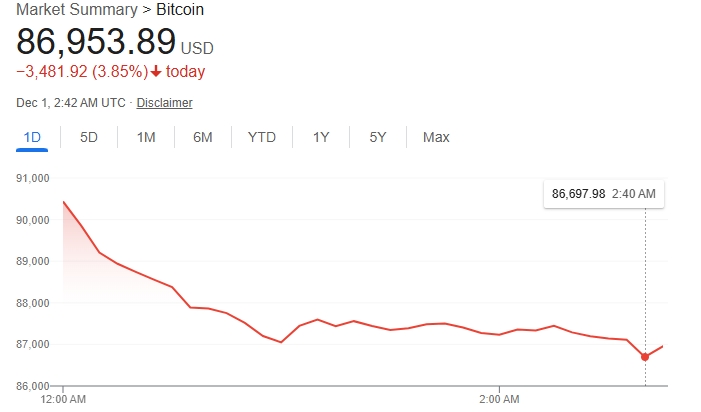

Bitcoin crashes $4,000 in minutes, plunges to $86K as mass liquidations trigger sudden market breakdown

Bitcoin traders barely had time to react Sunday evening before the market cracked wide open. Just before 8 p.m. Eastern, a surge of sell orders slammed through support, sending Bitcoin from the mid-$91,000s into the high-$86,000s in minutes. The drop didn’t look like a normal pullback. It felt like the kind of sudden shock that catches traders flat-footed and drags the entire market with it.

For most of the week, Bitcoin had been sliding gently, losing ground in small steps that suggested fatigue rather than fear. Then everything changed at once. A burst of heavy selling punched straight through multiple intraday levels. What had looked like slow cooling suddenly turned into a plunge that reset the short-term setup, leaving traders to reassess their positions.

Bitcoin has recovered some ground and is now trading at $86,826.82.

“Bitcoin falls -$4,000 in 2 hours as mass liquidations return. $400 million worth of levered longs have been liquidated over the last 60 minutes,” The Kobeissi Letter wrote in a post on X, describing the latest wave of liquidation-driven selling.

BREAKING: Bitcoin falls -$4,000 in 2 hours as mass liquidations return.

$400 million worth of levered longs have been liquidated over the last 60 minutes. pic.twitter.com/qKB7MYJapu

— The Kobeissi Letter (@KobeissiLetter) December 1, 2025

The sell-side volume spike made the moment stand out. It was the largest the market had seen in quite some time, the type that often points to forced liquidations, a large market order hitting thin books, or aggressive stop-hunting. Whatever triggered it, the effect was immediate and unforgiving.

Around $139 million in long positions were liquidated as prices collapsed, most of them wiped out during the same sharp price move. The speed of the selling created a chain reaction: each liquidation led to more forced selling, which pushed prices lower and triggered even more automated orders. The move erased days of patient gains and shifted the short-term market tone from steady to vulnerable.

Traders watching key intraday levels saw them break almost instantly. Each level, which usually serves as a pause point, failed to slow the drop. That kind of reaction usually tells you that liquidity is thin and the market is hypersensitive to pressure. Rebuilding lost support will take time, and any fresh weakness could easily reopen the door to more mechanical selling.

After the initial shock, Bitcoin, the world’s largest cryptocurrency, rebounded from the lows. As of 8:20 p.m. Eastern, the price had lifted back to $87,583. The bounce shows buyers were willing to step in after the flush, but it doesn’t erase the damage. The subsequent few sessions will reveal whether this was a one-off liquidation shock or the start of a deeper reset.