Revolut hits $75B valuation in secondary sale, becoming Europe’s most valuable fintech startup

Revolut just pulled off another jaw-dropping milestone. The London-based fintech startup confirmed on Monday that it completed a secondary share sale that pegs the company’s value at a staggering $75 billion, a 66% jump in just a year, and a clear signal that investor confidence in Europe’s most influential fintech is still surging.

The deal drew in heavyweight backers, with Coatue, Greenoaks, Dragoneer, and Fidelity leading the round. Andreessen Horowitz, Franklin Templeton, and Nvidia’s venture capital arm joined in as well. Though this wasn’t a public listing, the numbers now place Revolut above several long-established banks, including Barclays, Société Générale, and Deutsche Bank.

The news also lands six months after Revolut revealed plans to invest €1 billion in France as it looks to secure a French banking license and deepen its footprint across the European Union.

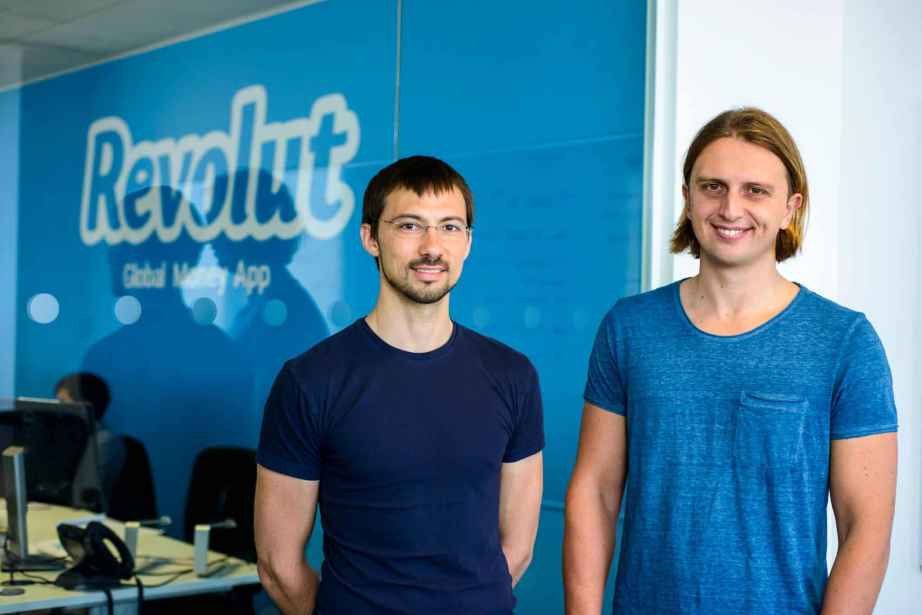

Revolut’s journey began in 2015 when former Credit Suisse trader Nikolay Storonsky teamed up with ex-Deutsche Bank engineer Vlad Yatsenko. Their idea was simple at first: eliminate hidden fees and simplify money management. Everything lives inside the app — no branches, no paperwork, no queues. That streamlined approach struck a nerve and helped the company gain explosive popularity across Europe and beyond.

Today, Revolut has built a user base of more than 65 million people. Last year, it posted a pre-tax profit of £1.1 billion, a 149% jump from the previous year. That sharp rise in profitability has played a major role in pushing its valuation higher. For context, it was valued at $45 billion just a year ago and $33 billion in 2021.

This latest transaction also marked the fifth time employees were given the chance to sell shares. In a statement, Storonsky thanked the team, saying:

“I’d like to thank our team for their determination and energy, and for believing that it is possible to build a global financial and technology leader from Europe.”

The CEO, who moved his residence from London to Dubai last year, has made it clear that one of his top goals is to secure a full banking license in the UK. That approval took years of effort and was finally granted recently, clearing an important regulatory hurdle that had been holding the company back.

Even with eye-popping growth, there are areas where Revolut is still playing catch-up to traditional banks. Analysts note that a substantial portion of its revenue continues to stem from crypto trading and interest income derived from higher interest rates, Reuters reported. Average customer deposits remain lower than at established lenders, and many users treat the app as a secondary account rather than their main bank.

That is starting to change. Revolut is now making a stronger push into areas typically dominated by big banks, including consumer credit, mortgage products, and, eventually, business loans. It is even exploring the possibility of acquiring a U.S. bank as a launchpad for deeper expansion in the American financial market.

With more than 55 million customers worldwide, zero physical branches, rising profits, and growing ambitions beyond simple digital banking, Revolut is no longer just a fintech success story. It is shaping up to be one of Europe’s most influential financial institutions of the next decade.