Defense Tech funding shows that AI and frontier tech are being pulled deep into national security strategies, creating significant opportunities for startups while intensifying ethical and regulatory debates.

Source: Crunchbase News.

13. Australian Startup Freemantle Seaweed raises $2.2M to scale methane-reducing seaweed for cattle

Australian climate-tech startup Freemantle Seaweed has secured about $2.2 million (A$3.3 million) in seed funding to expand cultivation of seaweed strains that, when added to cattle feed, can significantly cut methane emissions. The company is focusing on scalable farming and processing methods that make it easier for livestock producers to adopt seaweed-based supplements at a commercial scale. The round, reported by StartupDaily, includes backing from climate-focused investors who see methane reduction in agriculture as one of the fastest ways to curb near-term warming.

Freemantle Seaweed is part of a broader wave of biotech and ag-tech startups targeting greenhouse gas reductions with biological solutions rather than just offsets. By attacking methane — a far more potent greenhouse gas than CO₂ over short timeframes — the company’s approach aligns with global climate strategies that prioritize “fast-acting” interventions. If it can bring costs down and secure regulatory approvals in key markets, its products could plug directly into existing feed supply chains. That positions the startup at the intersection of agriculture, biotechnology, and climate policy, an increasingly crowded but high-impact niche.

Why It Matters: Agricultural methane is a major driver of climate change, and Freemantle Seaweed’s funding shows investor appetite for biotech startups offering practical, scalable tools to decarbonize food production.

Source: StartupDaily.

14. Dutch fintech startup Renno lands €1M to fix late payments in construction with smarter cash-flow infrastructure

Amsterdam-based fintech startup Renno has raised €1 million in pre-seed funding to address chronic cash flow problems in the construction industry, according to EU-Startups. Construction projects often involve long, opaque payment chains in which subcontractors and small suppliers wait months to be paid, creating liquidity stress and insolvency risk. Renno is building software that digitizes invoices, contracts, and progress milestones, giving all parties a clearer view of when payments are due and automating some of the approval and payout process.

The company’s thesis is that construction — despite being one of the world’s largest industries — still runs on fragmented spreadsheets, manual approvals, and PDFs. By creating a vertical-specific cash flow platform, Renno aims to reduce disputes, speed payments, and provide lenders with better data to underwrite short-term financing for projects. While not an “AI startup” in the narrow sense, the platform sits within the broader trend of digitizing real-world industries so that data and, eventually, machine learning can be applied to reduce risk. If Renno can prove out its model in Europe, it could open doors to similar infrastructure plays in other under-digitized sectors like manufacturing and logistics.

Why It Matters: Renno’s raise is a reminder that some of the biggest fintech opportunities still lie in unglamorous, offline sectors like construction, where better cash-flow infrastructure can make or break thousands of small businesses.

Source: EU-Startups.

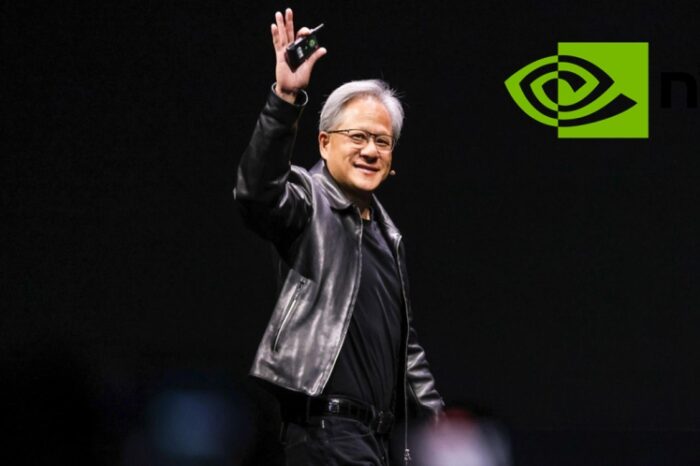

15. SoftBank’s Masayoshi Son says he “cried” over selling Nvidia stake as he doubles down on AI bets

SoftBank founder Masayoshi Son revealed in an interview that he “cried” after the conglomerate sold its stake in Nvidia, which has since become one of the world’s most valuable companies on the back of the AI boom. Speaking to Bloomberg, Son framed the sale as one of his “big regrets,” but also as a catalyst for his renewed commitment to making SoftBank a central player in the AI era through investments and internal projects. The comments come as SoftBank has been repositioning from a broad tech investor to a more focused AI-first group, using capital from earlier exits to fund new bets on chips, infrastructure, and AI-native startups.

The admission is notable because it underscores how even veteran tech investors underestimated the speed and scale of the AI hardware wave. Nvidia’s chips now sit at the heart of many large-scale AI systems, from cloud data centres to autonomous vehicles, and its stock performance has become shorthand for the AI trade itself. Son’s renewed focus suggests SoftBank will keep pushing into capital-intensive AI projects, potentially including chip design and data-centre infrastructure, rather than pulling back after turbulent years with the Vision Fund. That could reshape funding dynamics for late-stage AI startups, particularly those building foundational infrastructure.

Why It Matters: Son’s regrets over Nvidia and renewed AI push underscore how central AI hardware and infrastructure have become to long-term tech investing — and signal that SoftBank plans to stay aggressive in the space.

Source: Bloomberg.

That’s your quick tech briefing for today, covering everything from government-mandated cyber apps and sovereign AI projects to multicloud networking, visual AI, defense tech funding, fintech infrastructure, and climate-focused biotech.

We’ll keep tracking how these developments evolve across AI, cloud computing, cybersecurity, quantum and data centres, energy and climate tech, startups, regulation, and frontier innovation.

Stay tuned as the power dynamics behind tomorrow’s technology continue to shift.

That’s your quick tech briefing for today. Follow us on X @TheTechStartups for more real-time updates.